The oil market is waiting for the next OPEC + move

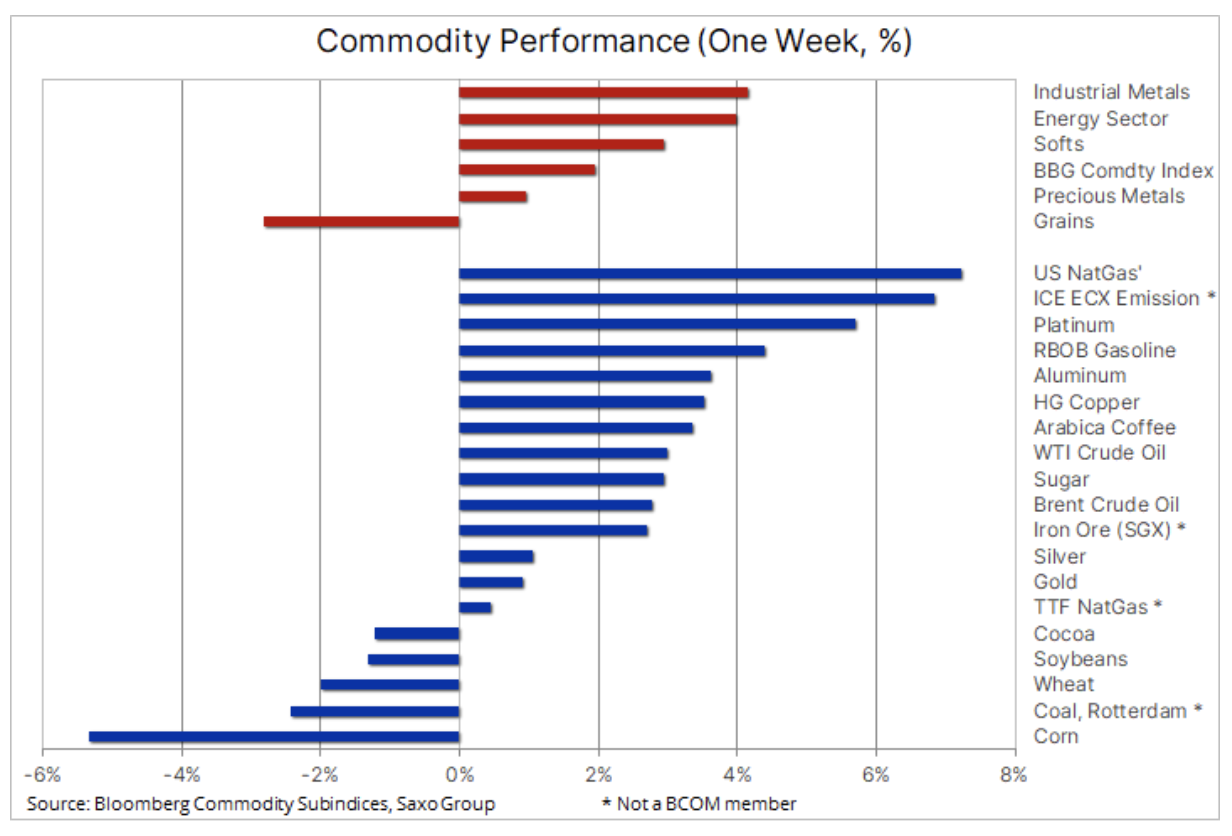

Financial markets saw a strong recovery last week after recovering from the FOMC meeting, which saw the dollar and US government bond yields go up while stocks and commodities depreciated. Many of these initial movements have already reversed; this was mainly the case of US equities hitting new all-time highs, as well as long-term bond yields that have stabilized, while dollar investors are still struggling to decide whether the strengthening after the FOMC will continue or there will be a full reversal.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Regarding raw materials, the shift away from metals and agricultural products for energy showed signs of inhibition. With the exception of the cereals sector, all other sectors surged last week as the effects of the FOMC weakened. Oil and gas appreciated in response to rising demand and the fact that US shale oil and gas producers focused on financial discipline rather than increasing production. As a result, both fuels hit levels last recorded in 2018, with the crude oil market in particular focusing on another potential move by OPEC and Russia, following a July 1 meeting where producers are expected to set production levels for August and beyond.

Industrial metals

Primarily copper, returned to the game after Chinese authorities released only small batches of metals from state reserves in an effort to contain price increases. Moreover, in Russia there was a proposal to introduce a 15% tax on exports aluminum material, copper, nickel i steel to combat inflation in domestic metal prices and to increase tax revenues. As Russia is an important export country, the introduction of this tax could further reduce supply in markets and provide price support in the second half of 2021.

Support - albeit moderate - also extended to copper prices after President Biden's US $ 579bn infrastructure plan gained support from both parties. However, an agreement that would boost copper demand by driving the energy transition to establish an electric vehicle power grid still needs to be approved by an extremely fragmented Congress.

Gold

Gold had a problem with finding new buyers despite the recent dollar weakening and a decline in real US bond yields to pre-FOMC levels. The market is still torn on projected inflation; so far the consensus has shifted towards support for the temporary nature of inflation assumed by central banks, in particular the Federal Reserve. Considering that other gold-related metals such as silver or platinum, recording exceptionally strong results, gold may slowly prepare for further growth. However, prospective buyers are likely to exercise restraint in anticipation of a further decline or a break above $ 1 / oz.

NATGAS

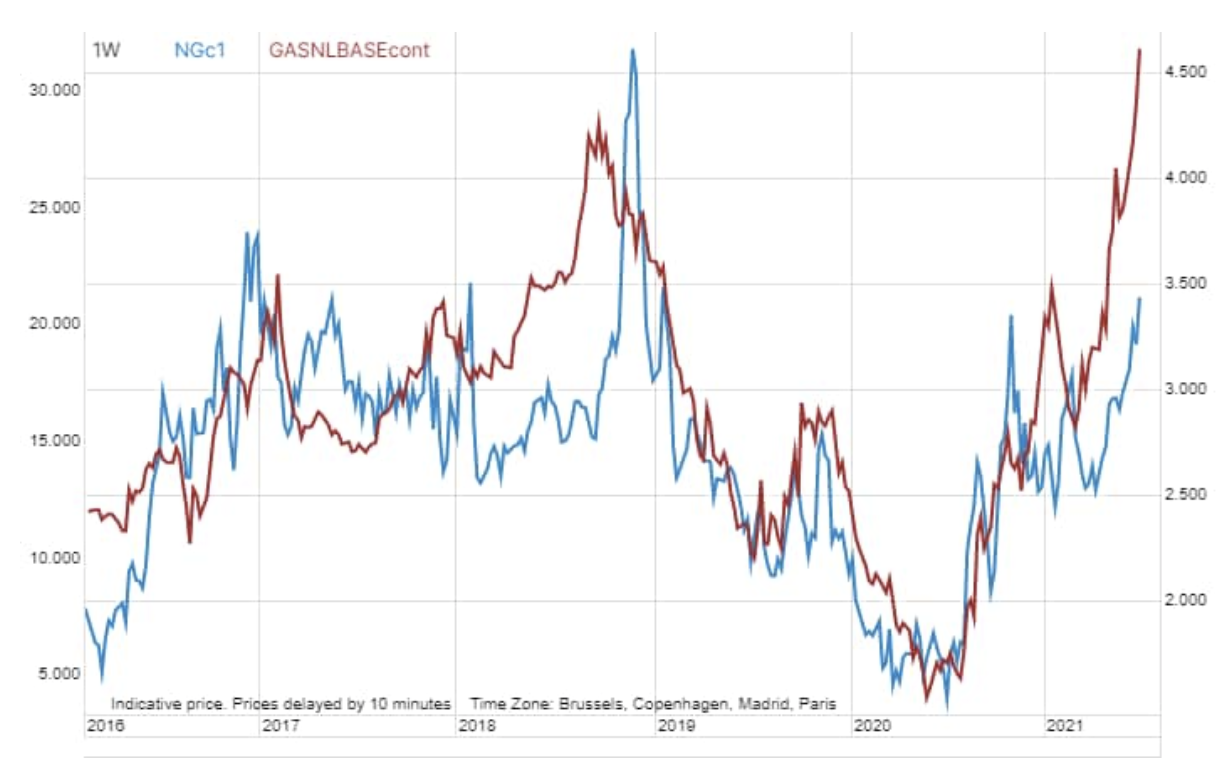

American prices natural gas reached their highest level in more than two years, $ 3,44 / MMBtu, after extreme heat in the US west fueled demand from the utilities sector, straining an already limited supply. Inventories are now 6% below their normal levels during this period of the year due to increased demand for domestic and exported LNG gas as shale gas producers, like shale oil, cut production in response to investors' calls for financial discipline. The prices of the futures contracts with the earliest expiry date were last so high in June 2014, when they reached 4,55 USD / MMBtu.

In Europe, the price of the Dutch TTF gas contract reached its 2008 high., exceeding EUR 32 / MWh, which is the equivalent of USD 11,25 / MMBtu. Gas stocks have fallen to their lowest level for this period since 2009 due to LNG terminal maintenance, strong heat demand and a decrease in supplies from Russia, potentially geographically motivated to force an agreement on the Nord Stream 2 pipeline, which will be launched soon . The reduction in gas supply and wind energy production has contributed to an increase in coal use, which in turn has boosted carbon prices, which are steadily rising, now exceeding EUR 55 per ton.

In the short term, the direction of prices will depend on the Ukrainian pipeline capacity auction scheduled for June 29, the key transit route to Europe, and whether Russia and Gazprom decide to send further supplies via Ukraine. In particular, one should remember about the upcoming ten-day maintenance of the Nord Stream 1 pipeline, connecting Russia directly with Germany.

Chart: Both the monthly Dutch gas forward contract TTF (left) and the US gas Henry Hub contract for the first month reached new highs due to the surge in demand and limited supply.

Petroleum

After a slight adjustment after the FOMC, Petroleum gains quickly resumed, with both WTI and Brent crude reaching levels last recorded in 2018. This is based on the belief that OPEC + will increase production in the near term in a way that provides continued price support as global demand continues to recover and thereafter due to growing concerns that the lack of capital expenditure on new production may result in insufficient supply on the market from the end of 2022. WTI crude oil came to the fore of the last bull market, whose discount to Brent crude oil narrowed due to speculation that the stocks in Cushing, the hub for WTI's oil contracts, may shrink even further as a result of strong demand from refineries in the Midwest.

Price movements, which in recent weeks have been more conducive to energy than metals or agricultural products, have also triggered a movement among speculative investors. Despite the reduction in exposure to metals, both precious and industrial, as well as agricultural products, the total long net position in crude oil and fuel products (excluding natural gas) shows the strongest confidence in energy price increases since October 2018, but with 977 lots of futures are still 000% below the January 33 record position. While on the one hand it highlights the risk of the market becoming too one-sided, it also shows strong investor confidence that prices will go up.

However, the oil market will increasingly focus on the OPEC + meeting scheduled for July 1, and action or lack thereof by the group will send a clear signal as to whether OPEC + will aim to stabilize prices by increasing production or higher prices. Given that Russia's current budget is based on the price of oil in the lower US $ 40 region, it may be more inclined to support the expansion of production to secure a greater market share while limiting the risk of increased non-OPEC production.

However, the position of Saudi Arabia will be of key importance, including due to a credit of confidence from its actions in January, when it unilaterally cut production to support prices during the re-lockdown period. The whole world is waiting for a decision as to whether Saudi Arabia will try to push up prices even more by opposing the increase in production. Continued limited supply will create a steep curve backward, which will benefit OPEC + producers selling oil based on high spot prices. At the same time, debt-financed producers, such as US shale oil producers, are often forced to hedge some of their future production for 12-18 months ahead, and due to the shape of the forward curve, to sell at much lower prices than the current spot prices.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)