The situation in the automotive industry ceases to make sense

This year should be the year of the return of the global auto industry after the disastrous 2020 impacted by the global pandemic, with a 6% increase in new passenger car registrations worldwide as proof of this return. However, as the car registrations chart for the US, Europe and China shows, the global auto market has weakened in recent months, primarily in Europe. In fact, cumulative new car registrations in the world's three largest automotive markets fell by 19% from their peak in August 2018. Since December 2015, global new car registrations have only increased by 1,8% per annum with a marked saturation. starting in early 2017 and then turning into a long-term decline in late 2018.

The global auto market seems to have saturated and the pandemic has worsened the already weak demand side of the industry. As demand returned, the automotive industry faced a new problem with the supply of semiconductors. At the start of the pandemic, car makers canceled orders for semiconductors because they felt demand would be weak for an extended period, however, as governments applied unprecedented economic incentives to weather the pandemic, and vaccines were approved in late 2020, with the economy kicking off in early 2021. in full swing. However, car makers are buying semiconductors at a lower margin, and with the late re-ordering process, the semiconductor industry has already found willing buyers due to the high demand for gaming and graphics cards. cryptocurrency and semiconductors used in data centers and computers. Automakers have ended up at the bottom of the line and have been fighting for priority ever since, leading to production cuts due to a lack of semiconductors.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

The pandemic and awareness of climate change have also kicked off the demand for electric vehicles (EVs), and the transition to EV may have already reached a turning point where consumers are beginning to put off buying a gasoline car. Why buy technology that is being phased out and why not buy an electric car instead when governments are offering incentives to do so?

Despite these structural challenges and a low growth profile, the value of the MSCI World Automobile index has exploded in the last 18 months, due to the strong boom among electric car manufacturers and very high expectations, the best example of which is the debut of Rivian. From December 2005 to the peak of new car registrations in August 2018, this index gained 5,2% yoy compared to a 3,9% yoy increase in new car registrations over the same period. This underlines that the market value more or less follows the volume plus / minus changes in the price basket and operating margins.

With the recent rise in the global carmakers index, the industry's market value has completely lost its correlation with the base rate of structural growth. The only explanation may be that new car registrations close declines rapidly from August 2018, and that electric cars can be produced at higher operating margins, provided, however, that competition does not force retail prices of new cars to fall to the earlier profitability levels for gasoline cars. .

The streak of electricians will end at the cemetery

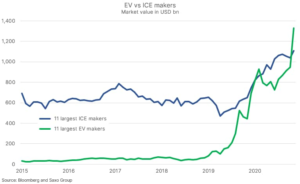

A key change in the automotive industry is the increase in the production of electric vehicles, as consumers increasingly choose such cars. There has been a flood of new auto companies producing only EVs in public markets, and the market now attributes higher market value to the 11 largest electric vehicle manufacturers than to the 11 largest conventional car manufacturers. As we wrote in previous analyzes, this reflects the exorbitant expectations for an EV, which in our opinion are difficult to justify given the structural growth profile of the entire automotive industry.

That said, we take into account the outlook for the auto industry for the next thirty years. Conventional cars show a negative growth profile, while electric cars will have a dynamic growth curve in the next 10 years, followed by a gradual slowdown. However, are manufacturers specializing only in electric vehicles the best choice for investors? Given the current market values, we believe that expectations are beyond the capabilities of these companies, so we encourage investors to look for other ways to play off the high growth rates in the electric vehicle industry. One way is to invest in semiconductor manufacturers with automotive exposure, lithium mining companies, or manufacturers of electric vehicle batteries. Below we list a few companies in this supply chain for electric vehicles.

- Infineon Technologies (semiconductors)

- NXP (semiconductors)

- Renesas (semiconductors)

- Texas Instruments (semiconductors)

- STMicroelectronics (semiconductors)

- Jiangxi Ganfeng Lithium (lithium mining)

- Albemarle (lithium mining)

- SQM (lithium mining)

- Livent (lithium mining)

- Orocobre (lithium mining)

- Panasonic (batteries)

- QuantumScape (batteries)

- TDK (batteries)

- Gotion High-tech (batteries)

- Varta (batteries)

Should car manufacturers separate units that produce electric vehicles?

Given the market value of pure electric vehicle companies, we believe traditional car makers should consider spinning off their electric vehicle units as separate publicly traded companies while maintaining majority shareholder control. The higher market value of pure electric vehicle producers could be used to raise significant amounts of capital to accelerate production growth, but a separate economic entity could reduce friction in the lines of internal culture and political struggles.

VW's recent internal problems show that trade unions and employees in traditional internal combustion engine departments will hinder such a shift. Porsche may be a good idea due to the fact that the manufacturer of traditional cars has selected a specific EV company, which can mean a significant improvement in the valuation. Porsche is aiming for 2025% of its revenues to come from electric vehicles in 40. If traditional car manufacturers do not separate their own EV units, we believe they will have difficulties keeping pace with companies that only produce electric vehicles.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response