Forex Strategy "At the End of the Day". Summary - weeks 6 and 7

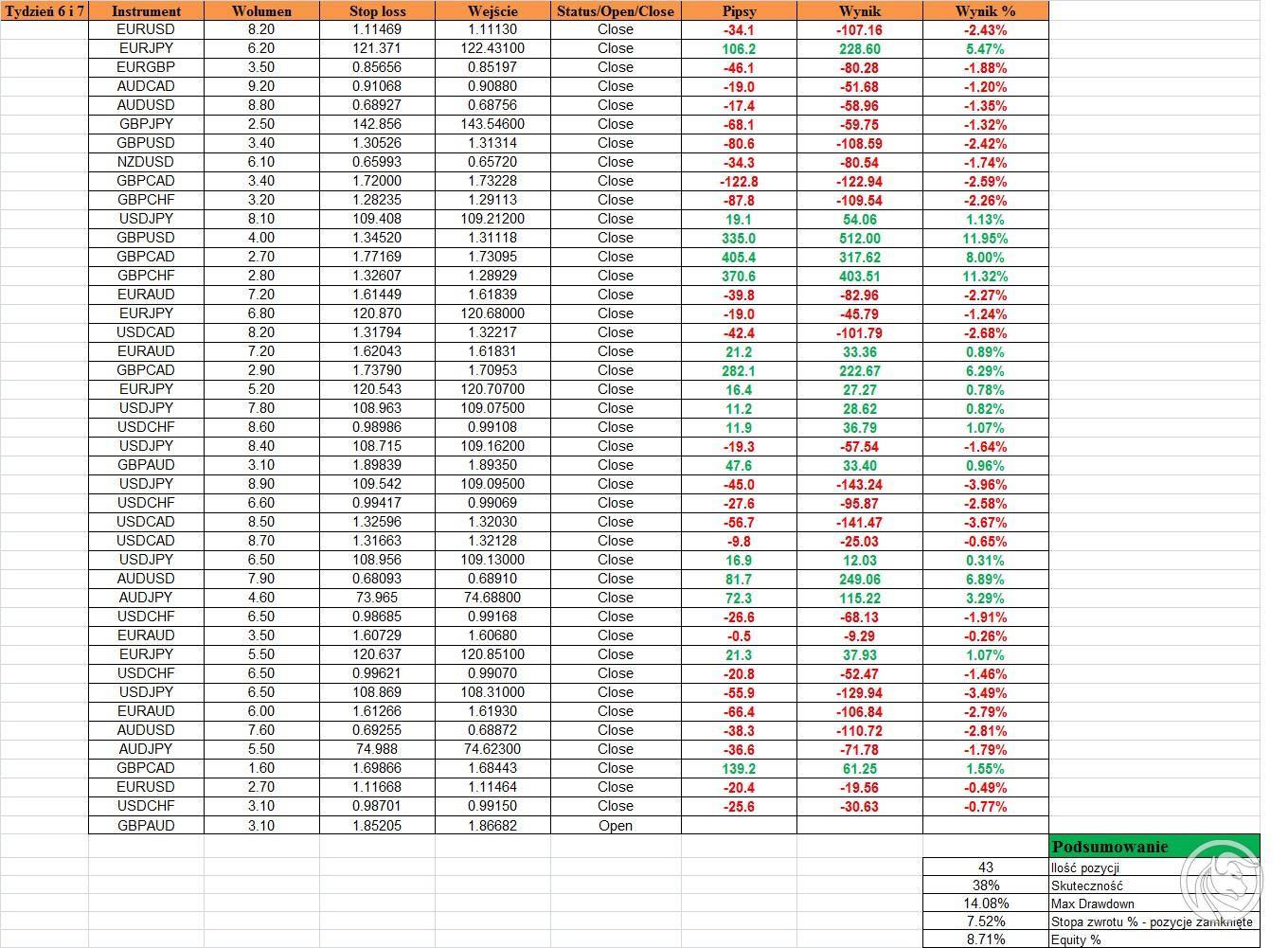

The next weeks of trading are behind us, so it's time for another summary as part of the "At the end of the day" strategy test. In short, it can be said that the last two weeks have been dictated by the pound and the yen. As for week 7, volatility was already much lower due to holidays. I will now briefly discuss the most important transactions of the past days.

Summary - weeks 6 and 7

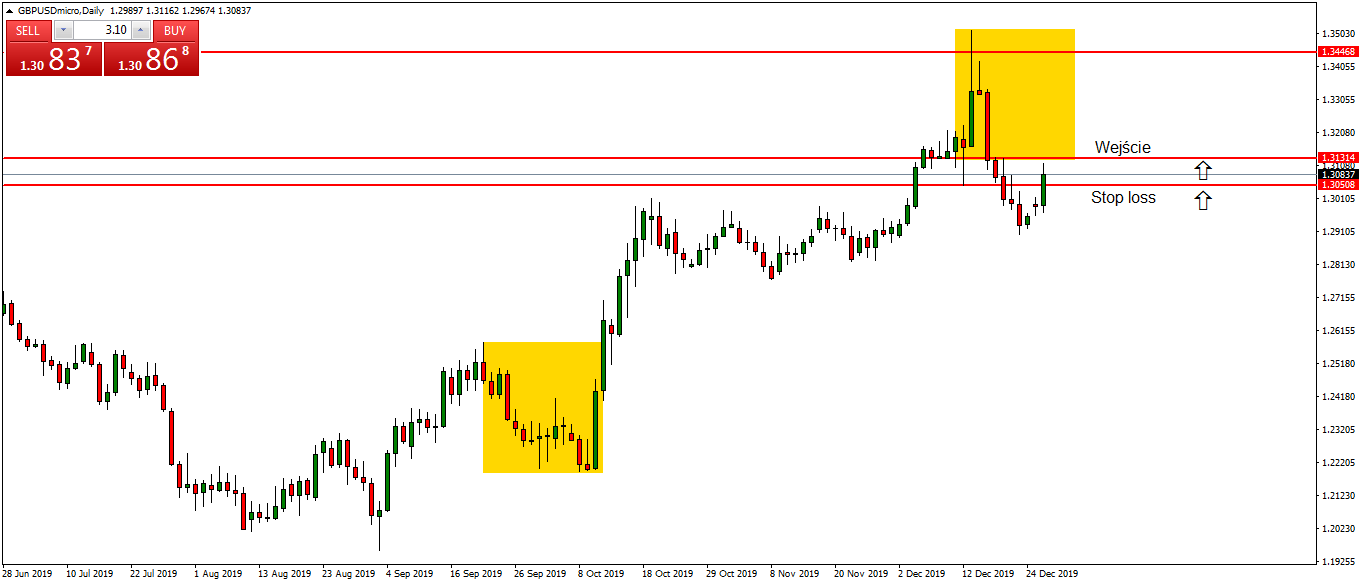

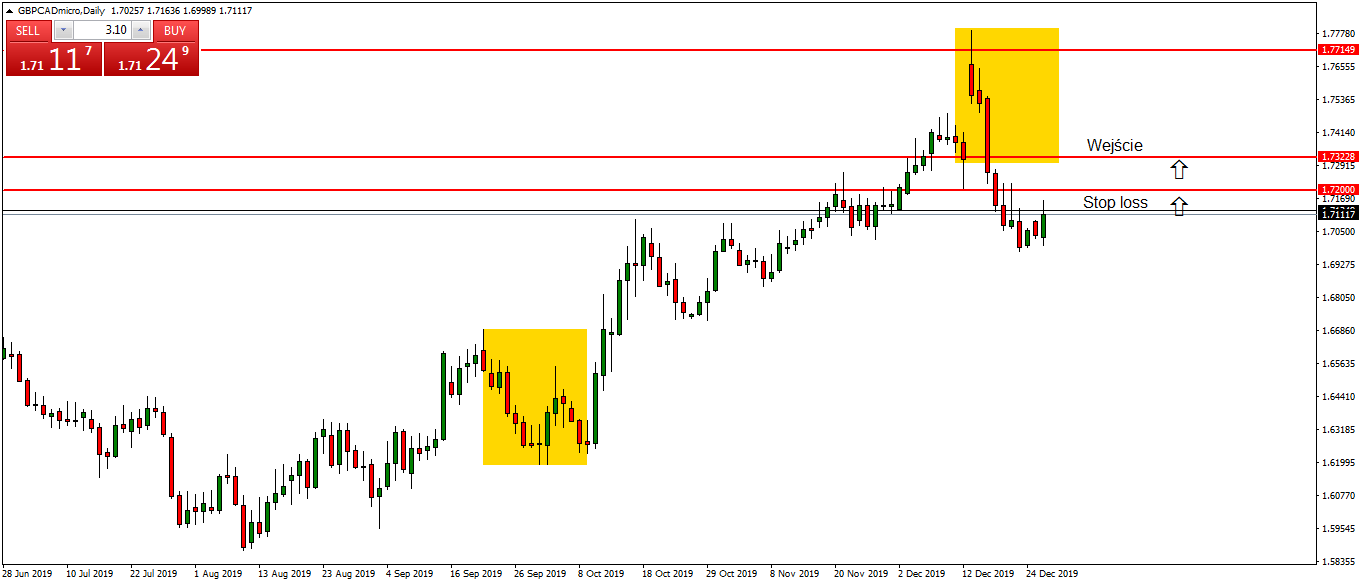

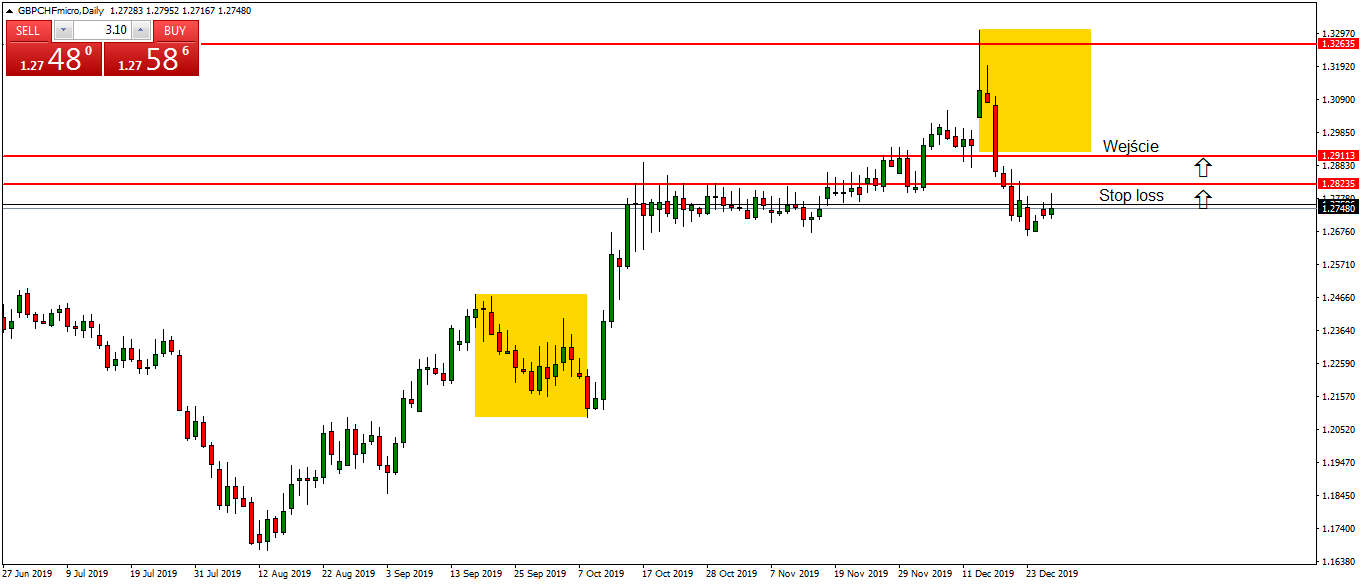

When it comes to losing positions, the pound has undoubtedly shown itself here. To make matters worse, the signals practically doubled on several pairs with this currency. From a strictly technical point of view, in my opinion, the upward trend is still in place. I wanted to join the traffic, but the corrections turned out to be too big, so they passed the positions stop loss. I played on GBPUSD, GBPCAD and GBPCHF. What prompted me to open my position in all three cases was getting the price to an interesting level of support, combined with overbalance, i.e. the equality of corrections in the current trend. Unfortunately, the price went down and the positions were closed. I never increase stop loss by force, sometimes you have to accept that the price goes in a different direction than we expect. Such situations in trading happen and will happen.

Long position. GBP / USD chart, D1 interval. Source: MT4 XM

Long position. GBP / CAD chart, D1 interval. Source: MT4 XM

Long position. GBP / CHF chart, D1 interval. Source: MT4 XM

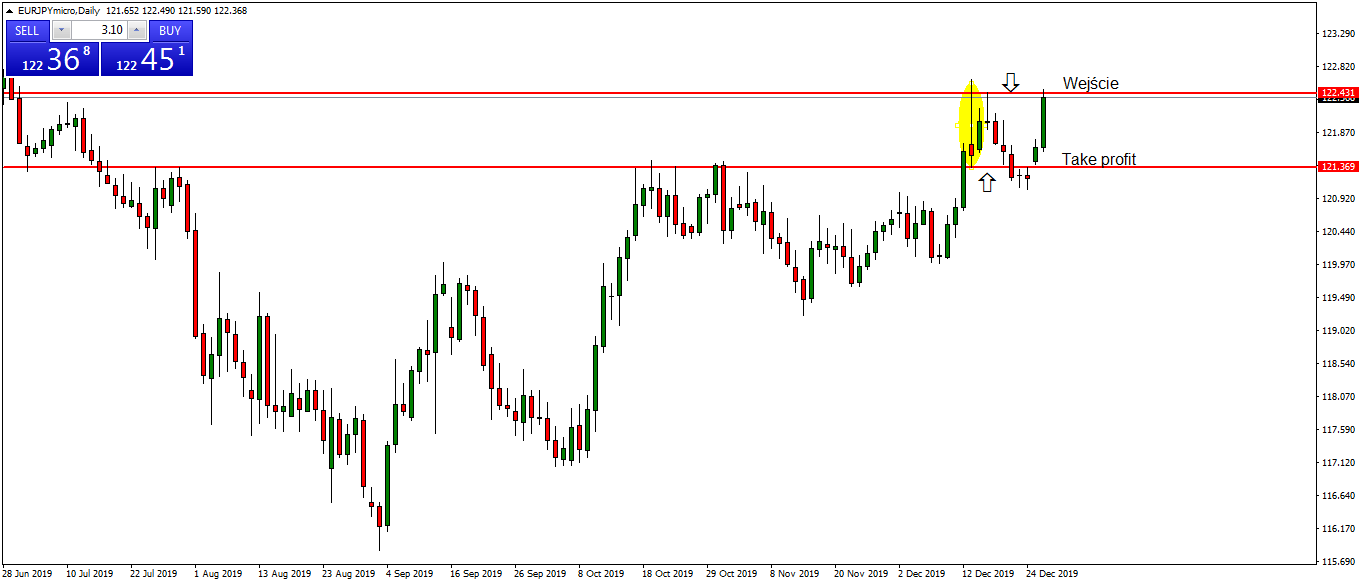

As for profitable positions, short on was definitely the best EURJPY. The pair reached strong resistance around 122.430, after which the price went back a lot. The candle's body was very small, in addition the candle had a long upper shadow. I set up a pending sell limit order that was activated two days later. The price moved down as planned. After a few days, the transaction earned almost 6% (5,7%) and after adjusting up it was closed for take profit.

Short position. EUR / JPY chart, D1 interval. Source: MT4 XM

To sum up, the overall profit decreased, but we are still in the positive area around 9%. At the moment I have one order open, it is buy on GBPAUD. I can already see some interesting setups, the next days promise to be very interesting.

Continuation of the strategy test

We decided to continue the strategy test also in 2020. It will last for at least another 2-3 months, so as to show an even more credible picture of its potential and possible threats. I would like to take this opportunity to wish all readers and editorial staff of the Forex Club website a happy New Year. This time is usually a good time to think. I wish everyone that the coming 2020 will be a year of success both on the professional and private path. In addition, I wish traders many pips and good transactions☺.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Tester 5 - combine for testing strategies [Review] forex tester 5](https://forexclub.pl/wp-content/uploads/2023/04/forex-tester-5-300x200.jpg?v=1679423429)

![4-5 and exit. Highly effective strategy [Video] Trading strategy: 4-5 and exit](https://forexclub.pl/wp-content/uploads/2022/06/4-5_i_wyjscie-300x200.jpg)