Raw materials await the direction of the Chinese congress

The commodities sector, primarily oil and fuel products, continued to show strength despite lingering concerns that central banks' fight against inflation by aggressively raising interest rates will further exacerbate the slowdown in the global economy. While the market continues to focus on dollar and bond yield movements to determine the broader economic outlook, investors are now keeping a close eye on China and the National Congress of the Communist Party of China in terms of initiatives that could support demand from the world's largest consumer of raw materials.

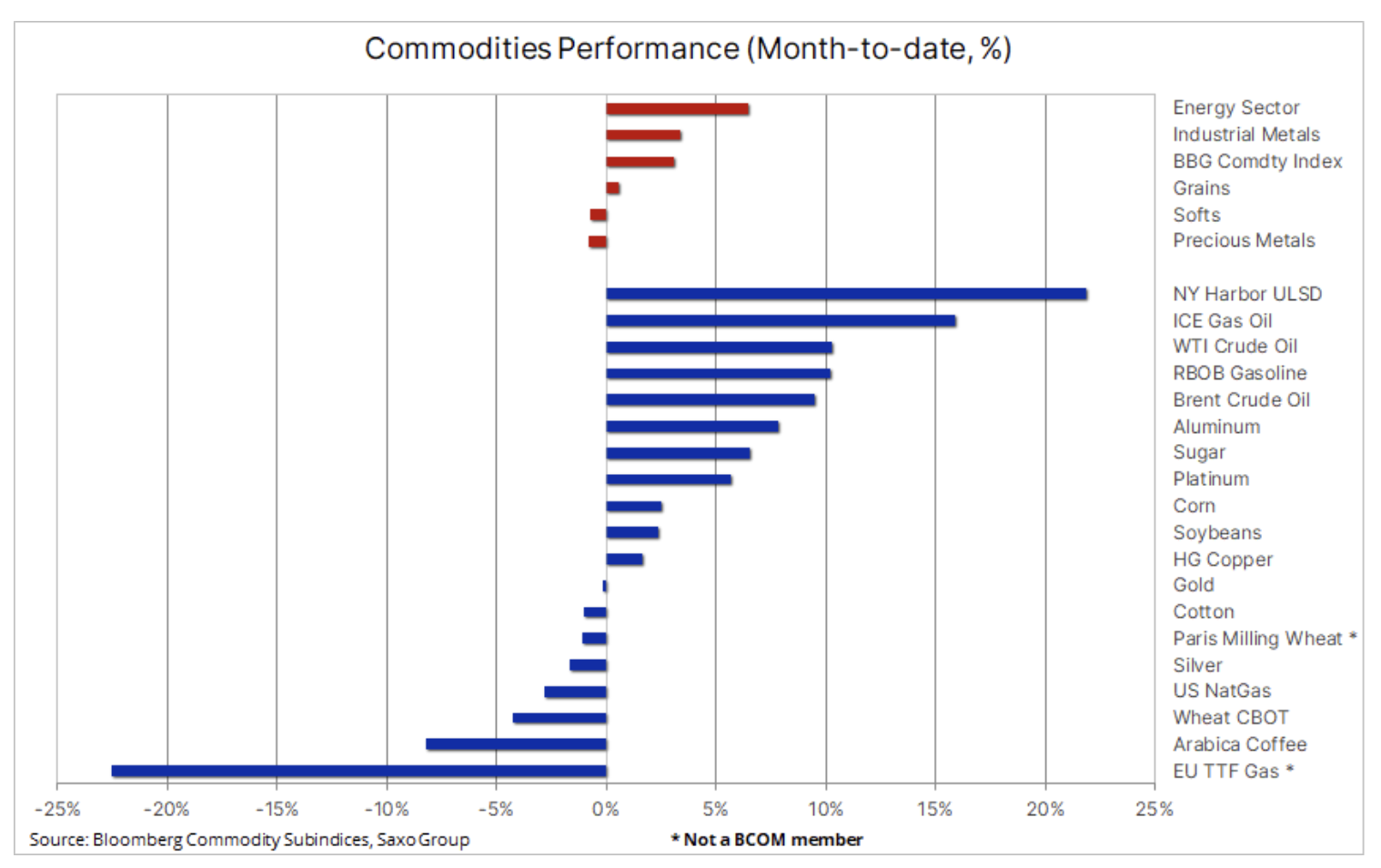

Overall, the market enters Q3 on a solid footing and the Bloomberg commodity index rose by more than XNUMX%, supported primarily by OPEC oil and fuel products rally, incl. distillates, low stocks of which pushed New York's refining margins to record levels.

While inflation in the US is expected to start decelerating soon, bringing some relief to global economies that have been hit by the strong dollar, the market will have to wait at least another month given that the September reading turned out to be higher than expected. As US consumers remain healthy and continue to spend, the global economy will continue to struggle with US interest rate hikes. FOMC, which will cause dollar appreciation, while other central banks will be forced to raise interest rates, which will cause their local currencies to weaken - and thus the dollar will strengthen. This process will continue until the peak of aggressive monetary policy - US bond yields then - we focus on two-year yields, currently at the highest level in 15 years - and the dollar starts to decline.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Russia's war in Ukraine and the measures taken by the West to counter Putin's decisions remain a key source of support for a range of commodities, including wheat, aluminum and diesel, offsetting the potential risk of a slowdown in demand. In addition, the controversial decision of OPEC+ led by Saudi Arabia and Russia to cut production despite the risk that such action could further damage global growth forecasts supported a strong recovery in the oil market.

Meanwhile, the industrial metals sector remains in the eighteen-month low as lockdowns in China contributed to a worsening demand. In the past few weeks, however, the market has become more balanced. Clearly lower inventory levels in China indicate an increase in demand, while the risk of sanctions against the Russian industrial metals industry may cause a decline in the supply of aluminum and other metals.

Watch out for China and the twice-decade National Congress

The biannual Chinese Communist Party National Congress makes decisions that are closely watched by commodity traders given China's importance as the world's largest consumer of commodities. In addition to the overall risk to global growth, China remains another source of low prices. It is the firm belief of the local government in the "zero Covid" policy that has contributed to limiting growth and consumption, and the ongoing crisis on the real estate market has also negatively affected economic forecasts.

The focus was on the speech of Secretary General Xi Jinping, during which he presented a report on the work of the Central Committee of the XNUMXth term. The market expects the leader and the report to pave the way that will lead the country out of the current economic downturn. However, all hopes for China to loosen its 'zero Covid' policy were shattered last week when the newspaper People's Daily for three consecutive days she published articles defending this strategy. Nevertheless, the market will seek additional economic support and incentives, primarily towards infrastructure and energy transition projects, all of which would benefit the industrial metals sector.

The commodity sector continues to signal limited supply despite a significant correction

Numerous areas of uncertainty, reflected in persistent levels of volatility and declining liquidity, will continue to weigh on most commodity prices through the end of this year. While signs of a coming recession are becoming clearer, the sector is unlikely to be severely hurt before accelerating again in 2023. Our forecast for stable and even potentially higher prices, primarily in relation to the current high price niches of key commodities in all three sectors: energy, metals and agricultural products, is based on sanctions, inflation of production costs, unfavorable weather conditions, low investment appetite and the continued limited supply of many key commodities, from diesel and gasoline to grains and industrial metals.

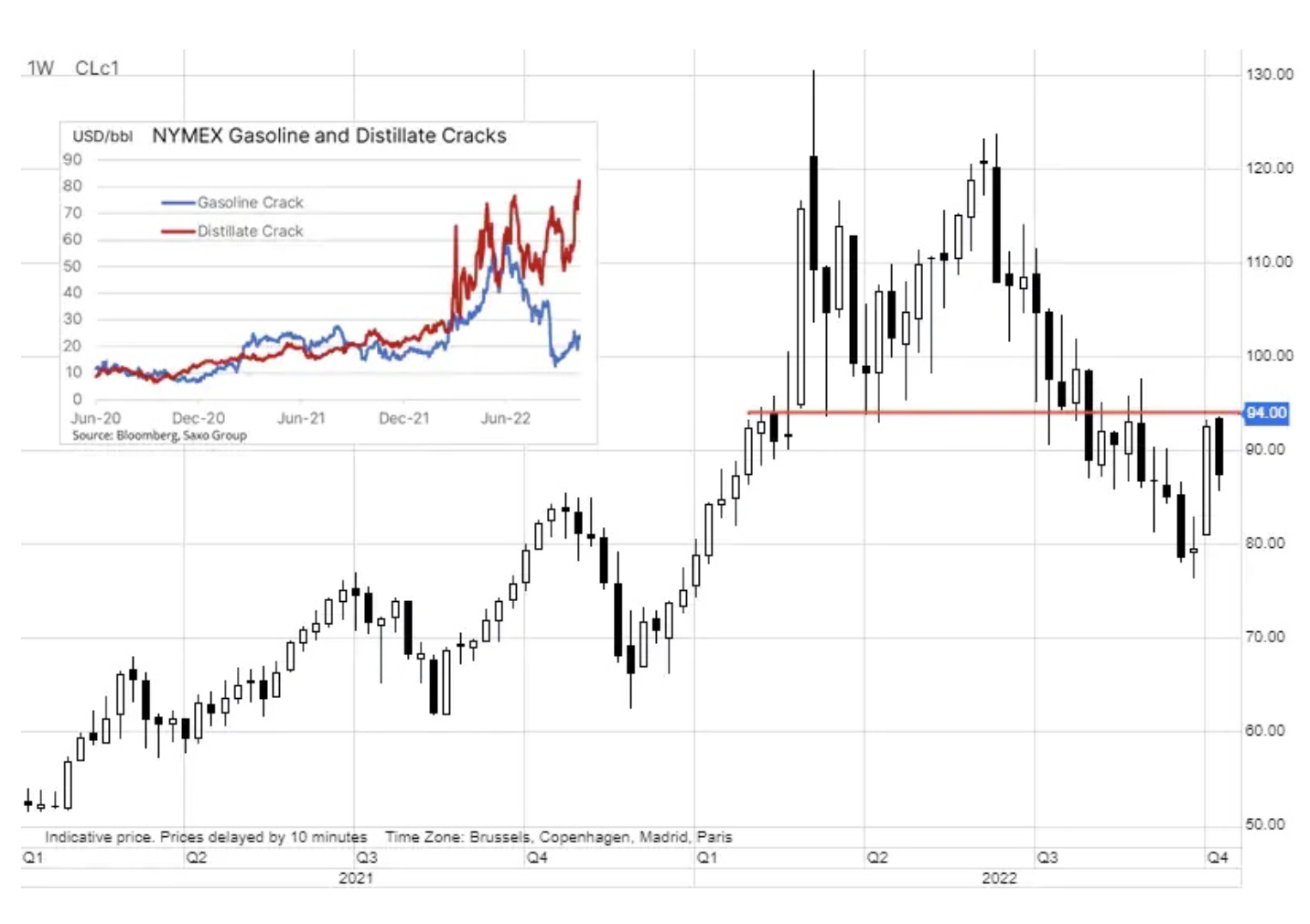

The oil market maneuvers between politics and concerns about demand

Petroleum during the week it recorded lower prices in response to renewed concerns about demand, however, in monthly terms, it continued to rise after OPEC +'s decision to cut core production by 2mbbl / day since November. This decision was heavily criticized by consumer countries as premature and at the worst possible moment; It also sparked extremely harsh criticism from the International Energy Agency, which said in its monthly oil market report that cuts in production would increase the risks associated with global energy security, thereby leading to higher prices and volatility, and potentially representing a turning point for a global economy that is already on the brink of recession.

Given that Saudi Arabia is one of the few producers forced to reduce production, the move - just before the embargo on Russian exports - is seen as beneficial for Russia at the expense of global consumers, including China - the world's largest importer. OPEC, EIA and IEA, however, expressed some support for this decision after a downward revision of forecast demand for 2023. However, due to the fact that there is no mention of a fall in demand next year yet, and the continuing risk to supply from Russia and from other producers struggling with lack of investment and high costs, the risk of further price increases in the economic downturn remains to be reckoned with.

The wave of demand for nuclear energy is looming

Canadian uranium mining company Cameco and renewable energy company Brookfield Renewable Partners announced last week that they jointly acquired Westinghouse Electric, a nuclear power company, in a deal worth $7,9 billion. Westinghouse Electric creates the technology that is used in about half of the world's 440 nuclear reactors, and the fact that the company was on the verge of bankruptcy just four years ago illustrates how much has changed in the industry.

The CEO of Cameco gave an interview in which he announced that the market fundamentals are among the best in the history of the nuclear energy sector. He also said that there was a "wave" of demand from Europe, and specifically from Eastern Europe, as Russia's invasion of Ukraine had radically changed the course of events. According to the World Nuclear Association, 55 reactors are currently under construction (90 including planned reactors), most of them built in Asia, complementing the existing 440 nuclear power plants. This year, nuclear power plants will generate 10% of the world's electricity. All of these events - if accelerated - can make the peak in oil demand faster.

Gold and silver still await favorable circumstances

Gold i silver, which had been under pressure for months in response to aggressive central bankers' efforts to contain inflation through sharp interest rate hikes, recently appreciated on expectations that the US Federal Reserve is approaching the peak of hawkish monetary policy. Although the quick coverage of short positions (short squeeze) proved premature, it highlights the upside potential of prices when trends reverse, ie when the market senses that US bond yields have peaked at which they may start to decline.

However, the timing of that shift was further delayed last week when a better-than-expected US employment report was followed by another strong inflation reading, highlighting the need and risk of additional aggressive rate hikes by the US Federal Reserve. All of these developments underscore the continued need to focus on inflation and economic data for any signs of weakness that could support a shift from the Federal Reserve's hawkish stance. Ahead of the latest inflation reading, Federal Reserve Vice Chairman Lael Brainard made a case for caution, noting that previous hikes still work in an economy during a period of high global and financial uncertainty.

Looking ahead, we see no reason to change our long-term constructive view of gold, with support potentially running the risk of a policy error that could slow US economic growth, lower the dollar and bond yields. In addition, we are concerned that the long-term level of inflation may turn out to be higher than what is currently reflected in market valuations. Failure to bring long-term inflation to market expectations could result in a significant and gold-friendly shift between (increasing) above-break-even (increasing) yields and (declining) real yields.

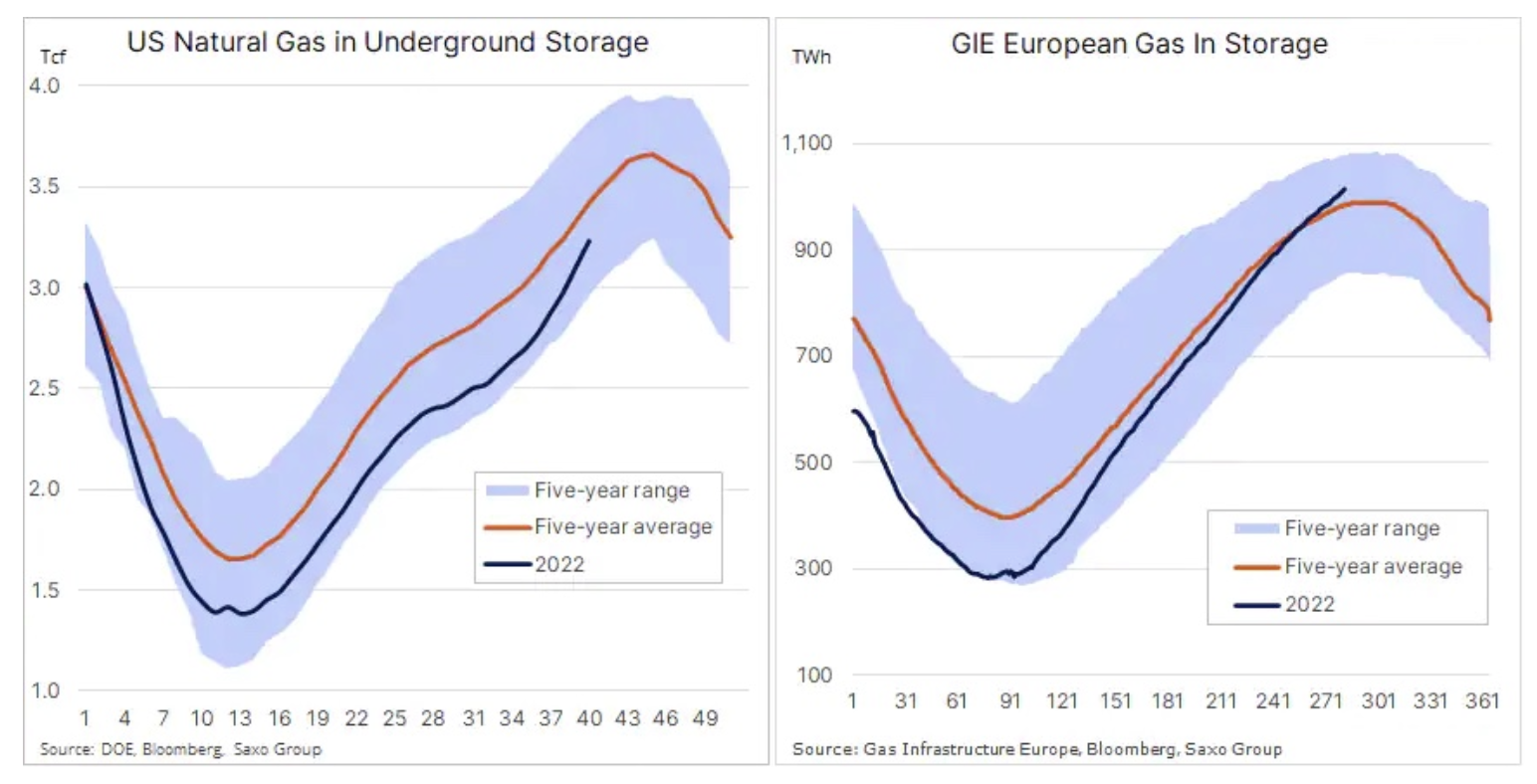

Rising stocks and falling gas prices in the US and Europe

Prices natural gas in the US, they continue to fall after hitting a 10-year high of $2001/MMBtu in August. We are currently experiencing the longest streak of weekly losses since 100 as a result of a combination of rising production and stable demand contributing to the rapid buildup of US inventories ahead of the peak of winter demand. Production has been consistently above 7,5bn cubic feet per day in recent weeks, up approximately 6,4% year-on-year, and with LNG demand and exports holding steady, rapid stockpiling has resulted in a five-year deficit average fell to just 18% from XNUMX% in April.

The energy crisis continues in Europe. However, the risk of insufficient supplies this winter can now be increasingly ruled out after gas stockpiles across the region have soared rapidly over the past three months. The need to reduce dependence on supplies from Russia has contributed to strong demand for LNG, e.g. due to less competition for supplies from Asia due to the economic slowdown in China.

With supplies from Russia down by 80% compared to the same period last year, Russia's ability to disrupt the market has been significantly reduced. Support from consumers and industry in the form of demand reduction, higher temperatures at the beginning of the heating season, as well as dynamic imports from Norway and via LNG resulted in a rapid increase in stocks in warehouses to 91% of their full capacity. As a result, the price of the benchmark Dutch TTF gas contract has fallen – this month so far by more than 20% below EUR 150/MWh. However, to support further rationing, the likelihood of another significant drop towards €100 is slim before the real start of the winter period when demand forecasts become clearer.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response