Drama on the company Adyen. Has the share price bottomed out?

Adyen shares fell more than 30% in one session. As a rule, such volatility is reserved for small companies with dire liquidity. This time such a collapse concerned European fin-tech. Is the market right or has it gone too far? Were the results so tragic?

What is Adyen?

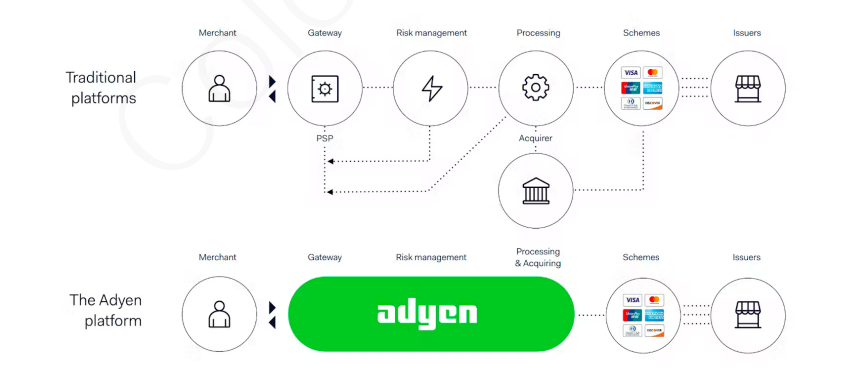

Adyen is a Dutch payment company that also has the status of an acquirer, i.e. a financial institution that processes payments. The company helps customers to accept mobile payments, POS (Point-of-Sale) and online payments.

Source: Adyen

Adyen allows customers to accept credit cards, debit cards and online transfers through its platforms. Thus, Adyen acts as a payment gateway and PSP (Payment Service Providers). The PSP is an intermediary between the customer and the entity accepting the purchase (e.g. shop). In addition, such companies also offer risk management services or fraud protection. As a PSP, Adyen offers software to integrate PoS systems with websites and mobile sites. Adyen works with many well-known brands. Among them are e.g. such as: Netflix, Meta, Microsoft and Spotify.

Adyen was founded in 2006 by Pieter van der Does and Arnout Schuijff. The company initially focused on the European market. However, after only 6 years, Adyen began to expand abroad and began to open offices in several foreign countries, including Paris, London, San Francisco. In the same year, Adyen obtained the status of acquiring for the EU market.

In the following years, Adyen increased the scale of its operations. This made it possible to raise capital from investors. In 2015, the valuation of the Dutch company amounted to USD 2,3 billion, as a result of which the company became the sixth largest European unicorn (a company with a capitalization of over USD 1 billion).

The following years saw further development of the scale of operations. The company acquired more and more customers, who processed more and more payments through Adyen. Adyen thus generated a lot of revenue from the so-called settlement fee and processing fees. The settlement fee is a fee charged to the seller as a percentage of the transaction value. Fee-related costs are included in this fee exchange and collected by the payment network. The processing fee is a fee for using the platform when conducting transactions.

Dynamic development in recent years

The Dutch fin-tech debuted on the stock exchange with a valuation of €7,1 billion. The IPO share price was set at €240. In September 2021, one share was over €2. Why was Adyen growing so dynamically? The reason was the rapid growth of business scale, high margin and good prospects for the future. As a result, investors were willing to pay a lot for the company's profits and free cash flow. Investor enthusiasm was so great that Adyen was valued at more than 700 times the company's net profits.

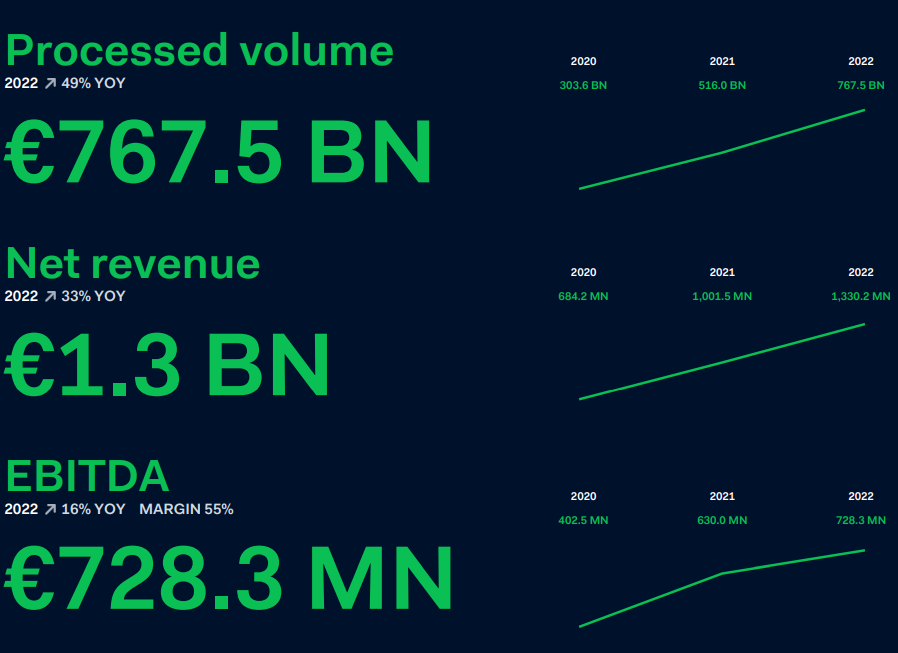

However, the increase in revenues was dynamic. This can be seen in the image below. In 2020, Adyen processed payments worth just over €300 billion. In 2022, it was already €767 billion. Revenues also grew in line with the volume, from €684m in 2020 to €1,3bn in 2022. It is also worth noting that in addition to dynamic revenue growth, Adyen is very profitable. Result EBITDA in 2022 it was €728 million, and two years earlier it was €402 million.

The financial results of the company. Source: Adyen

With the start of the correction on tech stocks, Adyen also lost value. In September 2021, its capitalization was about $ 100 billion. After yesterday's results, the company's capitalization amounted to approximately $31 billion. Below we briefly summarize the results of the Dutch company.

ADYEN Stock Chart, Daily Timeframe. Source: TradingView

Disappointing results for IH 2023

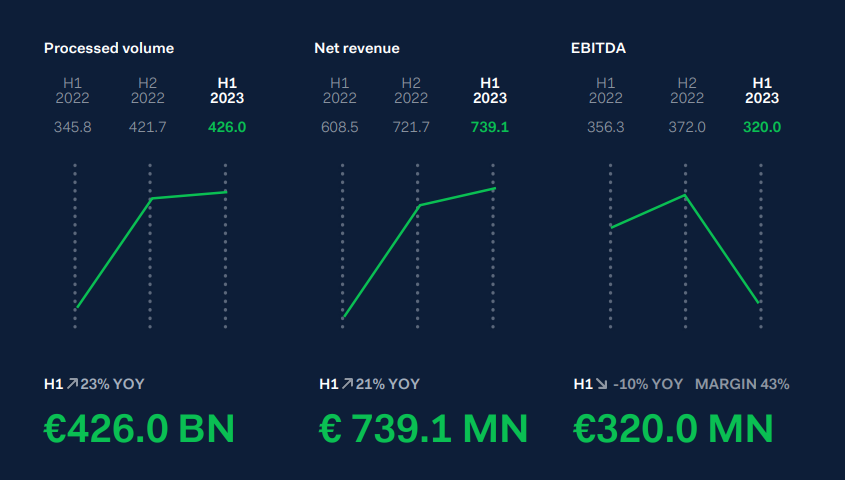

In the first half of the year, the Adyen platform processed transactions worth €426 billion. This meant an increase of 23% y/y. It is worth noting that in the first half of 2022, the company grew in this aspect by over 55% y/y. Therefore, a decrease in the dynamics of the payment volume is noticeable.

Adyen's revenues in H2023 739 amounted to €21 million. This meant that revenues increased by 2022% y/y. For comparison, in H53 XNUMX, the company's revenues increased by XNUMX%. Therefore, in the first half of the year, the dynamics of revenues is weaker than in the previous year.

It is worth noting that despite the increase in revenues, EBITDA decreased by 10% y/y to PLN 320 million. The reason for the decrease in the EBITDA result was the increase in expenses for salaries and investments in other activities of the company, which will be scaled in the coming years.

Source: Adyen

The results were worse than expected. You can see it on Twitter below. Adyen generated revenue 4,4% lower than expected. In turn, net profit per share was 4% lower than expected. Therefore, there was a slower growth in revenues, with a decrease in the operating margin and EBITDA.

https://twitter.com/Quartr_App/status/1692102469570982180

Summation

Adyen disappointed with the results. The reason for the weaker revenues was the intensifying competition in the payment processing market. This has put pressure on the fees charged. The market is concerned that the decline in business growth is due to the commoditization of the market. This means that some investors estimate that in the future Adyen will have to reduce its very high margin. It should be remembered that the current discount is partly forging too high expectations. Despite the decline, the current price of EV/EBIT (economic value to EBIT) is over 40. It is therefore a very high valuation of the company. Of course, the bulls will say that the current decline is an investment opportunity as the company looks set to continue to grow revenues and maintain a high operating margin. Bears, on the other hand, will say that the industry is very competitive and that high margins will decrease over time. At the same time, the European market is already heavily penetrated, and intensified competition is visible in the USA. Who's right? We'll find out in a few years.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)