Forex strategy "At the end of the day". Summary - week 15 and 16

Behind us another 2 weeks of trading "At the end of the day" strategy. We currently have over 110 days of testing behind us. It's time to sum up the week 15 and 16. In a nutshell - it was a very good period for our strategy, thanks to which we managed to exceed over 30% of the profit. Not bad for less than 4 months. Below, we describe the most important profit and loss positions from the last 14 days and those that are currently in play.

Check it out: End of Day Strategy Results Summary - Week 13 & 14

Profitable items

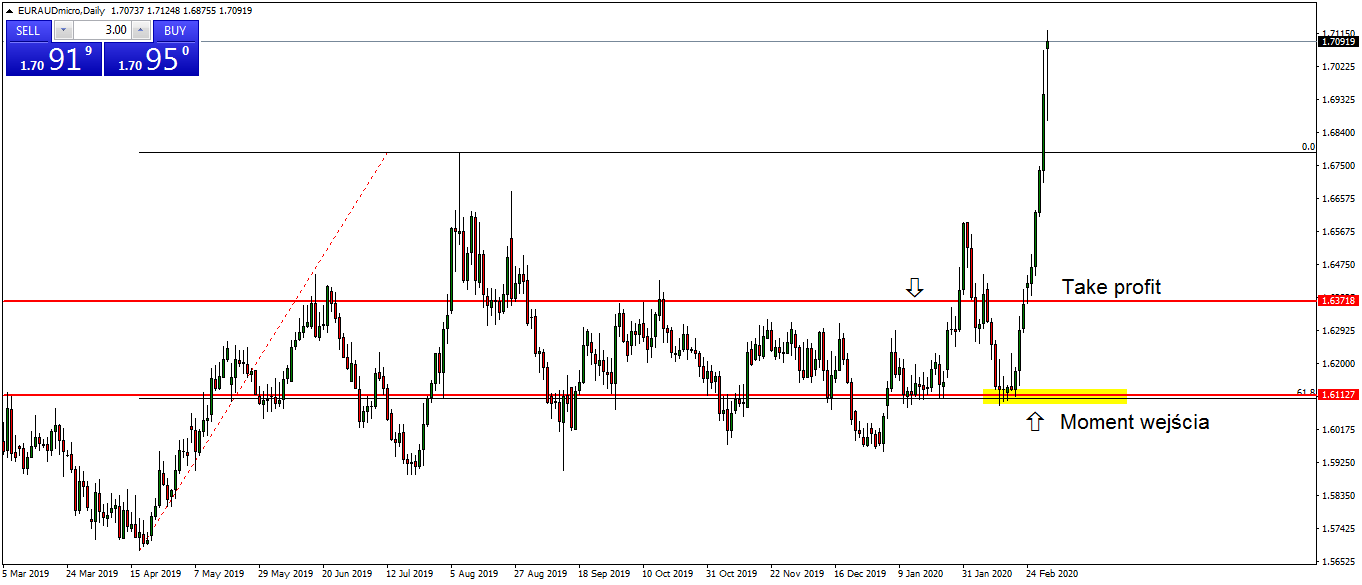

thinking "The best profitable positions of the past two weeks" Undoubtedly, transactions opened on EURAUD and EURJPY pairs should be mentioned. As for the euro against the Australian dollar, the main reason to go long (as always with the rest) was to play with the current trend on the daily chart. The pair respected the demand zone around 1.61100 / 1.61300, which in my opinion was a very interesting place to go long. Additionally, the zone was strengthened by the removal of 61.8% of the marked impulse. Admitting honestly and by the fact, now it is clear that the take profit was too "modest" and its bolder setting would have brought much better results.

Long position. EUR / AUD chart, D1 interval. Source: MT4 XM

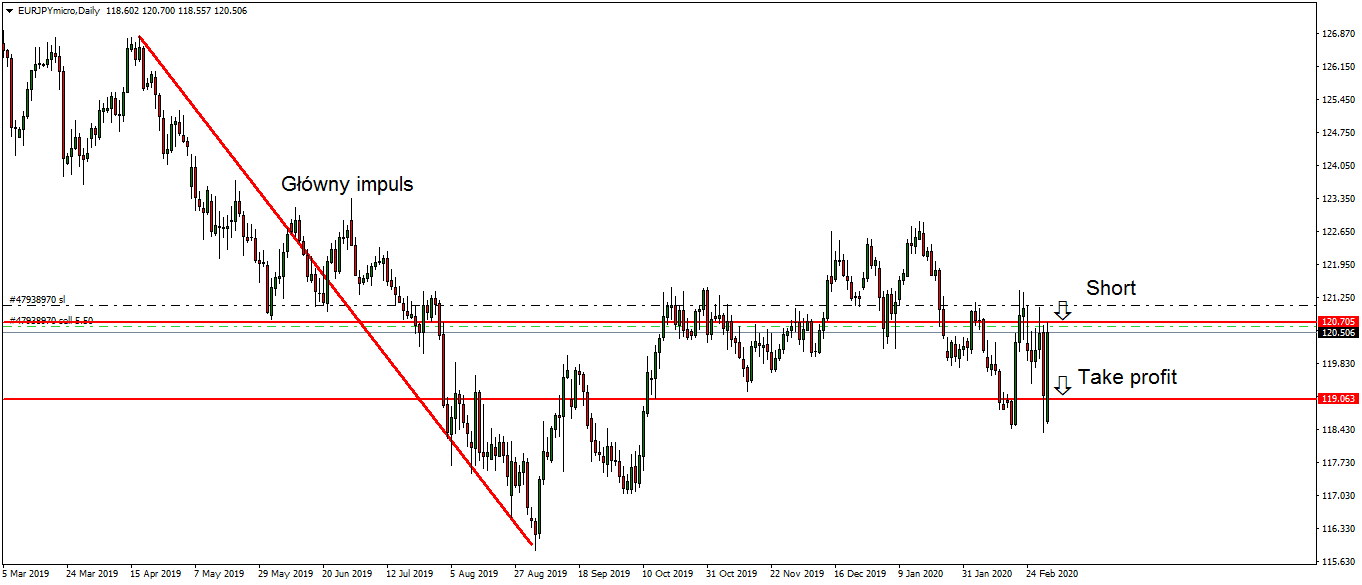

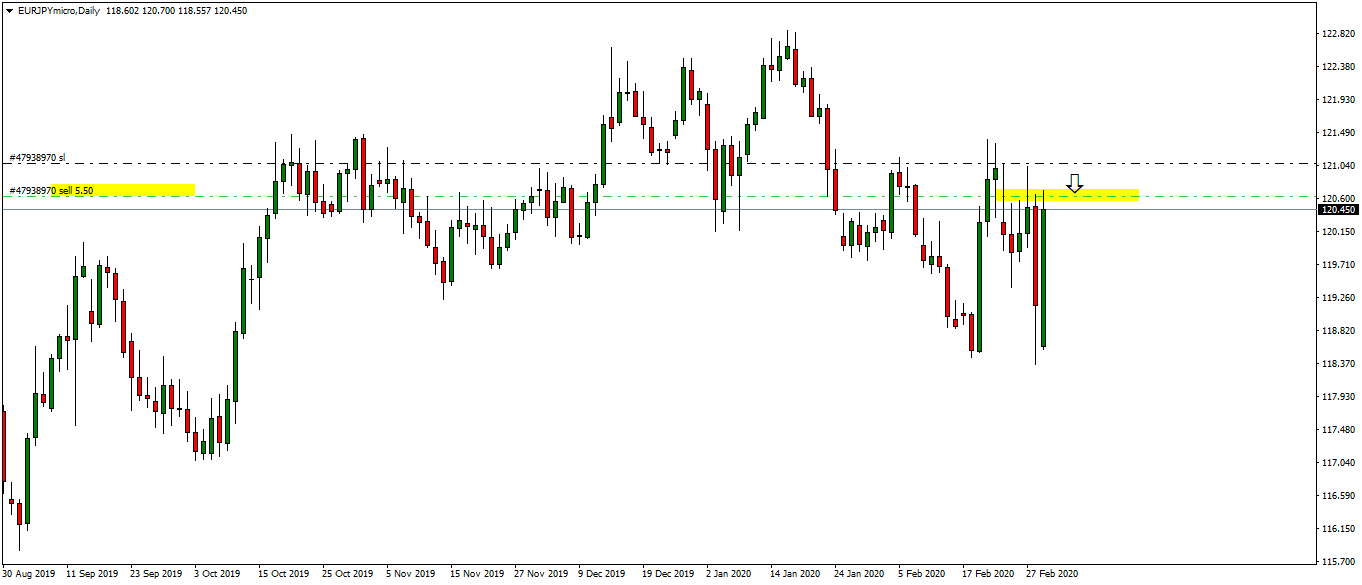

The second pair is EURJPY. Here you can say that over the past few days the candles have been a bit "torn". We are dealing with high volatility, but in my opinion it does not disturb the main trend in this asset yet. In my case, only declines were involved, so I was looking for the opportunity to enter the short position. I think that an interesting place to join the trend is around 120.700. I also set the sell limit there. The position was opened, and a little later, due to a kind of price tug, take profit was caught.

Short position. EUR / JPY chart, D1 interval. Source: MT4 XM

Loss positions

When describing lossy transactions, you could really limit it to one ... pound.

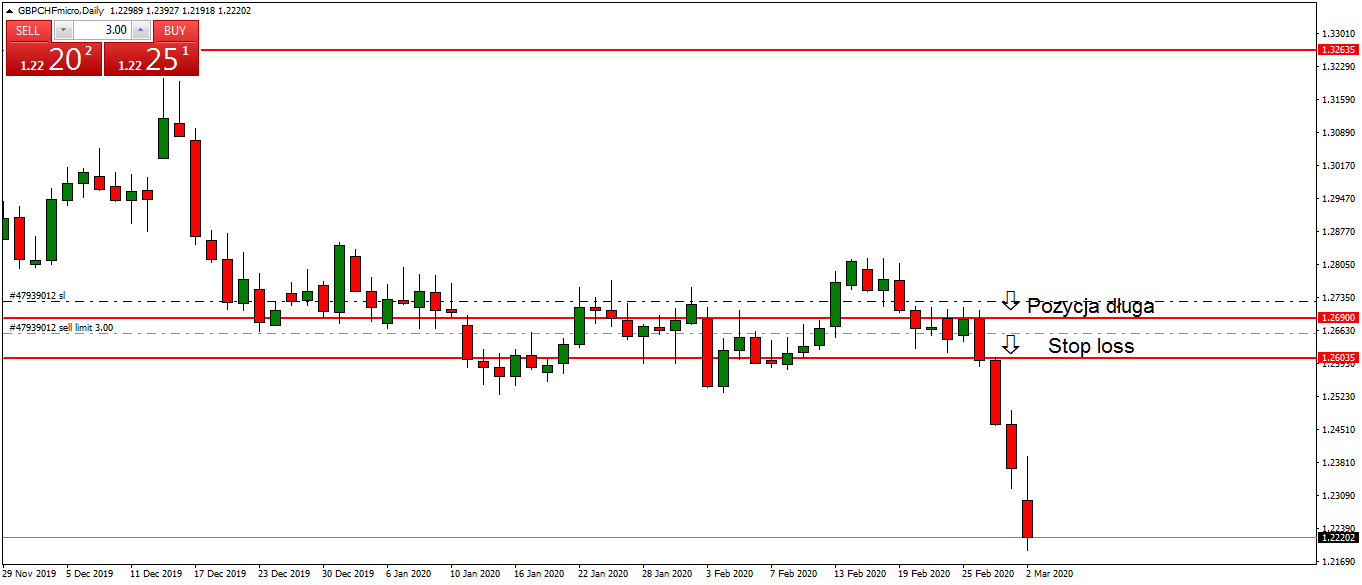

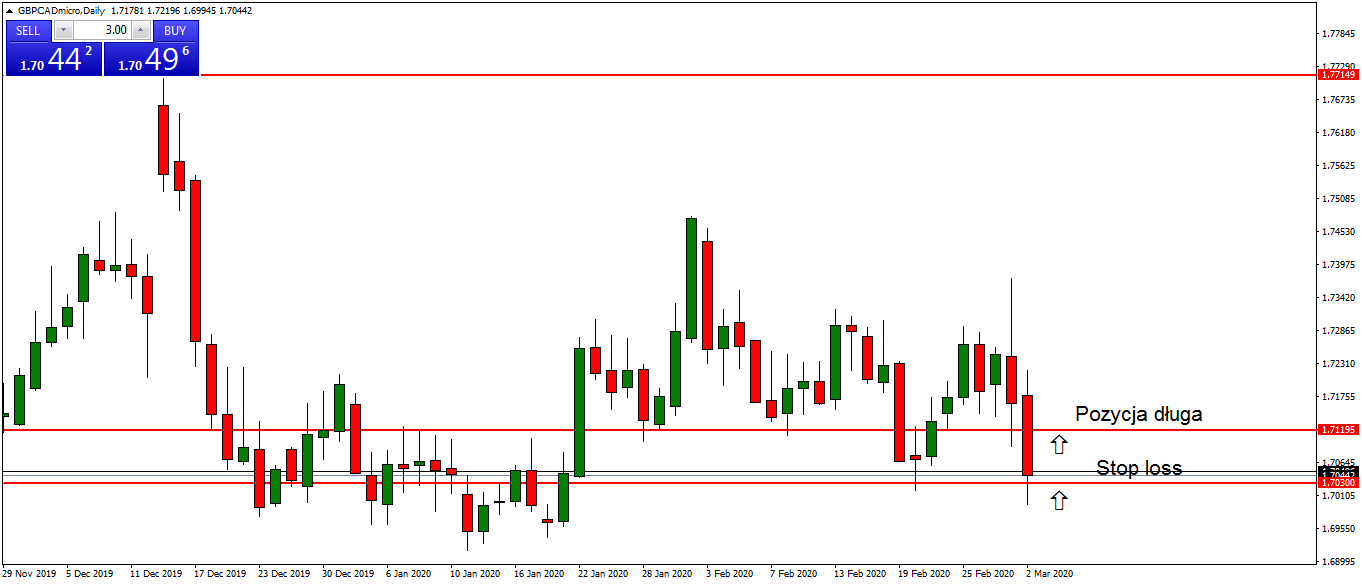

GBPCAD and GBPCHF - in both cases I was counting on a rebound up. I've covered a bit more about GBPCHF in a dedicated forum thread. After rejecting the zone around 1.26770 / 1.26640, the descent was very dynamic. In turn, GBPCAD reached the zone in the area of 1.71100. The price receded, which gave hope for continuing the upward move, but the next candle was strongly falling and this led to the closing of the position.

Long position. GBP / CHF chart, D1 interval. Source: MT4 XM

Long position. GBP / CAD chart, D1 interval. Source: MT4 XM

Positions in the game

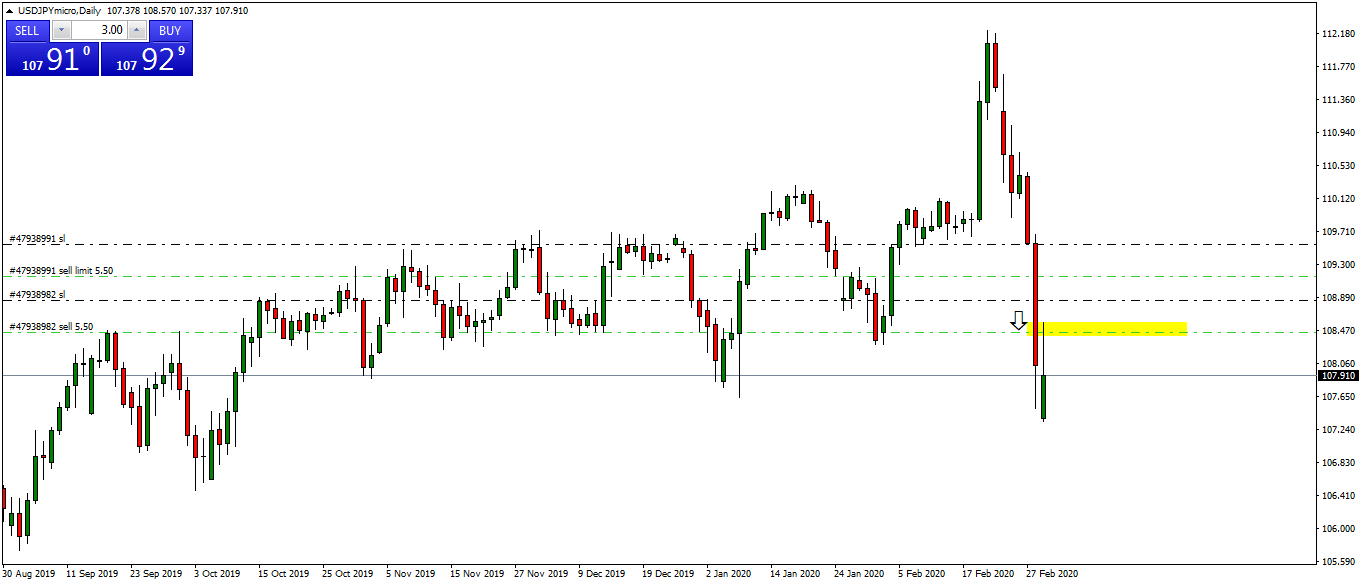

The transactions currently open are two shorts - USDJPY and EURJPY. In the case of the euro, I assume the same scenario as described earlier. The downward trend is still relevant for me and I am playing the position against it. The main direction of USDJPY is also south at the moment. There has been a very dynamic descent in the last few days. I play short, after a corrective move up. The order is exactly 108.453.

Short position. USD / JPY chart, D1 interval. Source: MT4 XM

Short position. EUR / JPY chart, D1 interval. Source: MT4 XM

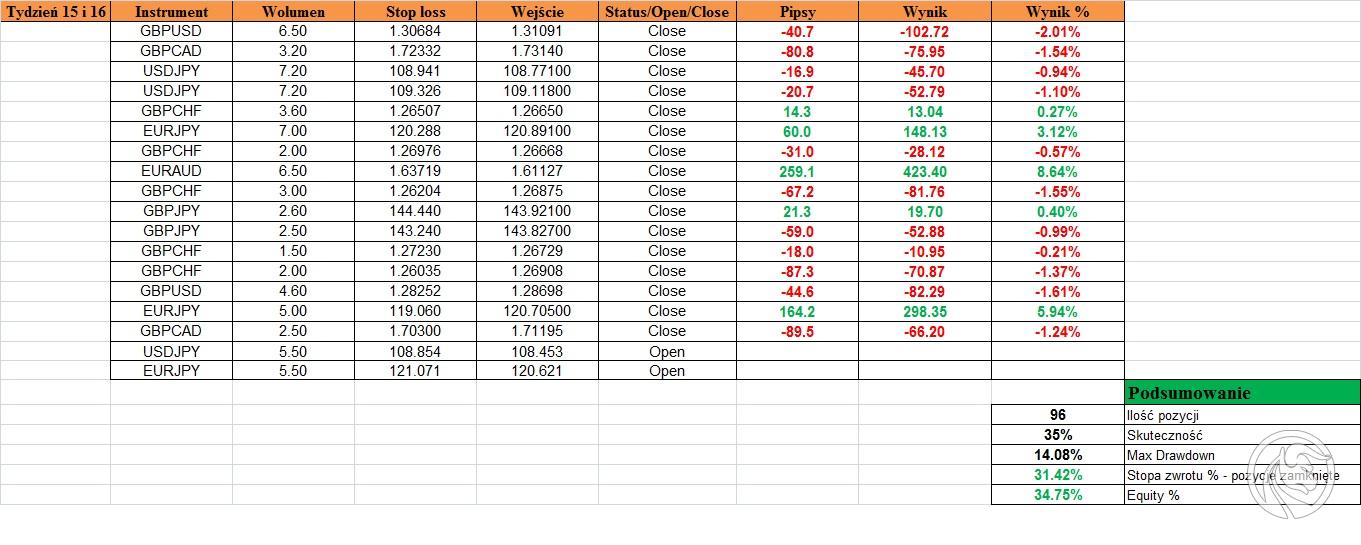

Summation

Four months of trading are behind us. Rate of return on closed positions + 31.42 %. Equity at the moment about + 34.75 %. The whole and the live results are available of course at MyFxBook profile. The current situation is presented on an ongoing basis forum.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Tester 5 - combine for testing strategies [Review] forex tester 5](https://forexclub.pl/wp-content/uploads/2023/04/forex-tester-5-300x200.jpg?v=1679423429)

![4-5 and exit. Highly effective strategy [Video] Trading strategy: 4-5 and exit](https://forexclub.pl/wp-content/uploads/2022/06/4-5_i_wyjscie-300x200.jpg)