Scenarios for the coming months: banking crisis, recession, crash?

Another exciting week on the financial markets is behind us, and "another weekend" is ahead of us. As a rule, financial markets are closed on weekends, but recently the most happening is during weekends. Several banks have "disappeared" over the past two weekends. And yet we know that all last Friday, investors were excited about Deutsche Bank - another bank that was in the center of the markets' attention.

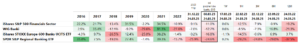

The S&P500 closed the week in the black (+1,4%), similarly to the previous one (+1,4%). How is it possible? Big tech companies did it! The Nasdaq100 gained +1,97% last week and +5,8% last week.

Polish investors (if they invest on the WSE) were not so lucky. WIG20 closed the past week with a loss of 0,5%, and the previous one with a loss of 6,75%.

Still turbulent in the markets

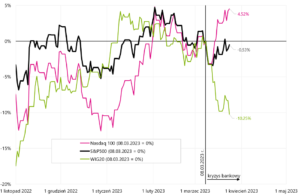

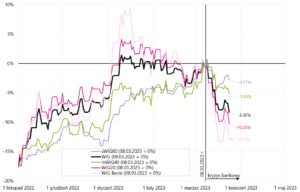

Although the S&P500 rose for the second week in a row, the mood in the markets is not the best. We can say that The world for investors changed beyond recognition on March 9 this year. Even the Fed meeting, which ended with Powell's press conference, was not as important as the continuing crisis of confidence in the banks. Banks suffer the most from this, and since we have a lot of banks on our stock exchange, this also applies to the WIG20 index. The chart below shows the change in selected stock indices since March 8 this year, i.e. since the beginning of the banking crisis.

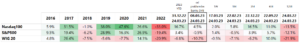

From March 8. the difference between the Nasdaq100 and the WIG20 is as much as 14,8 percentage points (and this is only slightly over 2 weeks). It is no better since the beginning of the year, where the difference is 23,5 percentage points. Details of the rates of return in different periods for the above indices are presented in the table below. What is interesting in the table below is the fact that Nasdaq100 "wins" with WIG20 in every period except 2022.

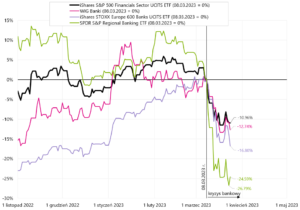

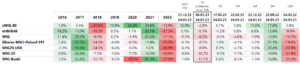

The real crisis, however, concerns bank stocks. WIG Banks from March 8 this year it is already 12,7% down – but compared to European banks, it is not the worst. iShares STOXX Europe 600 Banks UCITS ETF down 16,8% over the period. On the other hand, regional banks in the US (SPDR S&P Regional Banking ETF) fell the most since March 8, ie as much as 26,8%. The chart below compares the rates of return for these indices since March 8 this year.

In the past week, European banks lost the most (-1,1%), and the index of Polish banks slightly increased by 0,6%. Details for different periods are presented in the table below.

In the case of Polish stocks, we close the week close to zero (the biggest increase was iShares MSCI Poland ETF +1,3%, while the biggest decrease was mWIG40 -1,2%). If we look from March 8 this year. (beginning of the banking crisis), apart from the banking index, the WIG20 dropped the most (-10,2%). The sWIG80 performed best, falling only 2,8% in this period. Details are presented in the table below.

sWIG80 is the only index in the table above that has delivered positive returns for the last 12 months. On the other hand, the chart below shows the change in Polish indices since March 8 this year.

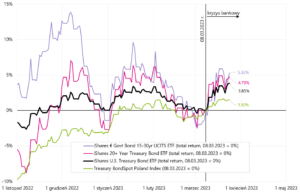

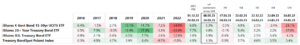

It can be said that relatively the largest changes since the beginning of the banking crisis concern bond funds. The yields on 2-year treasury bonds have fallen since March 8 this year. by 130 basis points (1,30%). In the case of 10-year US bonds, we are talking about a decline in yields over the same period by 62 basis points. In the case of Polish 10-year treasury bonds it was only 24 basis points. Falling yields are automatic gains for investors. The chart below shows the rates of return since March 8 this year. for selected treasury bonds.

And the table below shows the details of the returns for the above bond indices.

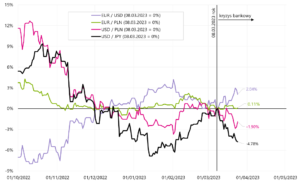

In the case of currencies, since the beginning of the banking crisis, we have had the biggest movement on the yen-dollar pair (the yen increased in value against the dollar by 4,8%). In fact, the dollar lost the most during the current banking crisis, also weakening against the euro by 2% and against the zloty by 1,9%. To a large extent, this is related to the potential effects of bailing out American banks (mainly fewer interest rate hikes in the US, bigger balance sheet of the Fed). The chart below shows the change in selected currency pairs since March 8 this year.

What are the possible scenarios for the coming months?

What are the possible scenarios for the coming months? All in all, we can talk about the completion of the economic cycle, which would involve the start of interest rate cuts by the FED. Then we could move on to another expansion in the economy and another bull market in the stock market. At this point, the most important question seems to be who is right when it comes to starting the cycle of interest rate cuts by the Fed?

- or the market? betting at the moment that the reductions will start already at the July meeting (July 26 this year) and valuing as many as 5 rate cuts until the meeting on March 20, 2024,

- or could the FED be right? , which states in its latest projection that there will be no cuts in 2023, and there may even be hikes. The median of the FOMC members' forecasts indicates the rate at the end of 2023 at 5,1% - and the market says that at the end of 2023 the FED rate will be 3,98%.

It is hard to imagine another real bull market in the stock market or expansion in the economy without rate cuts FED.

So let's break down the main scenarios:

- "goldilocks" scenario: the economy is slowly slowing down (but without a recession that could scare stock markets and cause deeper drops). With the economy slowing down, inflation ceases to be a problem, the FED sees that the fall of inflation to the target is real, so it starts slow rate cuts. We avoid further declines in stocks (S & P500), but we also need to be patient, because a new cycle and a new bull market could start for good only after some time (e.g. in 2024). What's wrong with this scenario? If possible, it would take a very long time. Slowly slowing economy means slowly slowing inflation. The Fed can wait for inflation to drop and then cut rates. In this scenario, the debt market is wrong, cuts will only be in 2024 and slowly, not quickly.

- Banking crisis scenarioThat is, something has just broken in the economy. This crack (which will cause a crisis/recession and rapid rate cuts by the FED) is failing banks in the US and Europe. If the markets "find" a new bank every week that is next in line to sell off its stocks and bonds, which of course in today's social media world will not go unnoticed by the people and companies holding deposits at that bank - then a quick withdrawal of deposits is a matter of "hours" , and the bank affected by this fact will not be able to cope and "will be closed" during the next weekend. Such a scenario is quite possible, but in general three things must be assumed: (i) it will continue to pay off for investors to aggressively sell shares and bonds of more and more banks, (ii) the trend of withdrawing deposits will not be interrupted, (iii) banks will not be able to withdrawn deposits. If these three things are somehow interrupted, the crisis may calm down and there will be no more spectacular bank closures, at least for a while. In this scenario, the market will "let go" of the aggressive pricing of interest rate cuts, it will continue to price them in, but not as many as 5 cuts from today's level in 12 months. Bond prices will fall and yields will go up. The markets will go into the phase of waiting for the next macro data or events.

- The scenario that something is about to break. In this scenario, the current crisis of confidence in banks will be averted, at least for a while. Let us remember that this crisis should not concern larger banks which, as a rule, hedged the interest rate risk by purchasing treasury bonds. There are no losses in these banks either caused by rising treasury bond yields due to interest rate hikes by central banks. But it is impossible to eliminate these losses from the system. Hedging the interest rate risk consists in passing it on to someone else. Someone else should have problems with ever-higher interest rates. But who will it be and when? ... you have to wait ... and maybe even many months (e.g. in 2008, the Bear Stearns bank collapsed in March, and the relative situation calmed down quickly - and this is the most important "crack" (i.e. Lehman) took place only in September). In this scenario, as in the second scenario, the market will “leave” aggressive pricing of interest rate cuts and will wait for the next macro data and important events.

- Scenario recession in the economy and peace in the markets. Scenario similar to the first one, but we will enter a recession. But since nothing spectacular will break in the markets or in the real economy, there is a chance that the stock markets will not fall on purpose ... they will just calmly wait for a real "pivot" from the Fed. After all, sooner or later the Fed will start cutting interest rates. Larger declines in stock markets due to declining corporate profits are also possible in this scenario, but not in an aggressive manner (as in a typical panic).

Which scenario has the best chance? In my subjective opinion, I would currently assign the following probabilities for the above scenarios:

- golidilocks scenario: 5%

- Bank crisis scenario: 30%

- Scenario that something is about to break: 50%

- Recession scenario in the economy and calm markets: 15%

Of course, the markets are pricing in different scenarios on an ongoing basis - as soon as new macro data or other important events appear.

It can be said that the FED's pricing of the path of rate cuts is not a market "forecast" of the future path, but merely an expression of the current information available to the market and the very nature of future date futures prices. For example, forward curves may be more a reflection of the spot price and the cost of money needed to arbitrage/set a forward price, rather than a "market forecast" similar to the forecasts of analysts, economists or market strategists. Not to mention the fact that the liquidity of contracts for further dates may be very low (and thus the "market valuation" based on such prices may not matter much).

The market is very often wrong and very often changes its mind. This is clearly visible, for example, in the changes in the valuation of the Fed's interest rate path. The market can quickly increase the number of increases and then quickly reduce them. Current inflation is very difficult to forecast, especially the reaction of the economy to such high inflation (which we last experienced 40 years ago). In addition, we currently have a "post-covid" economy - which we have probably never experienced before (pandemics have happened, but such strong monetary and fiscal reactions in connection with the pandemic rather not).

Summation

In the past week, the American S&P500 rose by 1,4% and it was the second consecutive week of gains (which rather does not reflect well the sentiment in the financial markets). The markets are still concerned about the situation in the banking sector – which can be seen in the results of banking indices, but also the Polish WIG20 (which has fallen by 8% since March 10,3 this year, while the S&P500 only 0,5%).

Last week, another FED meeting was held - hence we had the opportunity to learn the latest forecasts of FOMC members regarding the future path of the FED rate. The FED sees no cuts this year, and the reference rate at the end of 2023 is to be 5,1%. According to the market, the reference rate will be below 4% at the end of the year. So who is right? FED or Market? The answer to this question may determine the rate of return on your portfolio for the entire year 2023!

To give you an idea of what might happen in the markets, I've outlined four main scenarios for what could happen by the end of this cycle. In my opinion, further "cracks" in the economy and financial markets can be expected due to ever higher interest rates, but the current banking crisis (lasting since March 8) may not necessarily be the biggest crack in the current cycle.

About the Author

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will Deutsche Bank be next? [Closer to the Exchange] Will Deutsche Bank be next?](https://forexclub.pl/wp-content/uploads/2023/03/Czy-Deutsche-Bank-bedzie-nastepny-300x200.jpg)