Tickmill results for the year 2017. Increase of net profit by 103%

Group Tickmill announced strong consolidated financial results for 2017, which show the strong development of the company in recent years. Financial data released last year showed steady progress on key performance indicators.

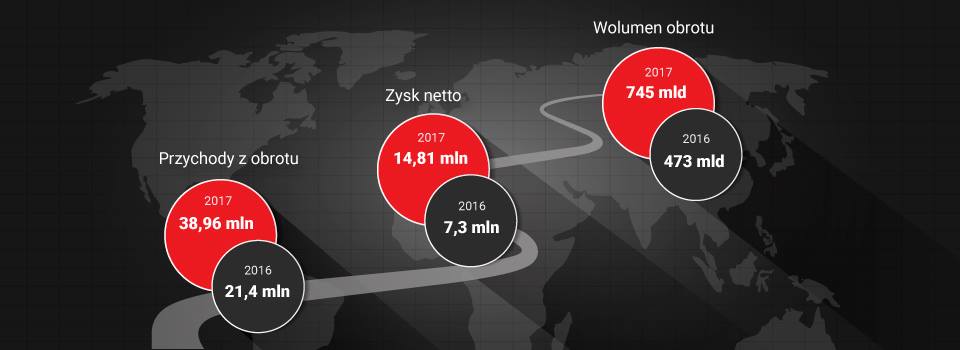

The most important data:

- Consolidated net profit increased from 7,29 million USD in 2016 to 14,81 million USD in 2017, an increase of 103%.

- Revenues from trading amounted to 38,96 million USD, an increase of 82% compared to the previous year.

- Total trading volume was $ 745 billion in nominal value, well above the projected range of $ 600-650 billion. In November 2017, Tickmill Group recorded its highest monthly turnover of $ 79 billion, when customers entered into a record number of transactions - 4,25 million. Taking a full-year perspective, Tickmill Group clients concluded a total of 42,58 million transactions, which also means a new record for the Company.

Growth forecasts for the coming year

Tickmill had a strong start in the 2018 year, recording a record-breaking monthly trading volume of 110,6 billion in January, maintaining three-digit values in February and March.

In 2018, the company plans to achieve a total trading volume of 1200-1300 billion dollars based on local growth in key markets in Southeast Asia, South America, the MENA region and Europe.

Duncan Anderson, CEO Tickmill UK Ltd, commented:

Duncan Anderson, CEO Tickmill UK Ltd, commented:

“Tickmill was flexible enough to achieve record revenues and profits in the past year, despite many regulatory changes and increased competition in the financial sector. Our global presence, excellent trading conditions and cutting-edge trading technology have made Tickmill a strong brand and broker for the most sophisticated retail and professional traders. At the company, we have always had a long-term horizon in everything we do, which makes us excited about the future of the Forex industry. "

Illimar Mattus, CFO Tickmill Ltd:

“Despite the long periods of low volatility in the market in 2017, the Group was able to achieve good financial results during the year. We doubled profitability and revenues by 82%. Our strong net capital base of $ 27,94 million at the end of 2017 will allow us to invest in new products and technologies to bring more value to our global customers. Following the successful completion of the Vipro Markets Ltd acquisition in 2017, we will continue to seek significant acquisition opportunities in 2018 to increase our market share and improve our overall efficiency. Building on last year's positive results, we are renewing our focus on the fundamental principles that underpin our success: delivering cost-effective solutions, strengthening our competitive advantages and diversifying our business. "

Year 2018 and ESMA

ESMA regulations that come into force may have a significant impact on the condition of the entire industry. Specialists say that the reduction of leverage in the European Union may lead to market consolidation, acquisitions of smaller entities by larger players and reduction of promotion spending. If so, what impact will it have on the situation in the Tickmill group? At the moment, it is impossible to prognode, but certainly the broker itself in a short time

The new ESMA regulations apply to all brokers from the territory of the EU, which consequently also means that the British broker cannot offer other conditions to clients, e.g. from Asia. It is worth noting, however, that the Tickmill Group currently consists of three brokers - Tickmill UK, Tickmill Europe (formerly Vipro Markets) and Tickmill Seychelles. The last company operates with a license in Seychelles, outside the EU regulations, which means that its clients will not be covered by the guidelines of the Pan-European regulator.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)