Trader of the Month earned in April over 52 000 $ [Tickmill Contest]

Trader of the month - April 2019

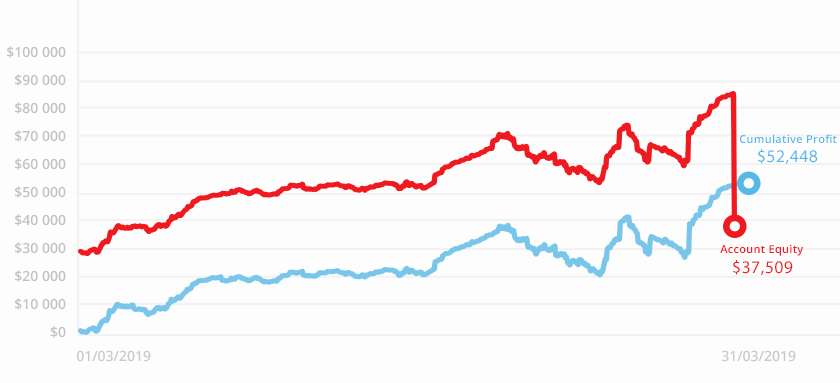

In a competition organized by a British broker Tickmill the best trader was chosen for the month of April. An investor named Wei earned over 52 thousand. USD closing equal 700 transactions, more than half of which were closed at a profit. Congratulations!

What strategy did he choose? About this below. We also encourage you to read the extensive interview given to Tickmill.

Pyramid on the road to success?

In the interview, Wei admitted that he applies the so-called pyramiding (You can read more about the pyramids in trading here) and uses a rather unusual approach to risk (SL at 60% + hedge). In the transaction history you can see that none of the positions has been equipped with a Stop Loss or Take Profit order (you can use these levels as "hidden").

Most of the transactions were made on currency pairs of which we have a wide range - main, cross and exotic pairs (eg USD / SGD). Transactions on WTI crude oil and precious metals occur sporadically. Volume? The lowest in the case of currencies was 0.66 lots. For WTI, it often exceeded 1000 flights, but we are talking about contracts. With an initial deposit of 28 thousand. USD it can be said that Wei did not play very aggressively, but you have to remember that he often engaged in several markets simultaneously.

Positions were usually closed within 2-3 days, but there were also longer "downtimes". Interestingly, unlike traders using averaging strategies, Wei quite often closed trades with a relatively high profit (even around $ 2), compared to losses that were sometimes extremely symbolic.

Even in mid-April, it's time for a crisis. The series of losses caused that the capital of the month trader fell from around 70 thousand. USD to 53 thousand USD (decrease by 24%). But sometimes you have to take a step backwards to be able to run forward. Eventually, the month was closed with a profit of 52 448 USD.

Transaction history in numbers:

- Profit: $ 52,448.75

- Return: 186.57%

- Total number of transactions: 700

- Profitable transactions: 57.29%

Statement trader (PDF)

Interview with a trader

How long have you been involved in trade?

I have been on the forex market since 4 for years.

How did your adventure with Forex trading begin?

Initially, I was a professional investor in a trading company, but ultimately the transactions ended in a loss. Then I studied on my own without doing anything except learning the ABC of the forex market.

What is your trading style?

I'm using a pyramid strategy. However, I do not add items too often. I pay attention to the levels, I do not look at the indicators from technical analysis.

If the price level is suitable for trade, I open a small order. If the price goes in the opposite direction, I make orders until the market starts to go towards me. As the market moves up or down, there will always be a trend change or a longer one-way traffic. You need to know how to deal with it, including stop loss orders. Never engage too much of your capital.

Do you have any risk management policies?

I use SL orders at 60% and I use hedge to reduce risk.

What good habits should investors be fooled about?

Do not place orders blindly and do not use price action if you do not understand it. Do not be too confident. Never engage too much of your capital, because you will not achieve 100% profitable transactions, no matter how well you know the market. The only purpose of investing in the Forex market is to make a profit, so it is good if we have profitable transactions. The amount of profit depends on the market, not on the size of the position.

Describe your best / most-remembered transaction (How much did you earn? What strategy did you use? On which pair?)

In January this year, I obtained a profit rate of 80%. At that time, after holding the position for 20 days, I achieved the first profit and the profit rate was 50%. I have never tried to maintain the position of the pyramids after they were made for profit, the effect was quite good. Quite often my security tools also bring profits.

What advice would you give to novice investors?

When I started trading in the Forex market, I used the Martingale strategy, then tried to block positions, hedging, trend indicators and so on, but later it turned out that in fact, most of these technical indicators are not useful. I say this because many traders like to use many indicators. In other words, they place an order when several indicators show the same signs of opportunity. This improves the win rate, but you can not always make a profit. I would rather look for a system that I can understand and that suits me and try to master this system, rather than using many methods that I do not know or belong to someone else. Trade does not have to be complicated. Strict loss cutting and disciplined position management is the key to winning, not deification technology.

Considering the current market situation, what do you think data / investors should pay attention to?

As already mentioned, never invest too much money on real accounts. When the moment of entry appears, do not treat it as if you hit the hill or down and the price will definitely go in your direction. Nothing in the trade remains the same, otherwise there will be no losers on the market.

What is the most important thing you expect from a Broker?

One of them is spread, which is the basic condition for cooperation of traders with brokers. I believe that a reasonable spread can lead to better cooperation. The other is a flexible financial leverage. The third is the changeability of consistency between the price of tools and the market price, and the slip should not be too high.

competition rules

The winner of the competition is selected by the Tickmill Jury. The win is not only determined by the rate of return - it is the total that matters. Factors such as earned profit, position management, risk and trading skills are taken into account. There is also one more necessary condition - interviewing the broker and consent to make the account history public. Only then does the prize of $ 1 go to the trader's investment account.

The principles introduced are aimed not only at showing that you can make money on the Forex market, but also consciously educate and encourage sharing experience with other traders.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Trader of the Month earned in April over 52 000 $ [Tickmill Contest] forex trader of the month](https://forexclub.pl/wp-content/uploads/2019/03/trader-forex-of-the-month.jpg)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

![Trader of the Month earned in April over 52 000 $ [Tickmill Contest] bitcoin ebay](https://forexclub.pl/wp-content/uploads/2019/05/bitcoin-ebay-102x65.jpg)

![Trader of the Month earned in April over 52 000 $ [Tickmill Contest] forex trading volume](https://forexclub.pl/wp-content/uploads/2016/03/wolumen-102x65.jpg)