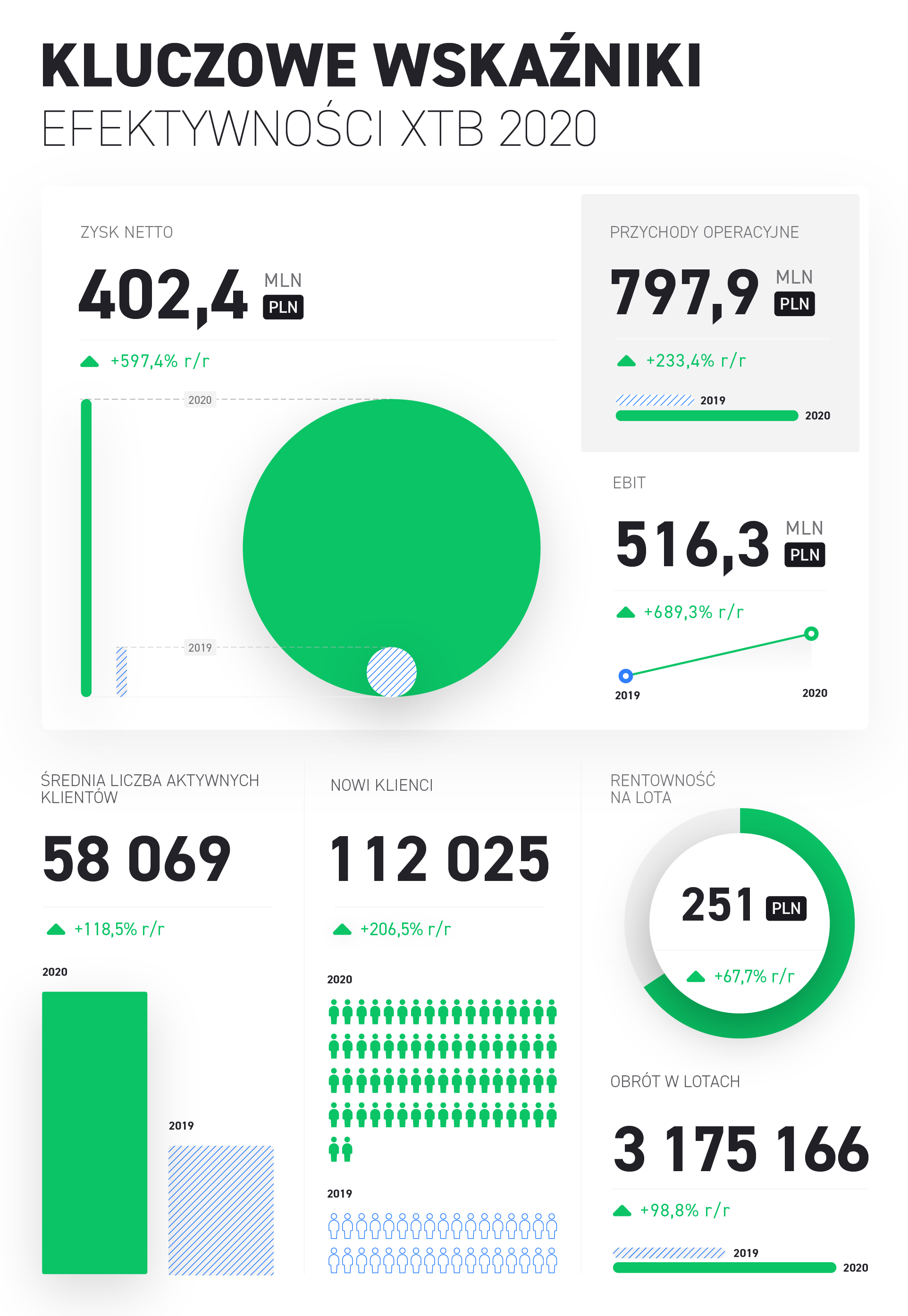

It was a record year for XTB. Initially: PLN 402,4 million of profit

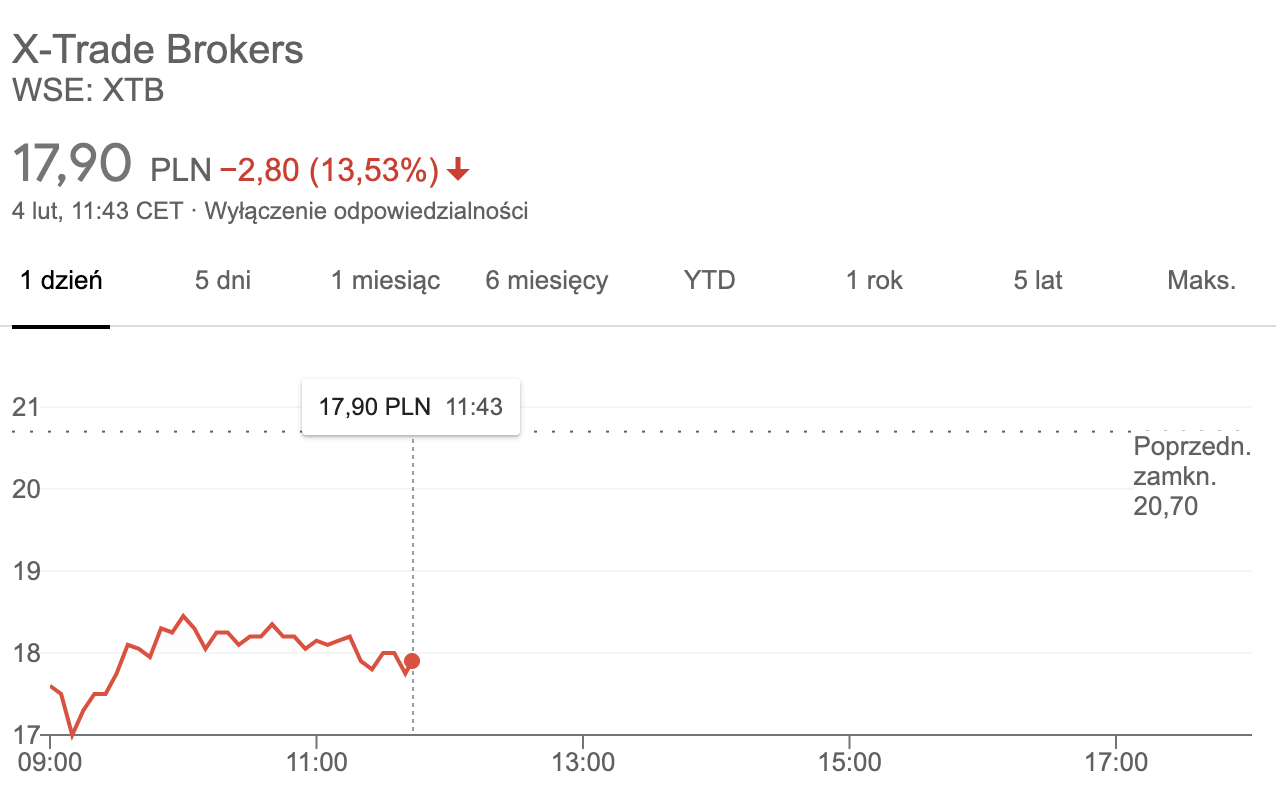

If you were wondering who earned money from the coronavirus pandemic, then undoubtedly at the forefront of companies are not only representatives of the broadly understood medical industry, but also Forex brokers. He just summarized the results for 2020 XTB. The preliminary financial results of the company listed on the Warsaw Stock Exchange are fantastic. The share price has reacted with a decline, but over the course of the year anyway increased by 465,57%.

Before the official calculations of accountants and auditors appear, representatives XTB they could not stand it and provided XTB's preliminary financial results for 2020. And it must be admitted that you cannot be surprised, because there is something to be proud of.

- In 2020, XTB generated the highest operating income in the company's history - PLN 797,7 million (an increase by 233,4% compared to 2019), consolidated net profit - PLN 402,4 million (an increase by 597,4% yoy) / y) and EBIT - PLN 516,3 million (increase by 689,3% y / y). XTB also acquired a record number of 112 thousand. new clients (an increase by 206,5% compared to the number of clients acquired in 2019) - we read in the message.

So we have records in all indicators. The company points out that this was due to significantly greater volatility in the financial markets caused by the coronavirus pandemic, as well as related interest rate cuts. This is because they made financial instruments more competitive and more willingly chosen than bank deposits that do not even protect against inflation.

The fourth quarter of 2020 was also very good, when the financial and pandemic turmoil has already calmed down. Despite this, the XTB group recorded PLN 140,1 million in operating revenues (in the fourth quarter of 2019 it was PLN 89,6 million) and PLN 40,5 million in net profit (compared to PLN 37 million in the corresponding period of 2019).

President: we want to conquer Poland, Europe and the world!

- 2020 was a very good year for XTB. Achieving three-digit increases in revenues and profits, however, would not be possible without several years of hard work on our product, technology and service improvement. Thanks to them, we used the opportunity for development and growth, which was provided by above-average volatility in the markets. This year has proved the stability of the foundations on which our business is based - says the president of the board of XTB Omar Arnaout. - We want to be the investment company of the first choice, not only for clients in Poland and Europe, but all over the world - adds Omar Arnaout.

As revenues and profits increase, however, costs also increase. In 2020, the operating costs amounted to PLN 281,7 million and were PLN 107,8 million higher than in the previous year (2019: PLN 173,9 million). Larger amounts were spent on online marketing, employee salaries and increased employment.

Over a quarter of a million XTB customers

In 2020, the XTB group acquired 112 new clients, which means an increase by 025% on an annual basis (in 206,5, XTB acquired 2019 clients). This is as much as acquired in the last six years (in 36-555, the XTB group acquired 2014 2019 customers)! In total, over 112 thousand used the broker's services. customers, and in 825 261 2020 of them were active.

- The increase in the number of active clients is and will continue to be one of our greatest priorities. Although the growth we achieved in 2020 was very solid, we aim to further increase our base of both acquired and active customers. We intend to make the best of the fact that more and more people are interested in investing. I am thinking not only about experienced investors who often know us and invest in XTB, but also about people who, thanks to the situation we observe on the markets, have only just started to be interested in this topic - Omar Arnaout, President of the Management Board of XTB, summed up.

He also added that the management board will recommend a dividend payment, but the amount is not known yet.

Interestingly, the XTB rate reacted to this information with a decline. After 11 on 04.02.2021/13,5/XNUMX it was already -XNUMX%. Investors apparently reacted according to the rule "Buy rumors, sell facts". Over the last 12 months, the XTB price has increased by 465,57%, and in the last 3 months by 31,85%.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)