EToro platform test - with a small profit at the end. # Week 10

After 10 weeks, we have completed our trading platform test eToro in the schedule of weekly summaries - the project will continue, however, about which later. The time has come for an "examination of conscience", which will cover both the results achieved and the advantages and disadvantages of the platform that we "discovered" during testing. We invite you to read.

Check it out: EToro Review - Social Trading Platform

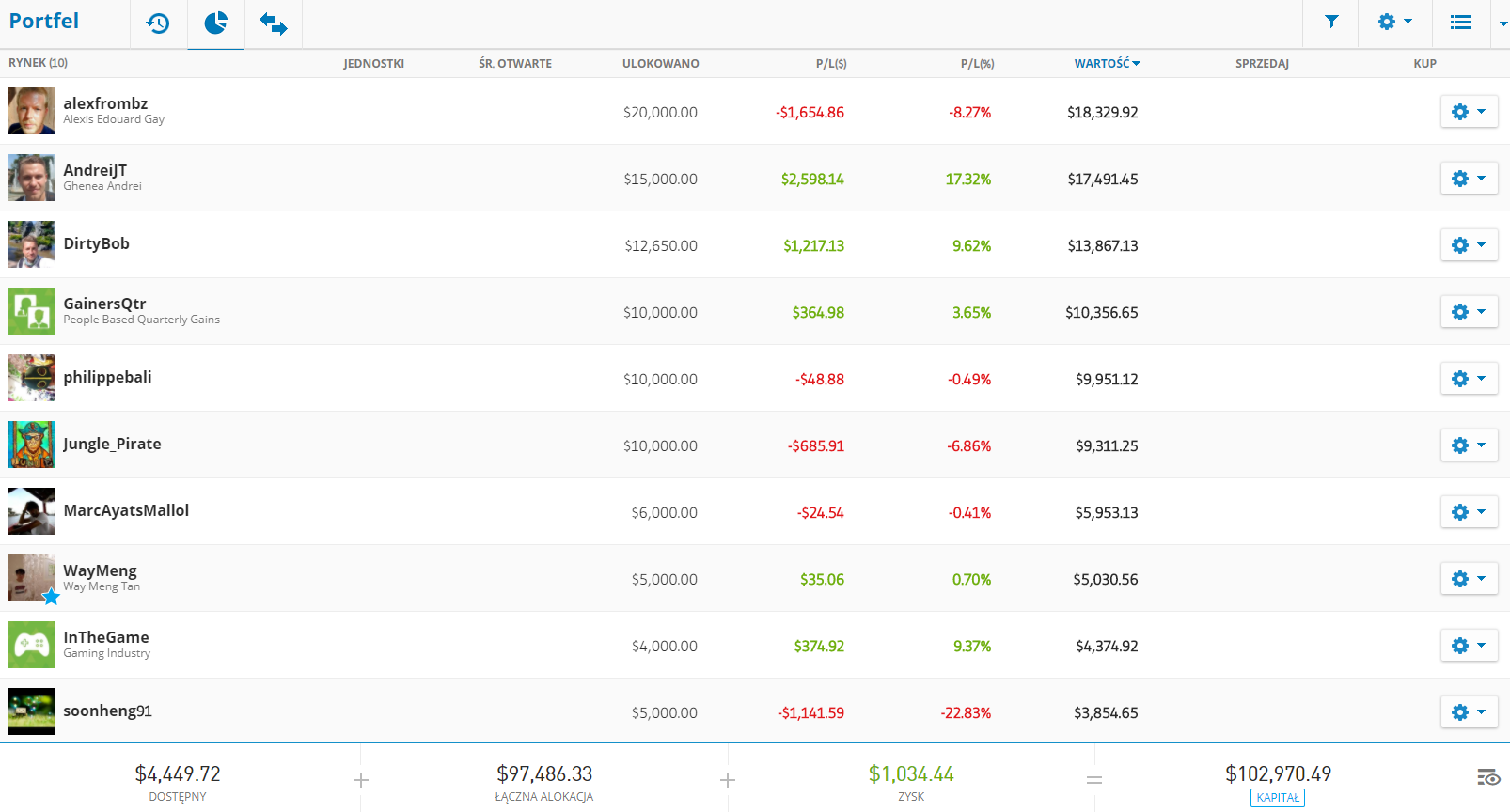

The composition of our eToro portfolio

The last week did not do as well as the previous two and some of the profits evaporated at the very end. Our net profit is symbolic, as is the amount of the booked funds. Investor adnreiJT obtained the best results so far and is close to + 20% profit. The second is DirtyBobwho was also close to similar results, but eventually stumbled and fared significantly worse.

Past performance is not indicative of future performance. The trading history shown is less than 5 full years and may not be sufficient as a basis for an investment decision.

During the test, some investors invested their funds in shares. Among the selected companies were:

- Alibaba

- Microsoft

- VISA

- Coca-Cola

- Intel

- Euronet

- Apple Lossless Audio CODEC (ALAC),

- PayPal

- Netlfix

- Master Card

Account balance after 10 weeks:

- The rate of return on the fund GainersQtr 3,65% (an increase of 0,43% compared to last week),

- 322 active items left,

- Our result is + 2970,49 USD, which gives a level of return of + 2,9 %.

Summation

Let us recall that our initial balance was as high as USD 100 and with the involvement of over 000% of these funds, we could expect a much better result. For 95 weeks there was not even a glimpse of a high profit proportional to such a high deposit and degree of commitment. This is in part the result of our initially highly conservative strategy of selecting signal providers. On the other hand, holidays are a period of reduced volatility and traders' activity. But after all this time, the clear pros and cons of the eToro platform itself emerged without fear.

Advantages

- It is not a time-consuming job. Our role is limited only to operating the platform (which is simple and transparent), selecting investors according to established criteria and making changes to them. These are a key element as in the event of poor performance it is best to swap signal providers and reallocate resources as early as possible.

- eToro brings together a wide range of investors and allows them to choose according to the country, market, profit and the period in which the investor made his investments. This differentiation is helpful in diversifying your portfolio.

- As with ZuluTrade, it can be an additional element of our investment portfolio.

- The available option of manual closing of orders will come in handy when our profit is at a decent level and we want to make a payment. At any time, we can go back to copying the investor's games.

- We have access to funds that have a diversified and predetermined structure. It is a good choice for achieving stable income with a relatively low level of risk in the long term. The GainersQtr tested us made a 3,65% profit and for 10 weeks we did not see anything disturbing here.

Disadvantages

- Poor performance of investors despite a large deposit. The rate of return is disproportionate to the funds involved.

- Despite the significant increase in risk, we did not achieve the desired effect. We noticed a negligible difference between traders with 5 and 9 risk (on eToro's 10-point scale).

- The main factor that improved our results was the very high (for a certain period) volatility in some markets (mainly cryptocurrencies), which suggests that under normal trading conditions and without. of involvement in trading on tokens, investors could be disappointed with the results achieved.

Our test will continue for another 10 weeks, same as ZuluTrade, but without the weekly summaries. The final results of our adventures of eToro will be released on October 2.

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

eToro is a multi-asset platform that offers both stock investing and CFD trading.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Past performance is not indicative of future performance. The trading history shown is less than 5 full years and may not be sufficient as a basis for an investment decision.

Copy Trading is not synonymous with investment advice. The value of your investment may go up or down. Your capital is at risk.

eToro USA LLC does not offer CFDs and does not make any representations or be responsible for the accuracy or completeness of the content of this publication, which was prepared by our partner using publicly available information about eToro that is not specific to entities.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)