Fear in the markets, bears prevail, conservatism in China

The past week was marked by the dominance of the "bears". Signs of deteriorating moods on the equity markets appeared earlier, but only the last few days have undeniably emphasized the advantage of sellers. Equity markets followed the declining bonds for several weeks. Fears about the future and nervousness of investors are reflected in the rise of the VIX index, known as the "fear index".

The deteriorating market sentiment is correlated with the growing pressure on the Federal Reserve. Expectations of more restrictive moves from the Fed mean that there are more and more signals in the markets indicating an increase in risk aversion. The lack of unequivocal symptoms confirming the dynamic rebound of the Chinese economy also inhibits investors' optimism.

The bears prevail

The relatively calm beginning of the week due to the lack of session on the US stock exchange did not herald such emotions in the following days. On Tuesday, US indices recorded their worst day of the year, losing over 2%. What's more, the dynamic declines did not encourage "hole seekers" to increase their activity and take advantage of lower share prices. Fuel to the fire was added by Friday's reading of the PCE inflation index, which turned out to be the "nail in the coffin" and caused the decline to deepen. Finally, the S&P 500 index ended the week with a loss of 2.67%. Bearish sentiment also dominated trading for the Nasdaq index, which returned a rate of -3.32%.

The indices of European stock exchanges did not resist the declines. The scale of the sell-off that affected stock exchanges in Europe confirms their relative strength, however the initiative belonged to the supply side this week. The German DAX lost 1.76% throughout the week. The French CAC 40 index (-2.18%) and the British index showed similar characteristics 100 FTSE (-1.57%).

Emerging markets indices were interesting this week, with China's Shanghai Composite (1.34%) being the leader, able to counter negative sentiment. The stock market in Brazil ended the week in the "red" (index Bovespa lost 3.09%). Optimism has also "evaporated" from other markets. The Hang Seng Index recorded a loss of -3.43%, and India's Sensex was equally weak, losing 2.52%.

Stocks on the Warsaw Stock Exchange also came under pressure from sellers. The weakness of banks and commodity companies led to decrease of the WIG20 index by 2.79%. Small and medium-sized companies tried to resist the negative sentiment, but also in their case the final balance sheet turned out to be unfavorable (the sWIG80 index lost 0.12%, and the mWIG40 achieved a rate of return of -1.70%).

Fear visible in the markets

Dynamic increases in risky assets in recent weeks meant that investor sentiment improved significantly, and the feeling of greed was definitely more common than fear. Investors' "sleeping" of vigilance, in the face of unfavorable circumstances (including an increase in the expected level of target interest rates in major economies), created a great opportunity for the "bears" to take control of the market.

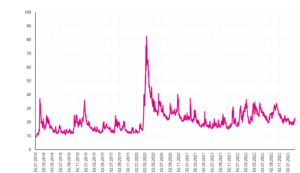

The change in moods and the arousal of uncertainty among investors is perfectly reflected by the VIX index, which has reminded many people in recent days. The VIX, commonly referred to as the "fear index", is an indicator that reflects market expectations regarding volatility the S&P 500 index within the next 30 days. The basis for calculating the value of the VIX index is the implied volatility of S&P 500 options with expiry dates between 23 and 37 days.

READ NECESSARY: VIX - Fear Index as a barometer of investor sentiment

In recent weeks, the VIX has shown no signs of investor nervousness. For most of January and February, the value of the index was close to 20 points, being at the same time close to a several-month low. The scale of index fluctuations was also not extraordinary, but in the last week there were symptoms indicating a change in the current situation. The index recorded a significant increase (mainly during Tuesday's session), reaching the highest levels since December 2022.

The VIX was named a "fear indicator" due to its negative association with the behavior of stock market indices. Taking into account the historical quotations of the S&P 500 index, it can be observed that the dynamic declines in shares are related to the increase in the VIX index. We had to deal with such situations, for example, at the time of the outbreak of the coronavirus pandemic or the outbreak of war in Ukraine.

The link between the VIX stock market index and the S&P 500 is particularly evident when strong directional movements occur. The jump in the indicator observed last week can be treated as another warning signal for investors. An increase in the value of the VIX indicates more nervousness and increasing volatility in the stock market.

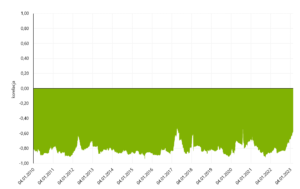

The relationship between the VIX and the S&P 500 index is best represented by a high negative correlation coefficient. The moving measure estimated on the basis of 100 observations in the years 2010-2023 was on average at -0.8157, which confirms the high dependence of the "fear index" quotations and the rates of return on the stock market.

Taking into account the negative correlation, this indicator could be used by investors as an instrument that allows them to earn profits in times of downturn on the stock exchanges or as an element securing the portfolio. However, there is currently no option to buy or sell an index directly, but a popular way to gain exposure to the "fear index" is to use of ETFs. This group includes, for example, the Lyxor S&P 500 VIX Futures Enhanced Roll UCITS ETF - Acc instrument, whose purpose is to map the VIX index quotations. The effectiveness of the solution works especially in the short term, as the need to roll contracts daily and incur costs in the long term has a negative impact on the achieved result.

W.5 Behavior Lyxor S&P 500 VIX Futures Enhanced Roll UCITS ETF – Acc against VIX index. Source: own study, CBOE, Stooq.pl

The Fed minutes did not cause any shock

The minutes from the Fed meeting published on Wednesday were described as one of the most important events of the week. In the final analysis, this event can be summed up with the phrase "from a big cloud a little rain". The importance of "minutes" was slightly less than usual, e.g. due to macroeconomic data released after the Fed meeting. However, the general tone of the minutes confirms the hawkish attitude of members of the institution responsible for shaping monetary policy in the US.

In the "minutes" there is information about inflation remaining well above the target set by the Fed at the level of 2%. At the same time, attention was drawn to the tense situation in the labor market, which contributes to the continuous pressure on price and wage increases. Participants of the meeting stressed that in recent months a desirable decline in inflation growth could be observed, but more evidence would be needed to permanently confirm the observed trend. Several Fed members at the last meeting advocated a 50 basis point hike, which would show greater determination to fight inflation and bring interest rates closer to levels indicating a sufficiently restrictive stance in terms of price stability.

The protocol stated that some Fed members see an increased risk of a recession. At the same time, the prevailing position is that the economy will avoid the "dark scenario" and only have a "soft landing" in the form of a slowdown in economic growth. Participants of the meeting, however, point out the great uncertainty regarding the future, e.g. due to the ongoing war in Ukraine, the opening of the Chinese economy or prolonged tensions on the labor market.

The publication of "minutes" did not have a major impact on the US stock or bond market, but it is worth paying attention to the reaction of the FX market. The hawkish messages from Fed members led to an appreciation of the US dollar. The exchange rate against the euro fell to the lowest level in several weeks, breaking important technical supports.

The strengthening trend of the US dollar observed in recent days is another argument proving that the scales are tipping towards the "risk-off" scenario and investors are looking for a safe haven for capital. Consolidation of this trend in the following days may be a confirmation of taking control over the market by the "bear camp". The strong dollar is not conducive to commodity prices, which has become evident in recent sessions. The downward pressure translated into copper prices, which for many years have been considered an excellent predictor of the economic situation (it is widely believed that copper has a "PhD in economics").

Conservation in China

The behavior of raw materials also depends significantly on the economic situation in China. The global economy has high hopes for the opening of the country after a period of strong restrictions related to the coronavirus pandemic. Observing the reports from the Middle Kingdom, one can get the impression that the authorities have so far been very cautious and conservative in implementing measures to stimulate the world's second largest economy.

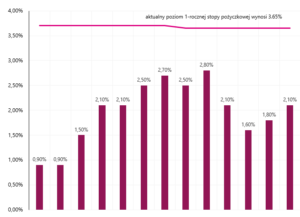

On Monday, the People's Bank of China held a meeting, at which it was decided to keep interest rates at the current level. The central bank left the base 3.65-year lending rate at 4.30%. The five-year benchmark interest rate for mortgage loans is currently XNUMX%. Taking into account the low level of inflation, as well as challenges for the economic growth prospects in the form of a poor situation on the real estate market, weakening exports and fragile consumer confidence, it is widely expected that interest rates will decrease in the coming months.

The uneven recovery is evident in the latest credit data. In recent weeks, the indebtedness of companies has increased significantly after the central bank's decision to extend the aid and further need to support the economy. In January, new bank lending jumped to a record high of 4.9 trillion yuan, equivalent to approximately $713 billion.

However, the increase in lending was driven mainly by public infrastructure projects, and the actual interest from enterprises remained low. Stronger demand for loans, however, led to tighter liquidity conditions and an increase in interest rates in the interbank market. Therefore, unofficial information appeared this week indicating that the central bank sent informal instructions to institutions to limit the pace of lending.

In addition, the People's Bank of China maintains pressure on banks to stimulate consumption, but these actions do not bring the expected results, as consumers are very cautious and often allocate extra funds to prepay mortgage loans. The operation in which funds from cheaper consumer loans are used to repay mortgage loans is a prohibited practice by regulators. In connection with irregularities and abuses in the subject of consumer credit, the Chinese banking supervision authority has recently fined five financial institutions.

Summation

The pendulum in global markets is starting to swing in the negative direction. The mood on the world's stock exchanges is deteriorating, and the highest reading of the VIX index in several months indicates the emergence of fear among investors. A symptom confirming the change in sentiment on the market is also the appreciation of the US dollar observed in recent days.

Hopes for an economic recovery in China are somewhat flimsy so far, which is not conducive to an increase in risk appetite. Taking into account the macroeconomic conditions and the continuing pressure to raise interest rates by major central banks, the coming weeks will be a real test for investors, and at the same time they should provide an answer to the question of whether the optimism at the turn of 2022/2023 was not premature.

Source: Piotr Langner, WealthSeed Investment Advisor

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)