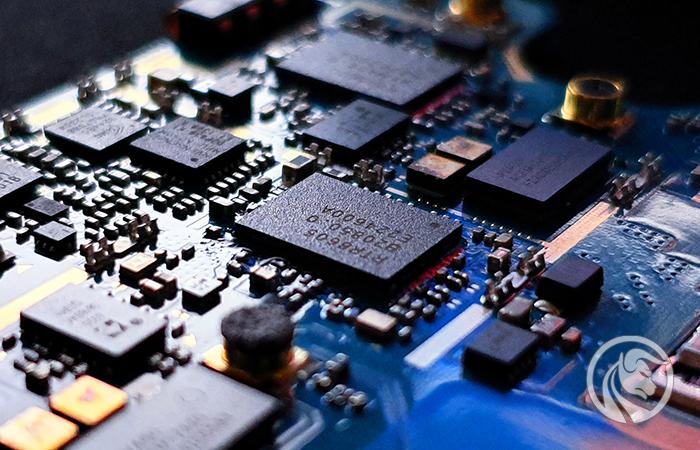

There will be plenty of cars and consoles - chip warehouses are filling up

The lack of chips, which caused major perturbations in the global economy last year, has now been overcome. Rising inflation and recession limit consumer spending on electronics and cars, which host most microprocessors. Following the pandemic boom, the industry now faces a few tougher quarters.

There is no shortage of semiconductors (already)

Until 12 months ago, on everyone's lips there was a common lack of chips - microprocessors needed for the functioning of virtually all electronic devices. The car industry suffered the most and was forced to stop production because of this. It was also very difficult to buy a game console or advanced graphics cards for computers. Now the situation is reversed: the demand for processors is falling, and at the same time their inventories are increasing.

Worldwide microprocessor sales are worth $ 630 billion annually. Processors are mainly used in consumer electronics and items sold to consumers, only 12 percent. global demand goes to industrial equipment. Nearly 31 percent From the world production, it is used in computers. Exactly the same amount goes to the phones and telecommunications industry. The car industry is responsible for 12 percent. world demand. And it was the significant increase in demand for consumer products that was the source of the boom during the pandemic. Now, the same causes have caused stagnation, as consumers, feeling the effects of rising inflation and the impending recession, are reducing their spending on purchases. This applies to virtually the entire world, including Asia, which uses 60 percent. world production of microprocessors (excl Japan).

The semiconductor industry in crisis

The industry's problems are taking its toll on the stocks of individual companies that did not participate in the recent sharp rise in tech prices and are among the worst performing companies this year. For example, NVIDIA announced its second-quarter results well below expectations. She also warned investors that the results in the coming periods will also be below previous forecasts. The industry is also not helped by the political tension on the Beijing-Washington line related to Taiwan, where TSMC (Taiwan Semiconductor) factories are located.

The US processor manufacturers are supported by an act passed by Congress "The CHIPS and Science Act". It provides for aid worth 53 billion. dollars to facilitate their competition with Chinese producers. It is also expected to increase the production of chips in the United States itself so that they become less dependent on foreign suppliers. The main mechanism is 25 percent. tax write-off of costs incurred for the construction of factories and research works. Based on these funds, Intel chip factory in the US state of Ohio.

Recent years have shown the increasingly visible key importance of chips for the global economy. The industry itself, however, has become less cyclical. Barriers to entry for new businesses have also increased once again as the chip design and manufacturing processes become more and more complex. The recent time has brought a healthy reset in terms of investors' expectations of the industry. Companies are now valued without a premium according to S & P500, and earnings prospects are lower than the average for companies in this index. It offers exposure to the sector EToro @ Chip-Tech SmartWallet and companies from Broadcom to ASML.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)