Strong sell-off of the zloty, markets are afraid of recession

On Tuesday the dollar went up by PLN 13 and exceeded the level of PLN 4,65. Never in history has the American currency been so expensive. The zloty is also losing against other currencies. All because of fear of recession.

A terrible day for the zloty

The dollar on Tuesday rose by as much as PLN 13, breaking above the local peaks of May and June, and also breaking the maximums of the "war" panic in March this year. Today, the American currency costs over PLN 4,65 and it is the most expensive in history. And a month ago it cost PLN 4,26, while the year before the dollar was valued below PLN 3,80.

USD / PLN daily chart. Source: Tickmill

On Tuesday, a wave of fear of a global recession is pouring through all financial markets, triggering an escape from risk, a sell-off in stock markets, a sell-off of emerging market currencies and other risky assets, including crude oil, which is 7 percent cheaper. At the same time, the US dollar benefits from it, which translates into a decline in EUR / USD below the USD 1,03 level, which has not been seen in years.

And it is this rise in risk aversion, along with a decline EUR / USD and with the weak performance of the zloty, which has been observed for many months, it beats the Polish currency today. At 16:52 the USD / PLN exchange rate increased by PLN 13 to PLN 4,6509, and EUR / PLN quotations by 5,3 groszy to PLN 4,7648.

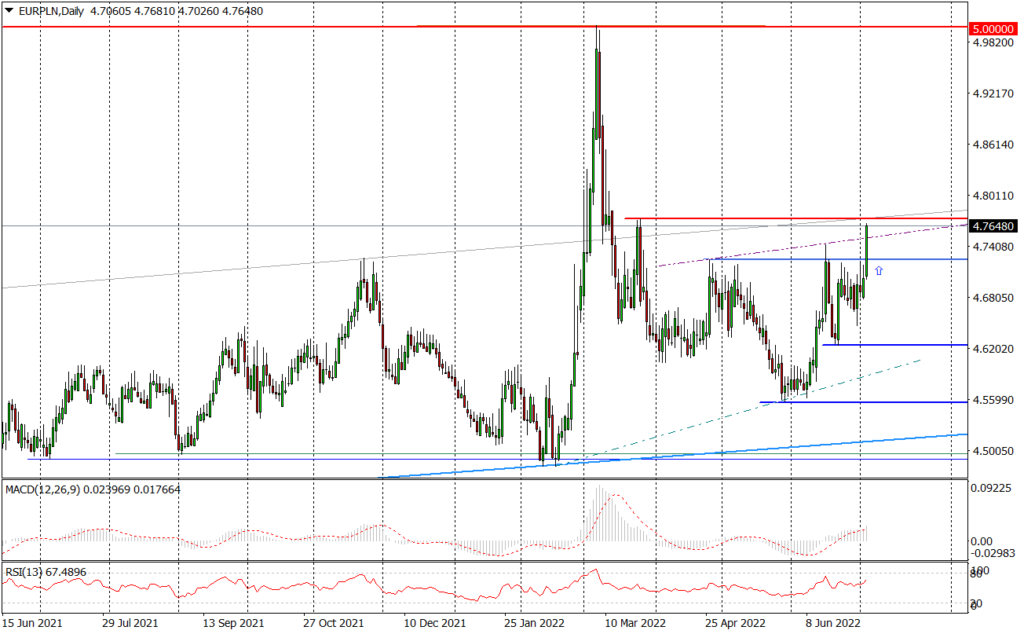

EUR / PLN daily chart. Source: Tickmill

What will the MPC decide?

Today's strong sell-off of the Polish currency places it unfavorably ahead of Thursday's meeting of the Monetary Policy Council (MPC), which the market is now looking at as another factor that could weaken the zloty. The market consensus assumes that the Council will raise the main interest rate in Poland by 75 basis points (bp) to 6,75%. With the current negative sentiment towards the zloty, such a decision will not lead to its appreciation. Especially that the market expects President Adam Glapiński to repeat the suggestion that the tightening of the monetary policy in Poland is about to end. Smaller rate hike (by 50 bp), which cannot be ruled out, will further weaken the zloty. And only an increase in interest rates by 100 bp, which seems to be the least likely scenario, could strengthen the domestic currency.

On the basis of technical analysis, breaking the USD / PLN above the March maximum (PLN 4,6189) opens the way to PLN 4,70. The EUR / PLN exchange rate, after breaking the resistance at PLN 4,7257, should easily deal with the resistance at PLN 4,7733 and then move towards PLN 4,80.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)