Trump, oil and risk - the appetite for volatility is growing

Geopolitics is still a more valuable source of information than macroeconomic data. The appetite for good variability increases as you eat. Recent events on major currencies, oil, or yesterday's session on Bitcoinie, stimulated markets to operate. Risk aversion is diminishing, and volatile financial instruments have now become a great object of speculation. The context of trade war returned to the main topics. Is the relationship between Donald Trump and China worse again?

No escalation, a lot of emotions

Speaking of the recurring theme of trade war, I do not mean its escalation, but the sentiment that the US President has created around it. At the last UN summit, Trump announced that he was not satisfied with the activities carried out before the other side of the conflict. He emphasized that he did not intend to sign the agreement if in his opinion it would be detrimental to the United States. Observing the development of the entire dispute, it can be safely stated that Trump considers virtually every proposal / compromise of China as unacceptable. For now, no new weapons have appeared on the front from the US, but the mere fact of dissatisfaction with the head of the United States already raises some speculation about further actions.

Chart EUR / USD, H4 interval. Source: xNUMX XTB xStation

China has one powerful weapon that Trump has guaranteed. These are, of course, choices. Careful selection of words and actions on the part of the President of the United States must be prudent enough so that his constituents do not lose their sense of control over the situation and resolve it in favor of the USA. One of the negative news that has recently come to the market is a reading on consumer sentiment, led by the Conference Board. Data show a decline on a monthly basis. Nevertheless, for now the market absorbs only good information, which is related to the strong appreciation of the dollar against major currencies and special to commodity currencies.

It is worth adding a few words about China's strategy. Currently, they focus mainly on the agricultural and commodity market. Purchases of the other party to the conflict, particularly large ones, were recorded on soy and pork.

The situation on EUR / USD does not look too optimistic. However, observations of recent market analyzes show that many analysts, however, look favorably at the euro and tend to appreciate it against the dollar.

What does China say?

In order to increase the purchase of goods desired by the Chinese government, an idea was presented regarding the tax exemption of companies that will import US soybeans into the country with increased imports. What solution are we talking about? Purchases up to 3 million tonnes are to be ignored by applying tax with refundable duties. If we consider large enterprises, Monday's imports reached 1,2 million tonnes. The expectations of the Chinese government are clear. They count on the second round of negotiations related to the imposition of duties.

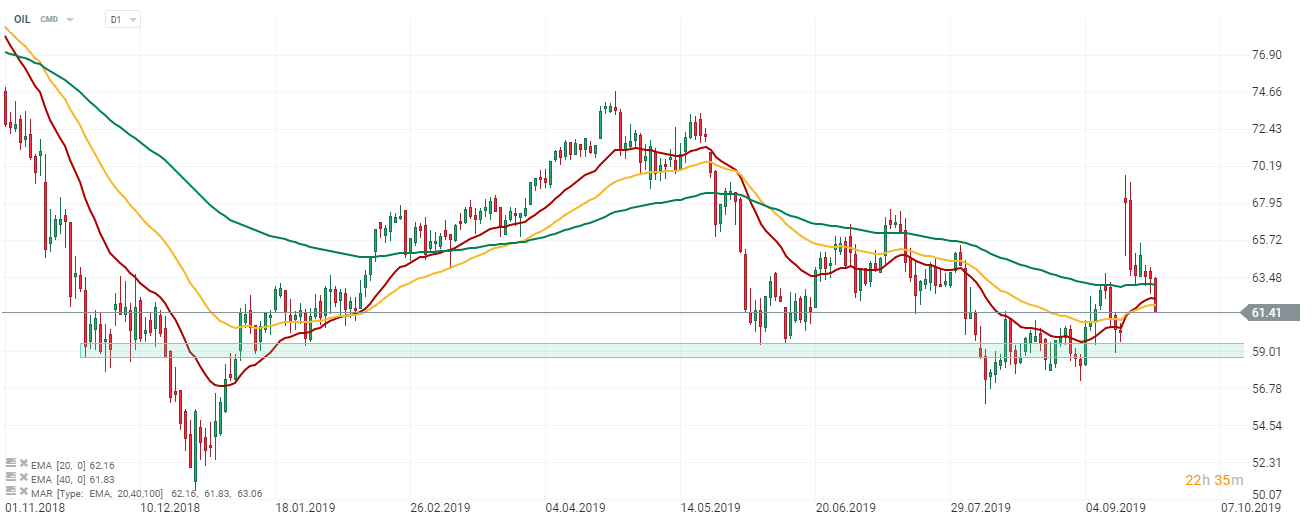

A little noise on oil

A week ago we could observe significant movements on oil in connection with the attacks in Saudi Arabia. Despite at least superficial control of the situation, black gold broke records of daily volatility. What is the situation today? Recent reports indicate that Saudi Arabia is expected to stabilize oil production next week.

Chart oil, H4 interval. Source: xNUMX XTB xStation

After the outflow of information on the stabilization of black gold production, a "small sale" began on this market. The average production in this region was 5 million barrels per day. At the moment, about half a million is missing to fully stabilize the situation before the attack.

Looking at the strictly technical oil chart, one of the key supports is the price around 59,01.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)