Raw materials enter 2021 with impetus

On the first day of the session, raw materials broke away from the starting blocks, as the phenomena that emerged at the end of 2020 continue to act as a magnet for new buyers. In a recent analysis, we speculated that this might not be the beginning of a new supercycle that we had not seen since the beginning of this millennium.

Some of the key factors that have supported and potentially will continue to support the commodity sector include:

- narrowing market conditions for the main raw materials, from copper to the most important crops

- boosting global growth and demand as vaccines begin

- China's unbridled appetite for raw materials

- the weakening of the US dollar, which revives this sector, and at the same time unblocks the demand from emerging economies

- fears of the weather affecting the rise in the cost of key food items

- a flood of cash on the global market, resulting in intense speculation in all markets

- increased demand for hedging against inflation due to the risk of political mistakes

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

What awaits us in 2021?

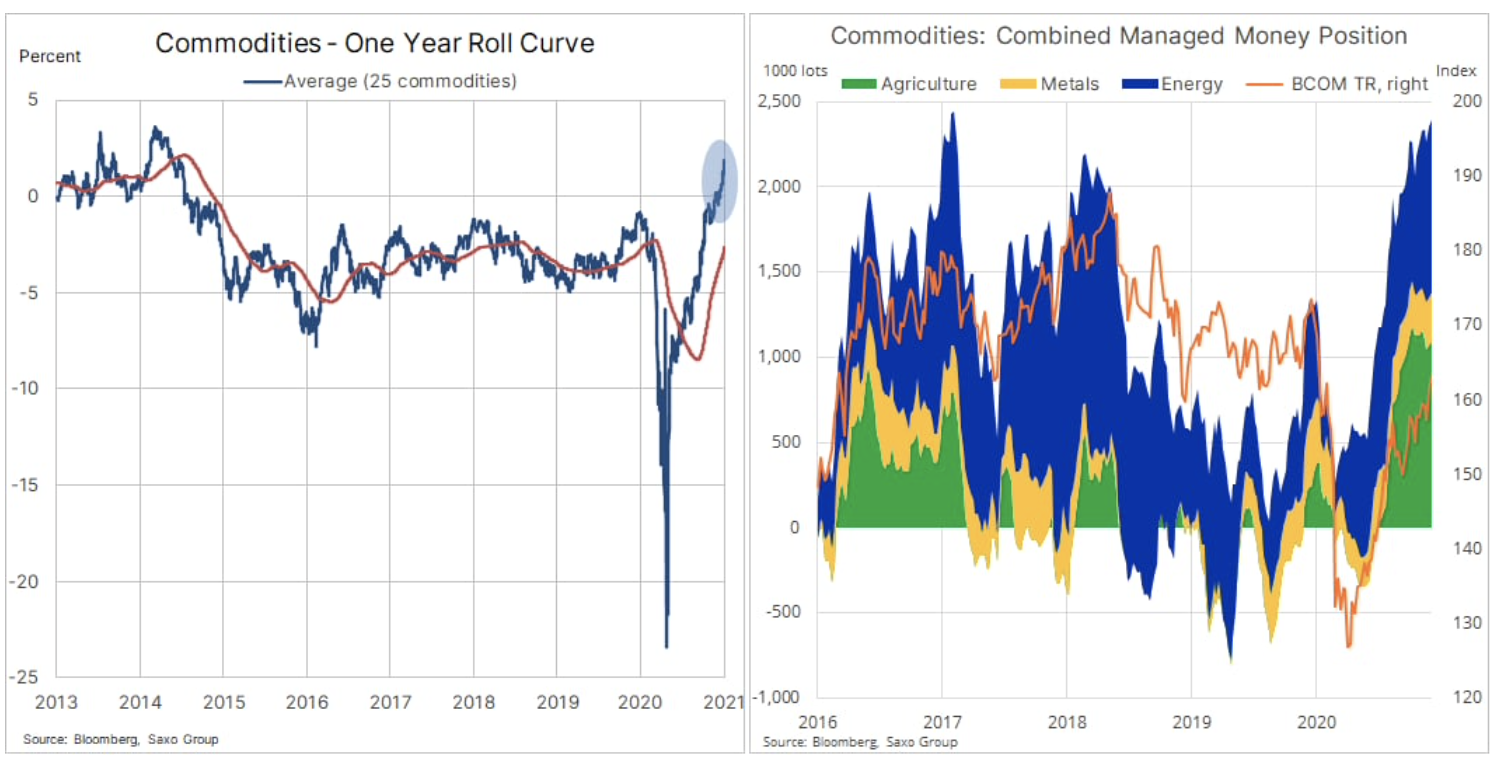

At the end of 2020, these phenomena contributed to a significant change in the annual cost of maintaining a basket of key raw materials. The enormous supply due to large investments, in particular in the mining and energy industry (shale oil), and mild weather conditions meant that for the last five years the maintenance of the raw material basket generated a negative profit on rolling. Historically, this has deterred investors from the sector as it indicated an oversupply and lack of growth potential. During the last six months, especially in the agricultural sector, the profit on rollover was positive again. This reflected a narrowing of market conditions, with spot commodity prices premium over the strike prices of futures, but also an increase in speculative positions.

In the second chart above, we can see that the number of speculative positions for the 24 most important commodities is at the highest level in four years (almost 2,4 million lots, equivalent to a face value of $ 121 billion). In terms of nominal net exposure, crude oil ($ 30 billion), gold ($ 26 billion) and soybeans ($ 12 billion) were on the podium. The chart also shows that although the two previous maximum increases in the number of speculative positions were mainly due to an increase in energy involvement, the most recent increase was in all three sectors. The agricultural sector in particular, with the three main crops in particular, has recovered from many years of poor performance.

Petroleum

Oil price hit a ten-month high at the start of the session, and US-Iran tensions and vaccine optimism continue to improve outcomes in preparation for an increasingly prominent deterioration on the horizon, driven by prolonged lockdowns in northern hemisphere it's winter now. On the supply side, the market is also waiting for the OPEC + decision on the possibility of further increasing production in the context of the spread of the virus.

The outlook for oil for the coming days, particularly at current levels, may be challenging as the global recovery in fuel demand continues to rise. OPEC expects crude oil demand to grow to 95,9mbbl / day this year, which is still well below the 100mbbl / day peak recorded before the pandemic one year ago. This pace of growth could also be a problem for OPEC +: the organization now has production reserves of more than 8 million barrels per day, which it will want to relaunch at some point.

From the perspective of growth and reflation, speculative positions in crude oil are likely to prove favorable for price in the first months of this year that are difficult for demand. We expect the upside potential for Brent crude oil to be limited to $ 55 / b over this period, with support at $ 49 / b and then $ 46,6 / b.

Precious metals

Price gold (XAU / USD) it exceeded 1 USD / oz at the beginning of the session; the next resistance level will be the November high of $ 900 / oz. The aspect of reflation, combined with the depreciation of the dollar and the decline in real yields, suggests the possibility of further gains in the short term. While 1-year US bond yields above the break-even point - reflecting inflation expectations - have reached 965%, real yields, a key driver of gold prices, have fallen to -2% and are near the low of the current cycle.

In the United States, Tuesday's Georgia Senate elections may further exacerbate sentiment about reflation and gold, provided that polls show that the Democrats are victorious, and with it, that they win a Senate majority. This is due to the projections that it will be easier for the Joe Biden administration to increase the level of both fiscal stimulus and budget spending.

Price silver (XAG / USD) increased by over 3% thanks to the support of gold, copper and the weaker dollar. The XAU / XAG ratio approached 70 again (an ounce of silver to one ounce of gold), while the immediate price was close to a resistance of $ 27,50 / oz.

The price also went up on the first day of the session copper HG thanks to the support of a weaker dollar, primarily against the Chinese yuan, which the People's Bank of China surprisingly allowed to strengthen overnight by over 1%. The Chinese manufacturing PMI has been increasing for the eighth consecutive month, suggesting continued strong metal demand from the world's largest consumer.

Agricultural commodities

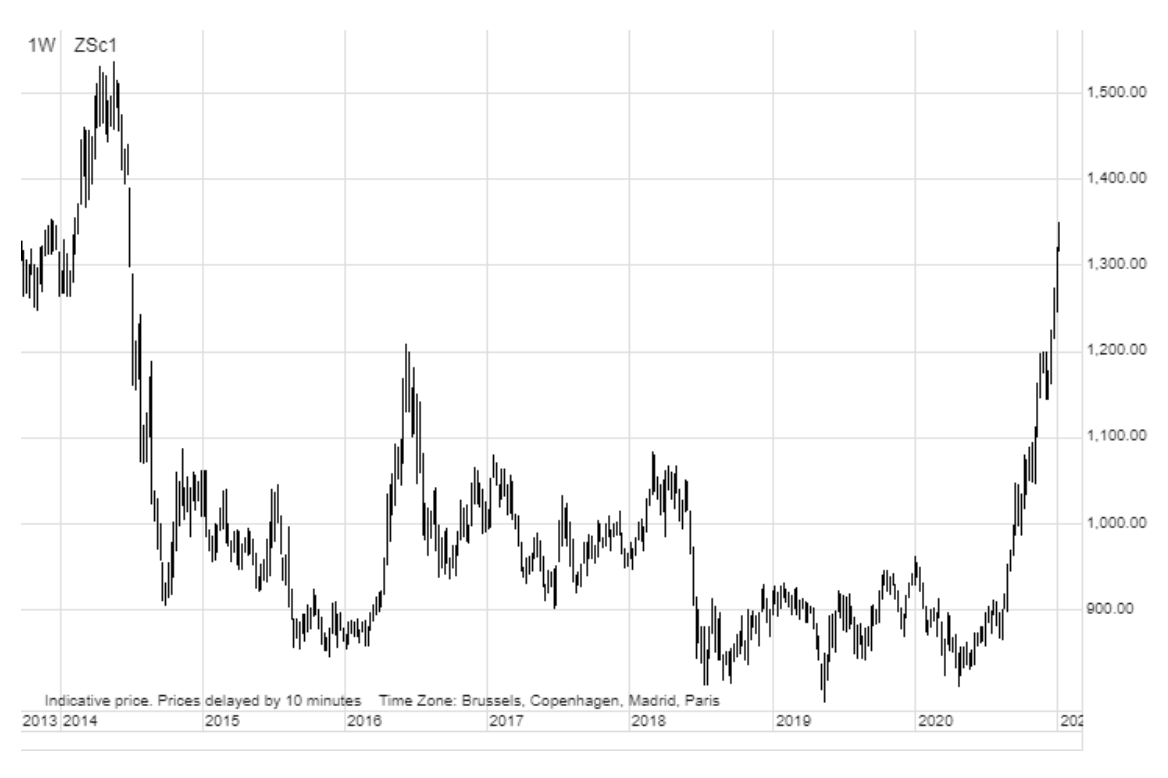

Soybean (SOYBEANSMAR21), maize (CORNMAR21) and wheat (WHEATMAR21) they saw an increase, supported by a weaker dollar, positive forecasts for demand, especially in China, and a drought threatening production in South America. This is especially true of Argentina, the world's largest exporter of soy products, but the drought is also worsening in Brazil. For the first time in 6,5 years, the price of soybeans exceeded $ 13 / bu, while maize has the longest profit period in sixty years.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response