Speculation - A Few Words About How Traders Trade [Video]

We usually associate speculation with crises and financial instability. After the spread of this trading method, it was mainly associated with Jesse Livermore and reading Stock Player Memories, which we reviewed for you. What is speculation really? Is it merely a derivative gambling? Or is it based on some rules? What are speculators looking for in the financial markets? Is this type of trading effective and requires preparation? Or is it rather spontaneous trading based on subjective beliefs?

Speculator, meaning who?

Let's start from the very beginning, that is, explaining what speculation is and who a speculator is. By definition, it can be said that the meaning and purpose of speculation is to make buy and sell transactions on financial markets in order to achieve high profitability from the concluded positions. Okay, but how is this different from other forms of investing? In general, a theory can be enriched with a few additional elements, the goal, the time in which we want to achieve a return, the tools we use to achieve it, and instruments. Generally, it's hard to imagine talking about speculation without including short selling and the possibility of leveraging your positions (using leverage).

Speculation relies on forecasting that does not need to be supported (but can) by any fundamental premise. We usually talk about speculation taking into account short-term investments, which does not have to be the rule. Admittedly, it is hard to imagine holding a position with a high degree of risk (leverage + volume) for several years in your investment portfolio. Livermore himself has spoken against treating speculative deals as long-term investments. Nevertheless, it does not mean that we cannot forecast the market (for such transactions) based on historical data from several to several years.

Forecasting the market, is it even possible?

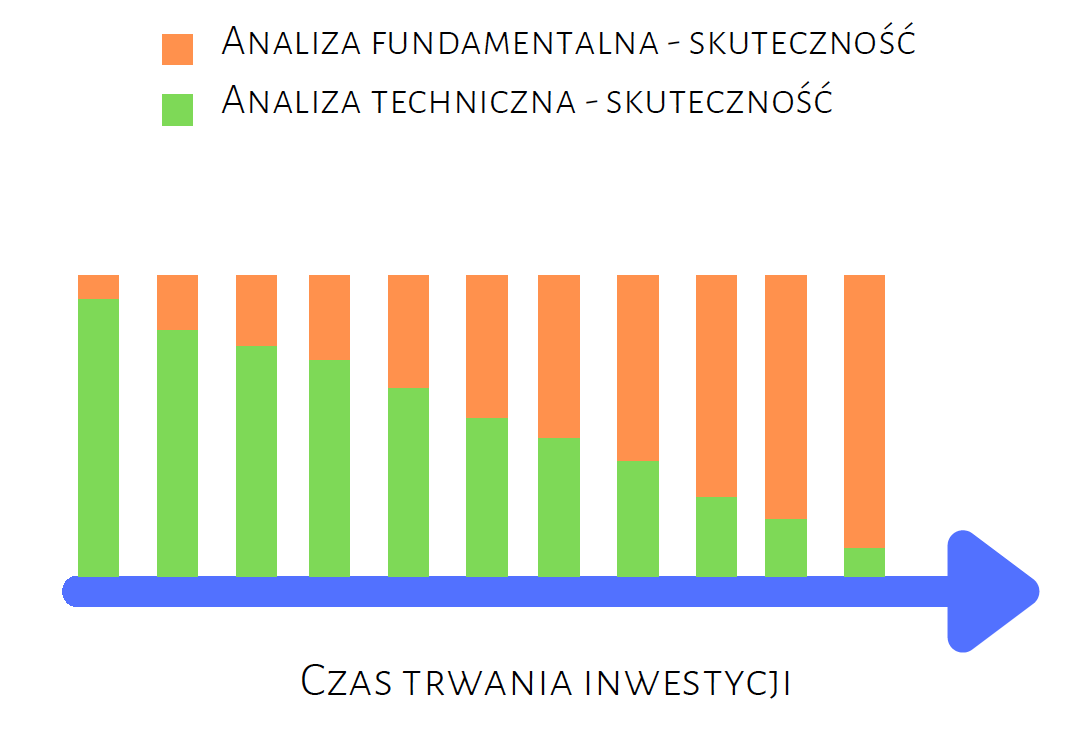

From practice and theory, we know two basic methods of market forecasting - fundamental and technical analysis. Of course, you can freely combine them with each other. However, we will not analyze them effects. We will focus on the key issue, i.e. the use of both analyzes to forecast price changes in the market de facto it is an integral part of speculation. Taking into account the classic assumptions of both analyzes, they can be presented in the following graphics.

Looking through the prism of classical financial market theory, it is not possible to predict price considering market efficiency. In other words, it is assumed that the market is efficient, which means that it reflects in the price all available information about a given instrument. Is this the case in practice? Of course, you can argue with this (which I personally think is right). The efficiency of markets is merely a hypothesis that sets out some idea of how markets should function properly.

The speculator in all this takes into account an extremely important thing, which also largely affects the short-term valuation of instruments. It is about emotions. If the markets were completely efficient, we could not talk about undervalued or overvalued assets, and we know perfectly well that there are really many instruments belonging to one or the other group.

Okay, how to speculate?

In the introduction, we wrote about what is usually associated with speculation. Most concepts suggest that speculation is based on looking for high returns on short-term investments. In order to be objective, it is also worth considering practice. I think the best words to describe who a speculator is are those of Jessie Livermore:

“Speculation is the most interesting game in the world. However, it is not intended for stupid, lazy people, those with emotional problems or looking for a quick income. Poor ones will die. "

This quote answers most of the questions in the introduction. So we know that this style of trading also needs to be prepared through analyzes and scenarios. There are not too many cases in speculation. It requires not only a purely technical preparation, but also a mental one (appropriate attitude, cleverness, willpower and consistency in action). According to the most famous speculator, certain market behaviors (formations, by default) repeat themselves due to the fact that investors (price movement makers) are still driven by the same emotions - greed, fear, ignorance and hope.

Where to find an opportunity for speculation?

Jessie, in his positions, focused mainly on the most available instruments at his time, i.e. actions. Where was he looking for an opportunity to enter? He mainly watched large companies. In his opinion, it was there that trends for the entire market were created and it was there that decisions about which direction the exchanges would go were made. Big companies were more stable for him (and are still viewed through the prism of the present day). Okay, but how does this stabilization compare to speculation? By observing general market trends, it is easier to spot deviations from the trend in other parts of the market.

Quote again Livermore:

“Watch the biggest - biggest companies and market leaders. This is where decisions are made in which direction the market will go. If you can't make money from the biggest - you won't make money from the rest of the market either. "

Where else can you look for speculative entries? Complementing the topic, along with Bartłomiej Chomka, an analyst at TeleTrade, we talked about our approaches - long term and short term.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Speculation - A Few Words About How Traders Trade [Video] speculation approach to the forex market](https://forexclub.pl/wp-content/uploads/2021/02/spekulacja-podejscie-do-rynku-forex.jpg?v=1614536808)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

![Speculation - A Few Words About How Traders Trade [Video] BOGLEHEADS financial freedom](https://forexclub.pl/wp-content/uploads/2021/02/BOGLEHEADS-wolnosc-finansowa-102x65.jpg?v=1614355697)

![Speculation - A Few Words About How Traders Trade [Video] Fed versus bond market](https://forexclub.pl/wp-content/uploads/2021/03/Fed-kontra-rynek-obligacji-102x65.jpg?v=1614595689)