There has been no such weak monthly volume since 2016.

November turned out to be a difficult and demanding month in terms of turnover. The aversion to greater market involvement may have been triggered by trade uncertainty since May last year. What's more, investors are becoming more cautious and sensitive to adverse macroeconomic data. Global policy and increased risk in global trade are not conducive to generating higher or at least constant (month by month) turnover. In the article, we look at the results of the main liquidity providers and key participants of the currency market.

Saxo Bank joins the list

Saxo Bank was on the list of the most "injured" financial institutions in the context of weak volumes. Trading on the forex market significantly affects the overall trading results of this broker. So we took a closer look at what the situation was in November. From the published data you can immediately see poor m / m dynamics. Namely compared to the previous month (October) the result worsened by 23,9%. It fell from USD 141,2 billion to USD 107,4 billion in November. Turnover with this broker has melted enough to become the worst monthly result in the entire 2019 year.

In fact, the volume of trading in November is the lowest monthly currency volume achieved since at least the beginning of 2016. Compared to the annual approach, the volume last month shrank by 37,4%. The situation is similar with goods. The volume of concluded contracts decreased by 4,7%. The other areas of Saxo Bank's operations, namely shares and fixed income assets, behave similarly.

Be sure to read: An unnoticed filter of market behavior, or a few words about the volume

Average daily turn down

The provider of the institutional trading platform Integral also provided turnover data. They are more optimistic than Saxo Bank, while the industry-wide downward trend in the industry has also affected him. The report revealed that the average daily trading volume (ADV) was exactly $ 34 billion in November. Comparing this result to the October readings, the dynamics of change is at the level of 6,6%. Moreover, volumes in November were lower than in the same month a year ago. The most recent data show a weakening of the current result by 11,2% y / y. Last year in November, Integral reported $ 38,3 billion.

Japan is also falling

Tokyo Financial Exchange (TFX) announced its volume readings for November. The Japanese stock market has generally seen a relatively weak month in terms of currency trading. The total trading volume of all available contracts for the entire Japanese stock exchange was 2 201 080. Converting to the average daily ADV, we get the number of 105 020 contracts. Compared to the previous month, this result is lower by exactly 24,3%. This reading is even worse compared to last year. TFX has regressed 28,3% y / y.

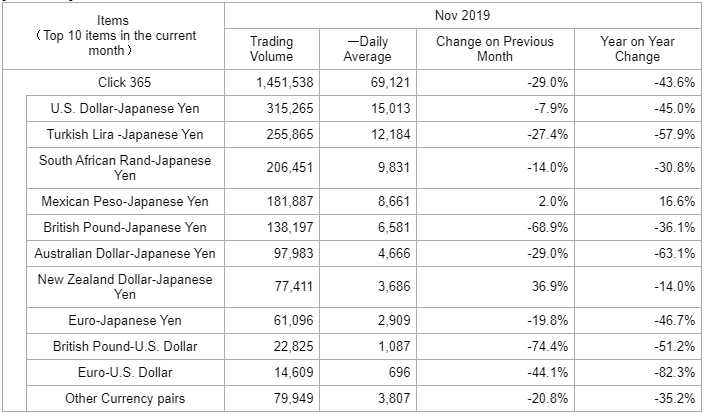

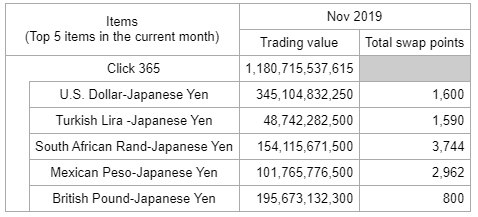

Given the total volume of futures in the Forex market, the picture doesn't look much better because only November 1 451 538 contracts were sold. This translates into daily turnover in the number of 69 121 contracts, which is a considerable regression compared to last month.

The above list shows the interest of individual currency pairs. Geopolitics and the related volatility sought by traders when trading currency contracts is of great importance here. The information provided shows that one of the biggest losers is the pair GBP / USD. Interest in the pound against the dollar fell by 74,4%, to the number of 22 825 contracts concluded.

On the other hand, the currency pair that recorded the highest monthly increase in November is the New Zealand dollar to the Japanese yen. Interest in NZD / JPY increased by 36,9 percent taking the October readings as a reference. In the overall annual comparison, the Mexican peso to the Japanese yen recorded the largest increase.

The situation is similar on GMO Click, which operates on the Japanese market. Its results deteriorated within 28%, which is analogous to TFX and other institutions and companies operating on the forex market. The decreases are so drastic that their monthly change dynamics reaches several dozen percent. It remains only to count that December volatility will be at a much better level.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Volume Spread Analysis: Frequently Asked Questions and Answers [FAQ] vs faq](https://forexclub.pl/wp-content/uploads/2023/06/vsa-faq-300x200.jpg?v=1685689430)

![The use of volume on the forex market in practice - Rafał Glinicki [Video] Volume utilization in the forex market](https://forexclub.pl/wp-content/uploads/2023/06/Wykorzystanie-wolumenu-na-rynku-forex-300x200.jpg?v=1685602297)

![Rafał Glinicki – The use of volume on the forex market in practice [Webinar] Rafał Glinicki Using volume in the forex market webinar](https://forexclub.pl/wp-content/uploads/2023/05/rafal-glinicki-Wykorzystanie-wolumenu-na-rynku-forex-webinar-300x200.jpg?v=1684850257)

Leave a Response