Space industry – How to invest in space companies? [Guide]

Space has fascinated people for thousands of years, because how else can we explain the constellations that humans have named? Although many generations of people have looked at the stars, it was only in the 50th century that humans were able to fly into space. First into orbit, then landing on the Moon. No one has returned to the silver globe for over XNUMX years, but plans to colonize the Moon are emerging. However, space is not only our satellite. Probes are being developed to explore the nooks and crannies of the solar system. New satellites, starlinks and space cruisers are also being created. There are also plans to colonize Mars. The voices of Father are heard more and more often space mining. As you can see, there is a lot going on in this sector. However, is the space industry an interesting market for an investor? Are space companies in your portfolio a good idea for diversification? This is what you will learn from today's text.

What does the space sector look like?

At the beginning, it should be noted that the size of this economic sector depends on the counting methodology. Is writing software for space stations, satellites or other devices a space sector or ordinary IT? Similarly, should the production of specialized suits be included in the production of clothing, or should it be included in the space industry? For this reason, we will base our market size on analysis The SpaceFoundation. According to these data, the market in 2022 reached a value of $546 billion and grew 8% y/y. This is not a sector that is developing dynamically at the moment, but it is not stagnant either. Interestingly, the market has been growing by 7-8% annually for over a decade, which means it is in a stable growth phase. According to forecasts, by 2028 the sector's revenues will increase by 41%. Therefore, it is a market that is not sensitive to changes in the economic situation. This sector also includes, among others: creators of infrastructure needed to develop space programs, solutions supporting communication and suppliers of products key to the development of this market (including space suits, electronics, specialized equipment). An important market is the one related to the sale of satellite data. According to a report by The Space Foundation, they dominate the space industry The United States, which accounts for 60% of the global market. They are in second place China with shares of 14%. It is worth noting, however, that other countries are also developing their space programs. They are a great example Indie, which managed to send an unmanned lander to the Moon in August 2023.

The important information is that the market structure has changed over the last few decades. Previously, spending dominated mainly from the government sector. This was due to the fact that once space agencies had astronomical budgets, currently NASA's budget is a shadow of that of the 60s and 70s. According to forecasts by The Space Foundation, government spending can be expected to increase in the coming years as the space race between economic powers intensifies. The Chinese are doing particularly well, having built their own Tiangong space station.

A factor that stabilizes the revenues of companies operating in this industry is the very long duration of operation of individual space programs. Typically, the project of sending a probe is a long-term process from design, building a prototype to the final product. Thanks to public-private partnerships, companies usually do not have to worry about the solvency of agencies or projects prepared by, for example, NASA or European Space Agency. The situation is much worse for start-ups that have not yet signed contracts with large players. Such companies experienced the negative effect of increasing interest rates. This made VC funds much more cautious when agreeing to finance new projects.

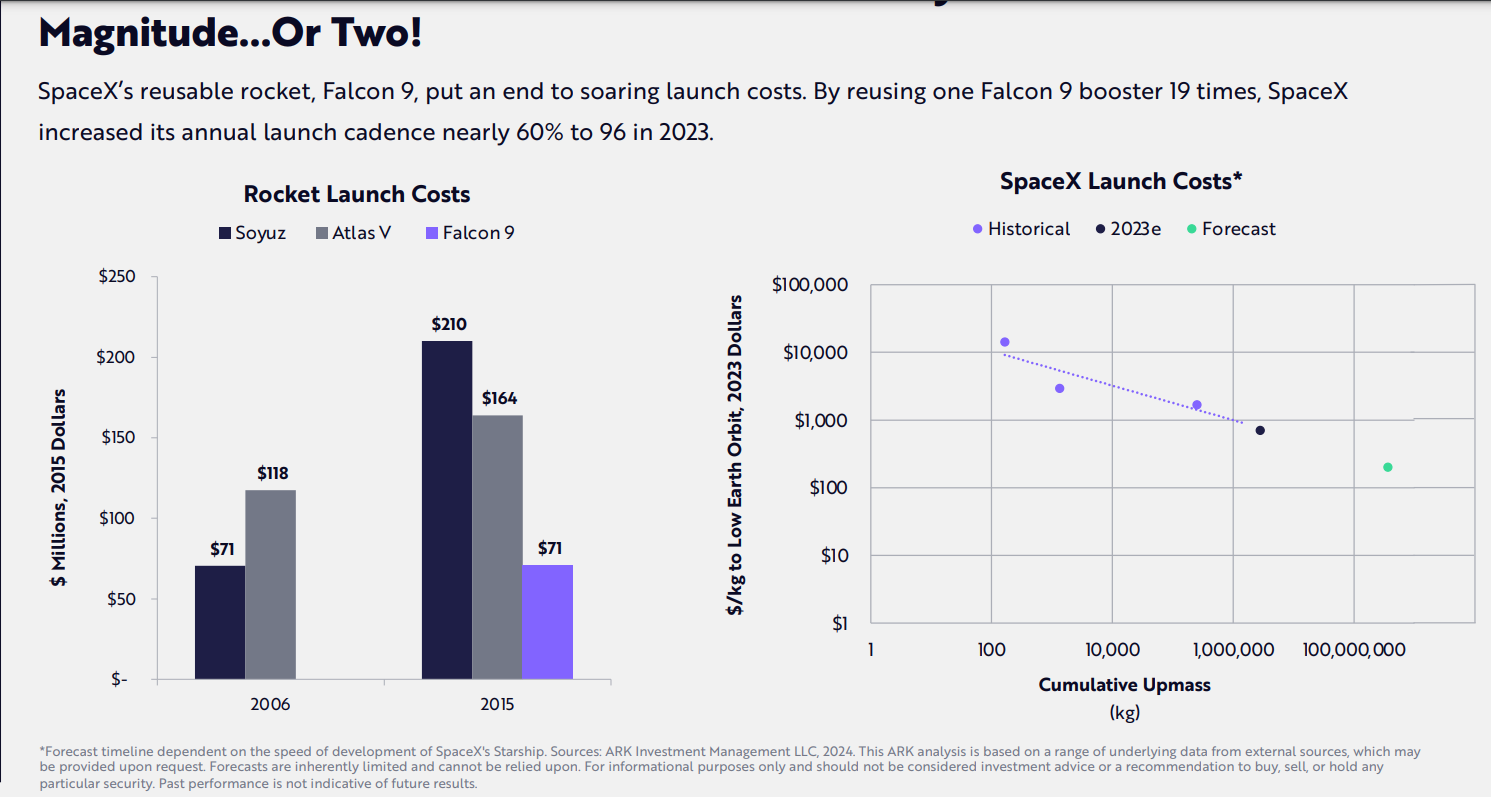

It is worth noting that in recent years there has been a sharp reduction in the costs of delivering cargo to orbit. Thanks to the development of the rocket F transport costs were reduced. This will make it possible to build bases on the Moon or Mars in the future. In addition, it will be easier to start exploiting space deposits (heavy equipment, warehouses, small factories processing ore, etc.). The progress is not over yet, but the progress is already impressive:

Another interesting business model with great potential is space mining. This is because many asteroids are made of metal ores with a high content of industrial metals. Thanks to this, the processing of such a raw material would potentially be less expensive than on Earth. Of course, for now there are many more problems than solutions. First, you would need to figure out a way to get to your destination safely and at low cost. Then it would be necessary to somehow bring the raw material to our planet. This would certainly be a very expensive process. For this reason copper ore with a raw material content of several percent it would not be profitable. Therefore, a sector of analysis of the asteroid belt would have to be developed, which would identify the most promising places. Many of the objects located near the earth are rich in valuable raw materials. Most likely, in the next two decades, companies will appear that will test the model of extracting raw materials from space. Objects such as:. 16 Psyche. According to researchers the value of metals in this celestial body has a value far exceeding world GDP. Most likely, the amount of iron will more than exceed humanity's needs for the next several million years. There are many companies that were created with the intention of creating “space mining”. For now, however, such companies are selling dreams because they still do not have the appropriate resources and technology to conduct space mining of raw materials. It will be much more likely to exploit lunar deposits at the beginning. It is a very promising raw material helium isotope 3He. Most likely, its huge deposits are in rocks on the Silver Globe. This isotope of helium combined with deuterium would be used for thermonuclear fusion (as fuel).

In addition, there are also companies that deal with this market organizing commercial space flights. This is still a small market, because according to the Grand View Research report, its size was estimated at just over $2023 million in 800. Companies operating on this market include: Virgin Galactic or Blue Origin. Ultimately, it may appear on this market SpaceX, but for now it is the melody of the future. Space tourism is also a dynamically developing industry. However, what prevents the spread of this activity is the price. The expense of a spaceship trip costs several hundred thousand dollars. Longer trips are even more expensive, with prices reaching up to several dozen million dollars.

The space industry is very important to the global economy. The communication segment is particularly important. Satellites are crucial in enabling global telecommunications. Of course, satellites have not only commercial but also military applications (access to fast information from remote areas of the world). Without them, there is no way the GPS network will function efficiently, which improves logistics and transport (including shipping). In the coming years, the Internet will probably develop very quickly with services similar to Starlink. Thanks to them, you will have access to the Internet from anywhere on Earth. The so-called satellite broadband internet will be widely used by, among others, new economic sectors such as augmented reality or smart cars. It can be expected that satellite technologies will develop very dynamically in the coming years.

Robotic Spacecraft Technology (RST) is another area of the space industry that is expected to experience dynamic growth. This is because “robot ships” are crucial in space exploration. Thanks to such facilities, it will be possible to repair satellites or conduct research on celestial bodies (in the future used by the mining industry). Such vehicles will be able to withstand extreme temperatures and pressure. This will make it easier to collect information about asteroids, asteroids and even larger natural satellites or planets.

How to invest in space companies?

Investing in the space industry requires specialist knowledge of technologies, trends and competition. Therefore, it is not a market that can be easily understood (like, for example, the consumer goods industry). It is worth remembering this before you decide to select the companies in which you want to invest. As in virtually every economic sector, you can invest through:

- individual selection of companies,

- ETFs.

Space industry – Is it worth looking for space companies yourself?

As we mentioned earlier, investing on your own is quite a challenge. It is worth considering whether it is worth devoting many hours to further education in this area. Financial literacy alone is not enough. It is essential to understand technology and stay abreast of new developments that may change the industry. If you do not want to invest more money, such an analysis may be ineffective from a financial point of view. This is because if you are starting to build wealth, it is crucial to increase your income and save as much money as possible. For this reason, if you have extra hours of free time and little capital to invest, we recommend training or overtime. This will allow you to build wealth faster. However, searching for companies on your own also has its advantages. These include, among others: the opportunity to choose a selected niche that has great growth potential. Investing on your own account may also allow you to look for a company priced below its intrinsic value, which will allow you to achieve a good rate of return in the long term.

How to invest in space ETFs?

Unfortunately, there is not a large number ETFs giving exposure to the space industry. This is because it is still a small market. For this reason, ETFs have small assets under management, which discourages the creators of this type of instruments from promoting their products and expanding their offer. Polish investors find it even more difficult to invest in this type of instruments due to EU and national officials (the need to translate the KID into a language accepted by individual countries). As a result, European investors can only trade two ETFs:

- VanEck Space Innovators UCITS ETF,

- HANetf Procure Space UCITS ETF Acc.

VanEck Space Innovators UCITS ETF

The mentioned product is not very popular among investors. Despite having a catchy ticker (JEDI), assets under management amount to approx € 7 million. This is not much considering that the product debuted in mid-2022. Such a small AuM poses a (still small) risk that the product may be closed. However, while it is still tradable, we will briefly describe it. ETF is relatively expensive as the management fee is approx 0,55% annually. The benchmark is the MVIS® Global Space Industry Index. The mentioned index consists of the largest and most liquid companies in the space industry. The condition for joining the index is that the company generates most of its revenues from activities related to space exploration, rocket propulsion systems, satellite equipment or other communication solutions. The ETF replicates the index physically, so its portfolio includes 25 companies. The rate of return of the investment product is not very high. Since mid-2022, the fund has earned just over 5%. Therefore, it is less than interest income from bonds or treasury bills.

The largest components of the ETF are:

- Wistron – 8,6%

- SES SA – 7,7%

- Iridium Telecommunication – 7,5%

- Rocket Lab – 7,3%

- Globalstar – 6,2%

HANetf Procure Space UCITS ETF Acc

Like the previous ETF, this one also has a Star Wars theme. This time the ticker is IODA. The effect is similar to that of a competitor, the assets under management are not impressive. AuM is only € 11 million, so the product is most likely not very profitable for the fund's creators, even though the TER is high and amounts to about 0,75%. The benchmark for the ETF is the S-Network Procure Space Index. The above-mentioned index groups companies operating in the space industry and generating the majority of revenues there. This ETF includes a lot of companies related to the satellite and communications market. The fund replicates the index physically. There are 32 companies in it, so it is quite a concentrated product. Since its debut in mid-2021, the ETF has lost over 40%.

The largest components of the ETF are:

- EchoStar – 8,4%

- Trimble - 5,3%

- Globstar – 5,3%

- Sirius XM – 5,3%

- SES SA – 5,2%

ETF from across the Great Water

If someone knows how to buy ETFs from the American market, or has direct access to this market, they are certainly interested in what products they can find there. Among the most popular are:

- ARK Space Exploration and Innovation ETF,

- Procure Space ETF.

The mentioned products have much larger assets under management than their European counterparts.

ARK Space Exploration and Innovation ETF

The most popular is the ARK Space Exploration and Innovation ETF. This is one of the funds managed by the famous Cathi Wood, who went from heaven to hell and back. The current ETF focuses on the comics sector and the beneficiaries of the development of technologies helping in space exploration and telecommunications. It is an actively managed ETF, which means that it does not passively track any index. The fund itself has approx $246 million in assets under management. ETF is not cheap because the annual cost of owning an ETF is about 0,75%. Since the fund's inception in 2021, the loss has been almost 23%. Interestingly, every year was a loss (2021,2022,2023, XNUMX, XNUMX).

The largest components include:

- Aerovironment Inc – 8,6%

- Kratos Defense & Security – 8,5%

- Trimble - 7,7%

- Iridium – 6,8%

- Teradyne – 5,4%.

Procure Space ETF

It's another ETF with a catchy ticker - this time it's this one UFO. The benchmark for the fund is the S-Network Space Index. Assets under management of this fund amount to approx $ 35,4 million. It is an expensive product because the annual cost is 0,75%. According to data from information documents, the ETF invests over 80% of its assets in companies that earn most of their revenues in the space sector. The companies include, among others: producers of software and hardware necessary in the development of space projects. In addition, companies operating in the satellite telecommunications niche. Of course, there are also producers of rockets and satellites, as well as producers of protective clothing and footwear (e.g. spacesuits). There are 32 companies in the ETF, and the largest 5 include:

- EchoStar – 9,3%

- Globalstar – 5,7%

- ViaSat – 5,2%

- Rocket Lab – 5,1%

- Sirius XM Holdings – 5,0%

Brokers offering ETFs and stocks

How to invest in companies from the space industry? Of course, the simplest option is to buy only shares, but for people who want to well diversify and balance their portfolio, investing in entire ETFs will be a better choice. An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments. For example on XTB Today, we can find over 3500 companies and 400 ETFs, a Saxo Bank as many as 19 shares and approximately 000 ETFs.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 21 exchanges |

| Number of shares in the offer | approx. 3500 - shares approx. 2000 - CFDs on stocks |

19 - shares 8 - CFDs on stocks |

3 - shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFDs on ETFs |

3000 - ETF 675 - ETF CFDs |

323 - ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | 0% commission* |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 | 100 USD |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

EToro platform |

*Zero commission means no brokerage/transaction fee was charged during the activity. However, they may still incur general fees, such as currency conversion fees for deposits and effects in non-USD currencies, fees for fees, and (if applicable) inactivity fees. Market spread also applies, although this is not a "fee" charged by eToro.

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

Space industry: summary

Investing in space may seem exciting, but it is worth considering whether projects related to, for example, space tourism or mining have a chance of generating large profits now or is it just a melody of the future. It is possible that investments in technological companies related to the satellite market (e.g. software producers, creators of key components) will be more promising. The market is certainly risky and it is worth considering whether there are other promising sectors that will provide a decent rate of return. It is also worth remembering that it is not always necessary to invest in a new sector to achieve spectacular profits. Sometimes you just need to choose companies that are properly managed. Then such a company has a chance to generate a good return on invested capital despite operating in... “boring industry”. However, if you want to try your hand at the space market, carefully consider the advantages and disadvantages of this market sector.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Space industry – How to invest in space companies? [Guide] space industry](https://forexclub.pl/wp-content/uploads/2024/04/branza-kosmiczna.jpg?v=1712148978)

![Space industry – How to invest in space companies? [Guide] Polish economy](https://forexclub.pl/wp-content/uploads/2023/04/zloty-silny-polska-gospodarka-102x65.jpg?v=1681975290)

![Space industry – How to invest in space companies? [Guide] monetary policy](https://forexclub.pl/wp-content/uploads/2023/12/Polityka-monetarna-102x65.jpg?v=1702630685)