Saxo Bank's Shocking Predictions for 2022 - The Revolution is Coming!

Shocking predictions Saxo Bank for 2022, they saw the light of day. This is a series of unlikely, but often underestimated events, the materialization of which could shake the financial markets.

While the above predictions are not Saxo's official market forecasts for 2022, they serve as a warning against potential risk misappraisal by investors, who typically attribute a probability of as little as 1% to such events. Saxo's Shocking Predictions is an exercise in considering all possible situations, even if they are not very likely; this is particularly important in the context of the unexpected crisis related to the Covid-19 pandemic. Undoubtedly, the events with the strongest impact (and therefore significantly "shocking") turn out to be those that surprise the consensus.

- Fossil fuel decommissioning plan pushed aside

- The exodus of young people is a blow to Facebook

- Constitutional crisis in connection with the mid-term elections in the United States

- Inflation in the United States above 15% as a result of the wage-price spiral

- Announcement of an EU-funded private pensions superfund for climate, energy and defense

- Reddit Women's Army versus corporate patriarchy

- India is a new member of the Gulf Cooperation Council with no voting rights

- Spotify is in trouble via the NFT-based digital copyright platform

- New hypersonic technology causes space race and a new cold war

- A breakthrough in medicine will extend life expectancy by 25 years

Steven Jakobsen, Saxo Bank's chief investment officer commented on this year's Outrageous Outlook as follows:

- The main theme of the Shock Forecasts for 2022 is Revolution. Many of us associate this word with the French Revolution of 1789, with its call to "freedom, equality and fraternity", but also with the Russian Revolution and its principles of "breaking up the capitalists." However, we mean revolution in the broader sense of the word: not the physical overthrow of governments, but turning points that trigger a change of thinking, a change of behavior and the rejection of an unsustainable status quo.

A tremendous amount of energy is building up in our society and economy, struggling with inequalities. Moreover, given that the present system is incapable of solving this problem, looking to the future, it is fundamental to assume that the main question is not whether there will be a revolution, but when and how it will occur. Each revolution means winners and losers, but this is not the most important thing - if the current system is unable to change, although it must, revolution is the only solution.

We are dealing with a culture war all over the world, and the division is no longer just between rich and poor. It's also young versus old, educated versus less educated working class, real markets based on price discovery versus government intervention, redemption of stocks versus R&D spending, inflation versus deflation, women versus men, progressive left versus center-left, opinions social media versus real social change, rentiers versus working, fossil fuels versus green energy, ESG initiatives versus the need to provide the world with reliable energy - and the list is by no means exhaustive.

In 2020 and 2021, we collaborated at the global level on Covid vaccines. Now, however, another joint venture, like the new Manhattan Project, is needed to significantly reduce the marginal cost of energy, adjusted for productivity, while eliminating the environmental impact of energy production. Doing so would trigger the most significant productivity cycle in history: we could desalinate water, make vertical farms work almost anywhere in the world, open the way to quantum computing, and push the boundaries of biology and physics.

It should be remembered that the world continues to move forward, although the pace of the process varies, while the economic and political cycles are always complete.

Saxo Bank's Shocking Forecasts by 2022

1. Fossil fuel decommissioning plan put aside

Summary: Politicians will push climate targets aside and support investment in fossil fuels to fight inflation and the risk of social unrest while rethinking the path to a low-carbon future.

Realizing the threat of inflation from rising commodity prices and the risk of an economic catastrophe due to an unrealistic green transition schedule, politicians are sidelining climate targets. They loosen investment bureaucracy for five years for oil production and ten years for extraction natural gasto encourage producers to provide adequate and affordable supplies that bridge the gap between present and future low-carbon energy.

This turn of events has already led to rising prices and their volatility, not only for energy, but also for industrial metals, most of which are needed in large amounts to bring about a green transition. In addition, soaring energy prices have increased the prices of diesel, and fertilizer in particular, important agricultural production costs, raising concerns about the cultivation of key food products.

Impact on the market: The iShares Stoxx EU 600 Oil & Gas fund (ticker: EXH1: xetr) will go up by as much as 50% as the entire energy sector will catch the wind in its sails.

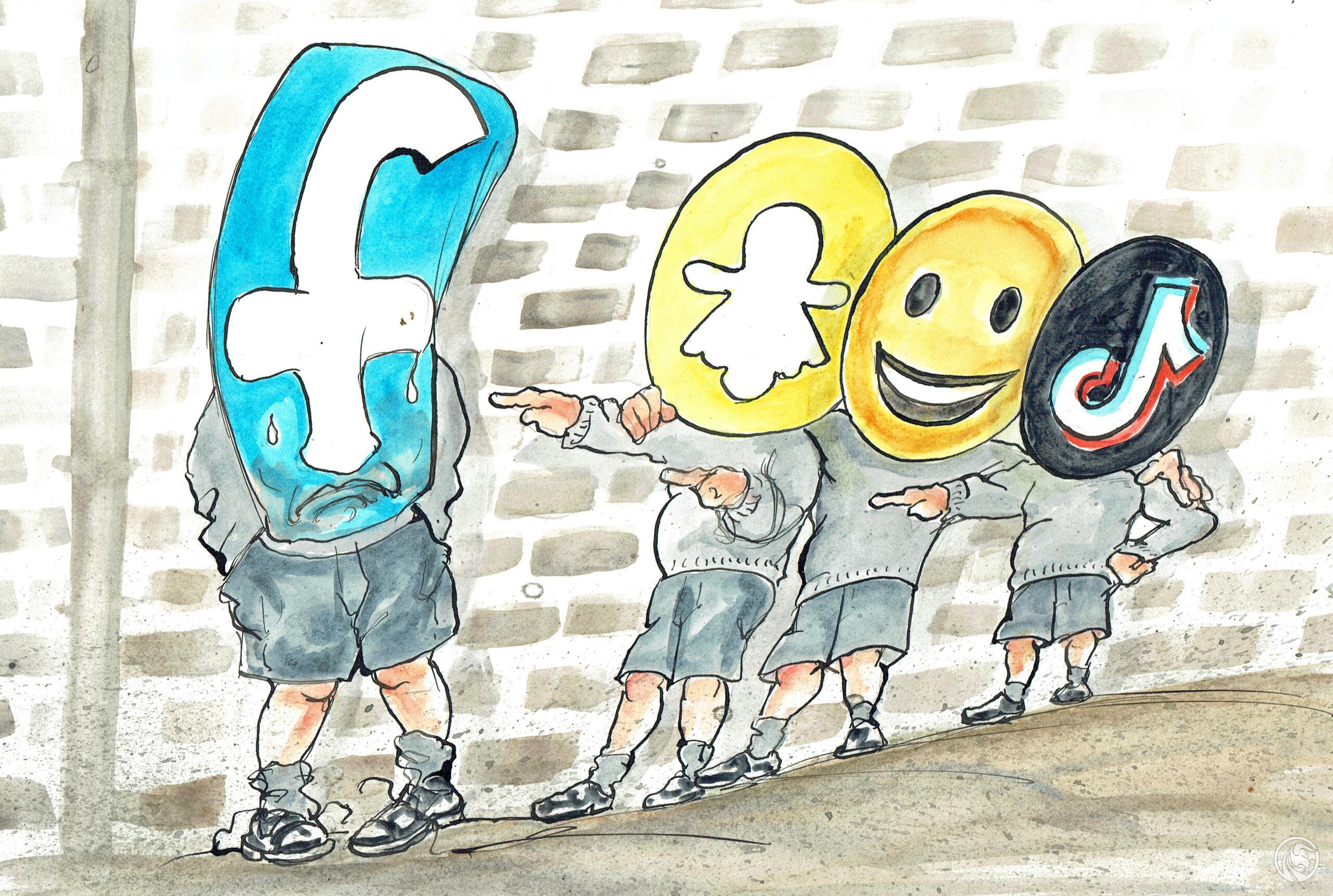

2. The exodus of young people is a blow to Facebook

Summary: Young people abandon Facebook platforms in protest of soliciting personal information for profit; Meta, Facebook's parent company, will try to lure them back to the troubled Metawersum.

Facebook from a bustling medium of young people it has become a platform for older "boomers". Young people are increasingly discouraged by Facebook's algorithms turning their social media experiences into a seamless feedback loop with identical content, or even worse, content that is hateful and spreading disinformation. Facebook's own research suggests that teens spend two to three times as much time on TikTok than on Instagram (which is Facebook's youngest social networking site) and their preferred way of communicating with friends is Snapchat.

New company name (Facebook is now called Meta) and brand identity to separate and protect Instagram (the company's most valuable asset today), as well as creating a new product geared to the needs of young people, is exactly the same pattern that tobacco manufacturers have been following for years. However, in 2022, investors will realize that Meta is rapidly losing the young generation, and thus the company's future potential and profitability. In a desperate move, Meta will try to take over Snapchat or TikTok while spending billions of dollars to build the sinister Metaversum. Its goal will be to monitor users more directly than ever before and bring young people back to Meta's social platforms in line with the popular assumption that technology is the first to win. It will be difficult to implement this plan because the younger generation will not be interested in it.

Impact on the market: Meta, Facebook's parent company, will struggle with problems, lose 30% to the broadly understood market and will be forced to promote its individual components as separate entities, smashing Zuckerberg's dreams of a monopoly.

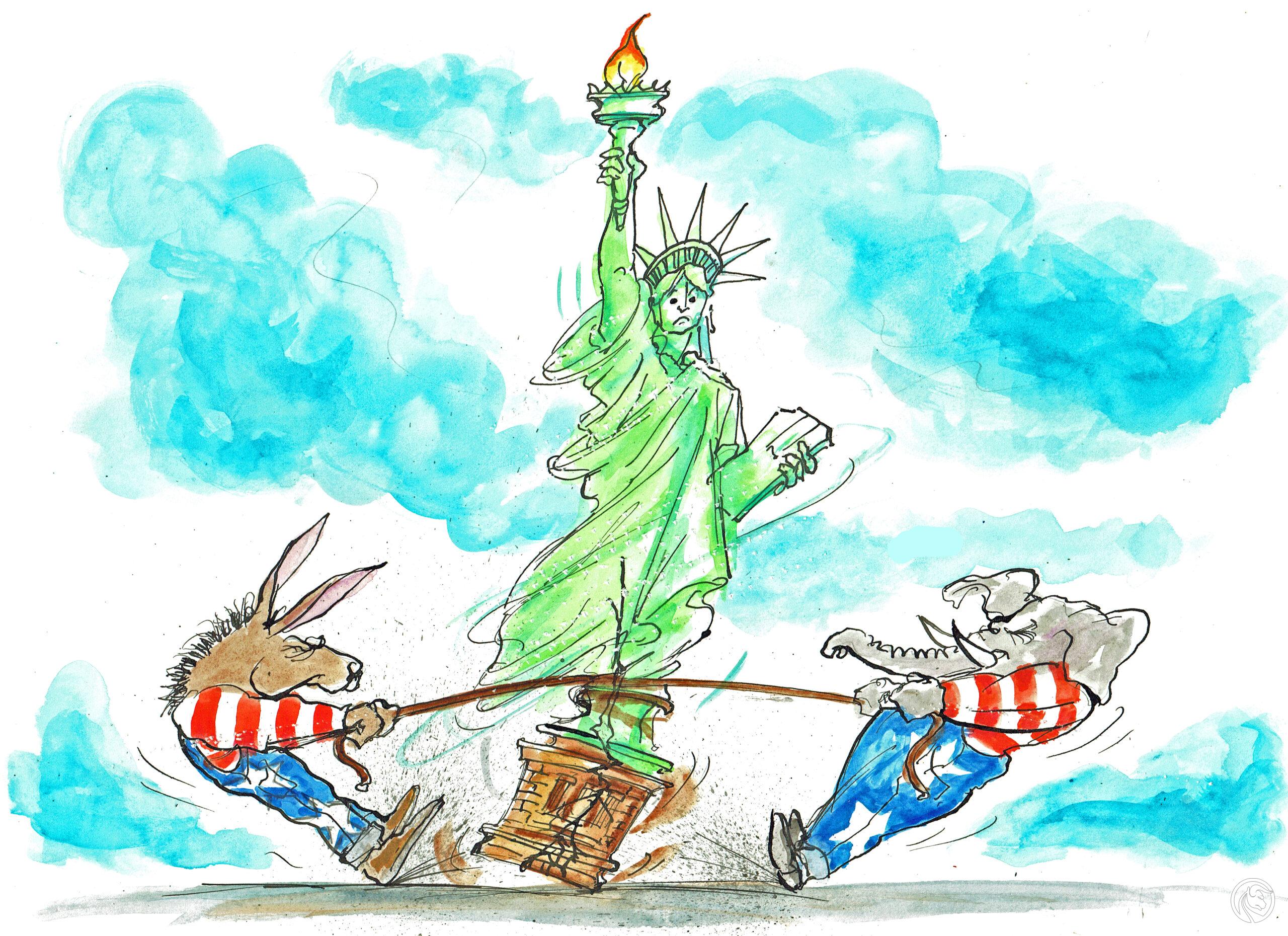

3. The constitutional crisis in connection with the mid-term elections in the United States

Summary: The US mid-term election will spark a dispute over the credibility of a similar election result to the Senate and / or House of Representatives, which could lead to a scenario in which the 118th Congress will not be able to deliberate as planned in early 2023.

The chaotic 2020 presidential election in the United States was a moment of terror for many American institutions. The incumbent President Donald J. Trump initially refused to admit defeat in the elections and swore that the election had been rigged, which was not proven in court, but which was met with widespread sympathy among his electorate. The crowd of radical adherents of the conspiracy theory about electoral fraud were encouraged by the president's rhetoric to the point that he marched to the Capitol to "Stop forgery"i.e. to prevent the official announcement of the election result on January 6, 2021, which was an unprecedented event in US history.

Earlier and also - again - later, during the heavily protested by-election to the Senate in Georgia, conscientious members of the electoral commissions - including many Republicans - risked their lives and even faced with death threats from extremists, fulfilling their duties by counting the true results . In 2022, the Republican Party will ensure that none of these traditional compulsory officials will be in the "wrong" place, and all election-related positions will be filled by disciplined party supporters willing to do whatever it takes to tip the tide, including actively lowering voter turnout.

Following the elections in 2022, several key races to the Senate and House of Representatives will be put in question, and one or both sides will oppose the approval of the voting results, which will prevent the new Congress from being constituted and scheduled to start on January 3, 2023. Joe Biden will rule by decrees and US democracy will be put on hold because even Democrats will oppose the Supreme Court, which is largely nominated by Trump. As a result of this impasse in 2023, a real constitutional crisis will begin to loom on the horizon.

Impact on the market: extreme volatility of American assets, when the yield of US treasury bonds increases and the dollar exchange rate drops as a result of hedging against the existential crisis of the world's largest economy, which is the issuer of the world's reserve currency.

4. Inflation in the United States above 15% as a result of the wage-price spiral

Summary: By Q2022 15, the wages of the lower half of Americans' earners will grow at a rate of XNUMX% per annum as companies compete for willing and skilled workers who will be increasingly selective and confident with the large number of jobs compared to the small pool of workers regardless of their qualifications.

The official US CPI reading peaked at 11,8% in February 1975. Only the 1980-1982 recession and the brutal reference hike interest rate and up to 20%, they finally managed to eliminate inflation.

In 2022 Federal Reserve and its president, Jerome Powell, will repeat the same mistake, because after the Covid pandemic, the economy, and especially the labor market, will struggle with severely limited supply, ridiculing traditional Fed models. Powell is confident that millions of Americans will return to work after the pandemic and fill some of the 10,4 million job vacancies. However, this belief is simply wrong. Some people have taken early retirement due to the crisis and have thus permanently left the ranks of the American workforce.

The fundamental difference between today's and yesterday's situations is that the pandemic has led to a widespread wake-up call for workers. All sectors and income classes realized that they now have more opportunities than ever before. They are demanding better treatment: better working conditions, higher wages, more flexibility and a feeling that their work makes sense. Combined with persistent inflationary pressures on the production side, the energy crisis and labor shortages, this will result in unprecedented, wide-ranging, double-digit annualized wage growth by QXNUMX.

As a result, before the beginning of 2023, for the first time since World War II, the annual inflation rate in the United States will exceed 15%. This will induce the Federal Reserve to tighten monetary policy too vaguely and too late in a desperate attempt to curb inflation. However, the central bank will lose its credibility and it will take a long time to recover it.

Impact on the market: extreme volatility in US stock and corporate bond markets. The high yield JNK fund will go down by up to 20%, and the volatility fund in the middle of the VIXM curve will gain up to 70%.

5. Announcement of an EU superfund for climate, energy and defense financed by private pensions

Summary: To counter the rise of populism, deepen its commitment to slowing climate change, and defend its borders as the US security umbrella is phased out, the EU will set up a novel $ 3 trillion super-fund, financed by pension contributions instead of new taxes.

The security umbrella provided for much of Eastern Europe by the United States during the Cold War and thereafter is rapidly declining and threatens to lapse altogether in the coming years as Washington looks to much more serious economic and military rivals from the east.

French President Macron, with the support of Draghi, who will seek to stem the tide of populism in Italy, will present the vision of an "EU superfund" for the implementation of three priorities: defense, climate and the associated clean energy transition.

Given the aging population in the EU and the high tax burden, politicians will be aware that it will be impossible to finance the superfund with higher income taxes or other traditional tax revenues. However, France will be dazzled by planning to reform its pension system and looking at high pensions in Europe. It will decide that pension funds for all employees over the age of 40 must gradually, over the years of the insured, dedicate an increasing proportion of their retirement assets to super-fund bonds. This will enable the implementation of new levels of fiscal stimulus in the EU, even using the trick of disguising spending in inflation and negative real returns on low yield superfund bonds, which will in fact be disguised EU bonds. At the same time, the younger generation will benefit from a stronger labor market and less unfair tax burdens, as the new system proves to be so successful that it will lead to a gradual reduction in income taxes.

Impact on the market: Bond yields across Europe will be harmonized, which will lead to a deterioration in the performance of German Treasuries. The best results will be achieved by EU companies in the defense, construction and new energy sectors.

6. Reddit Women's Army versus corporate patriarchy

Summary: Following the tactics of the Reddit Army to invest in meme stocks from 2020-2021, a group of female traders will launch a coordinated attack on underperforming companies in terms of gender equality, which will lead to huge volatility in their share price.

Women don't want to wait any longer. With little progress, in 2022, they will embark on massive grassroots grassroots action based on social media platforms to force companies that break civil rights to change unfair, sexist, racist, age-discriminatory and disability-based practices. Although women are less well-paid, they are better off saving than men. These savings will come in handy now as women decide to take matters into their own hands and use their significant influence around the #metoo movement in the financial markets.

Unlike the original, often nihilistic, Reddit Army, the Reddit Women's Army will be more sophisticated and traders will coordinate debts squeeze by sorting out the actions of selected patriarchal enterprises. At the same time, they will direct funds to companies with the best representation of women in middle management and middle management positions. Rather than condemning these actions, politicians around the world will welcome and support them, putting even more pressure on companies with outdated patriarchal views, gender inequality in pay and women's under-representation on boards and in management to rectify their mistakes.

Impact on the market: This move will bring real results when the topic takes hold of the broadly understood market and joins these actions, forcing the prices of the companies under attack to drop sharply, prompting companies to change the way they operate. This will be the beginning of a renaissance of gender parity in the markets.

7. India becomes a new member of the Gulf Cooperation Council with no voting rights

Summary: Global geopolitical alliances will enter a phase of drastic correction due to the ominous cocktail of new deglobalizing geopolitics and much higher energy prices.

Countries dependent on most energy imports in a rapidly deglobalizing world will need to take swift action to reorient strategic alliances and secure long-term energy supplies. Under one such alliance, India, with a powerful technology sector, could join the Gulf Cooperation Council (Gulf Cooperation Council, GCC) as a non-voting member or as a kind of free trade zone. Such an alliance would reduce India's energy uncertainty as it would secure long-term import obligations.

Interregional trading zones will ensure production and investment "closer to home", combined with the security of a reliable supply for India and a solid target market for the GCC. The Alliance will help the GCC countries to lay the groundwork for planning their future beyond oil and gas, and help India to accelerate its development with new large-scale investment in infrastructure and improved agricultural productivity along with the import of fossil fuels, paving the way for a long-term future based on post-carbon technologies.

Impact on the market: In a year of high volatility in the markets, the Indian rupee will prove much more resilient than other emerging market currencies. The dynamic Indian stock market, along with others, will correct in early 2022, but will show relatively solid performance after hitting mid-year lows.

8. Spotify in trouble via the NFT-based digital copyright platform

Summary: Musicians are ready to change as the current music streaming paradigm means that music labels and streaming platforms are capturing 75-95% of listening revenues. In 2022, a new blockchain-based technology will enable them to recover their rightful share of industry revenues.

Although the beginnings NFT looked chaotic and dangerous to asset buyers, the prospects for this technology are bright. The platform based on NFT will offer not only a new way of verifying the ownership of rights, but also a method of their distribution - without the participation of intermediaries, i.e. a completely decentralized system eliminating the need for a centralized platform.

In the next step, the use of NFT technology may prove particularly attractive to content creators in the music industry as musicians feel unfairly treated under the revenue sharing models used by current streaming platforms such as Spotify or Apple Music. These models do not target individual subscription fees to the actual music that the subscriber is listening to. Instead, all subscription fee revenues are aggregated and divided based on each artist's share of total streams. In addition, platforms charge large commissions which, along with the fraction paid to studios, account for around 75% or more of total revenue.

In 2022, the NFT-based service will gain momentum and start offering music from established stars - perhaps such as Katy Perry, The Chainsmokers or Jason Derulo, who recently backed efforts to create a new streaming platform based on blockchain technology. Other famous artists will start withdrawing their music from existing "traditional" streaming platforms, which will suddenly prove to be deadly. Investors will also see a similar risk to podcasts, movies and other digitized content.

Impact on the market: Investors recognize that the future of Spotify is uncertain, which will result in its shares going down 2022% in 33.

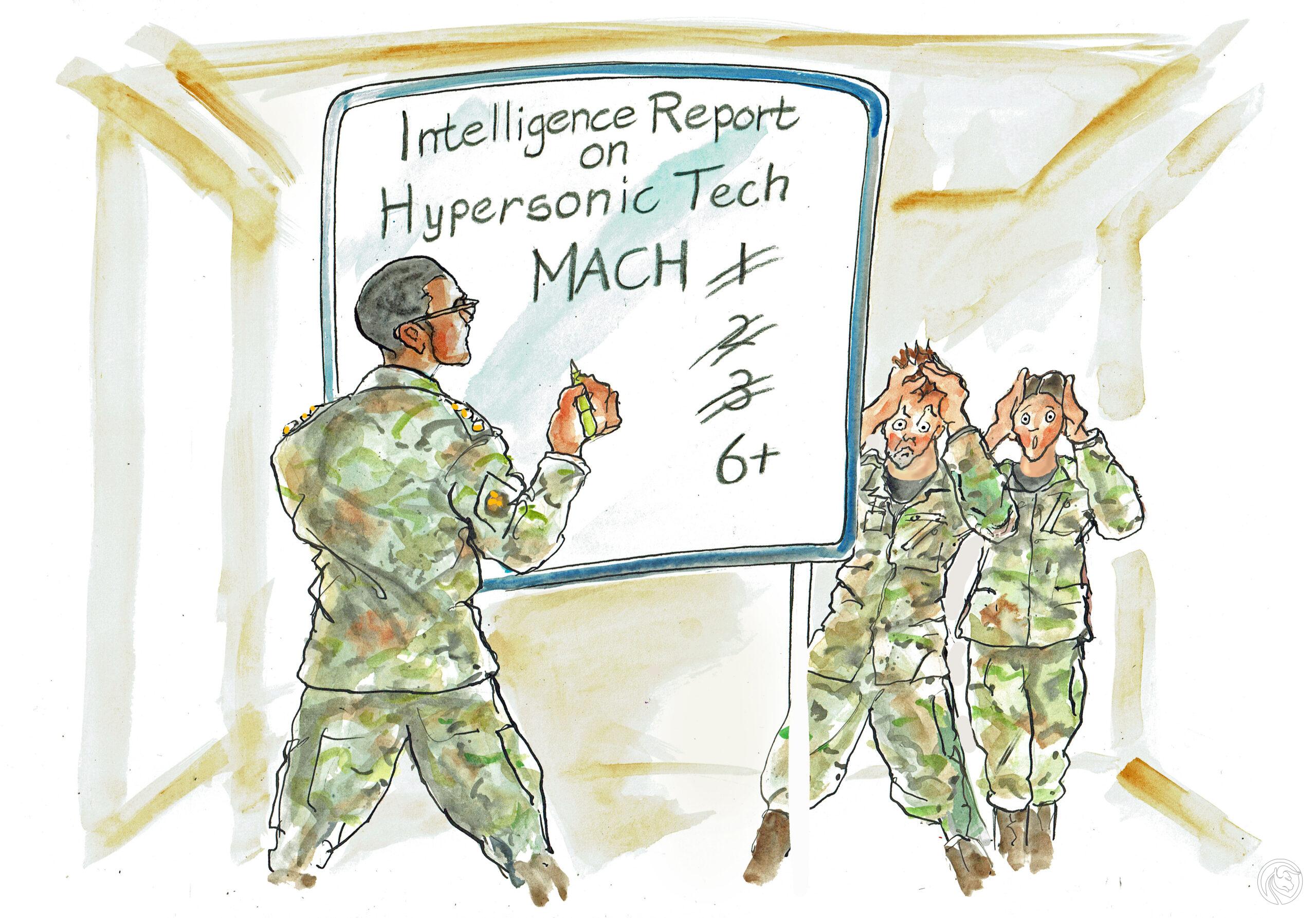

9. New hypersonic technology causes space race and new cold war

Summary: The latest tests of hypersonic missiles are causing an increasing insecurity as this technology could make existing conventional and even nuclear military equipment a thing of the past. In 2022, a massive hypersonic arms race will begin among the world's largest armed forces, as no country will want to be left behind.

In 2022, the funding priorities will make it clear that hypersonic technology and space will be key elements in a new phase of deepening competition between the US and China on all fronts - both economic and military. Other powers with advanced military technology will join the competition, probably including Russia, India, Israel and the EU.

Hypersonic solutions will unexpectedly threaten the long-term military strategic one status quobecause the technology will offer new, asymmetric defensive and offensive capabilities that will breach two powerful pillars of military strategy in recent decades. The first is the defense potential of hypersonic technology against conventional long-range bomber and ocean fleet attacks. deepwater navy) that can fight anywhere in the world without refueling.

The second pillar of the Cold War era was the principle of mutual guaranteed destruction. mutually assured destruction, MAD) in the case of a nuclear war, according to which there is no point in initiating a nuclear war as long as the enemy has time to conduct an equally devastating counterattack using land and submarine ICBM. However, the speed and agility of the hypersonic technologies will show that better defense can completely thwart an attack and even provide new opportunities for the first strike.

Impact on the market: mass funding of companies such as Raytheon, which develop hypersonic technologies with the possibility of launching them into space, and the underperformance of companies producing "expensive conventional equipment" related to the construction of aircraft and ships.

10. A breakthrough in medicine will extend life expectancy by 25 years

Summary: Eternal, or at least a much longer youth. In 2022, a breakthrough in biomedicine will offer the prospect of an increase in productive age and life expectancy by up to 25 years, resulting in ethical, ecological and fiscal crises on an unprecedented scale.

2022 will see a breakthrough thanks to the multifactorial approach, as a cocktail of drugs will be created that will improve processes at the cellular level to extend their life, and thus the life of an organism composed of these cells. It won't be cheap, but it will be effective, and it has already been demonstrated in laboratory mice with human DNA, extending their lives by at least 30%.

The prospect of a huge leap in the quality and length of human life is a great victory for humanity, but it is associated with a fundamental ethical and financial dilemma. Imagine that almost everyone can expect to live to an average of 115 years in better health. What would this mean for private and state pensions and even for the possibility or desire to retire? What about the cost to our planet if it has to support billions of more people, not to mention, will it have enough food for all? Add to this an ethical question - is it humane not to make the cocktail available to everyone, without exception? In short, how would our value systems, political systems and our planet fare?

The full text of all forecasts is available at this address.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)