A week under the dollar sign. EUR / USD lowest since April

The ending week brings a drastic change in the balance of power in the currency market. Mainly due to the sharp appreciation of the dollar, which was inspired by the Wednesday's FOMC meeting. A meeting that turned out to be a big surprise. And it's a surprise hawk. The monetary authorities have signaled that there is a change in monetary policy. This change is suggested in the latest projection interest rates two increases in 2023.

Interest rates have not changed so far, but ...

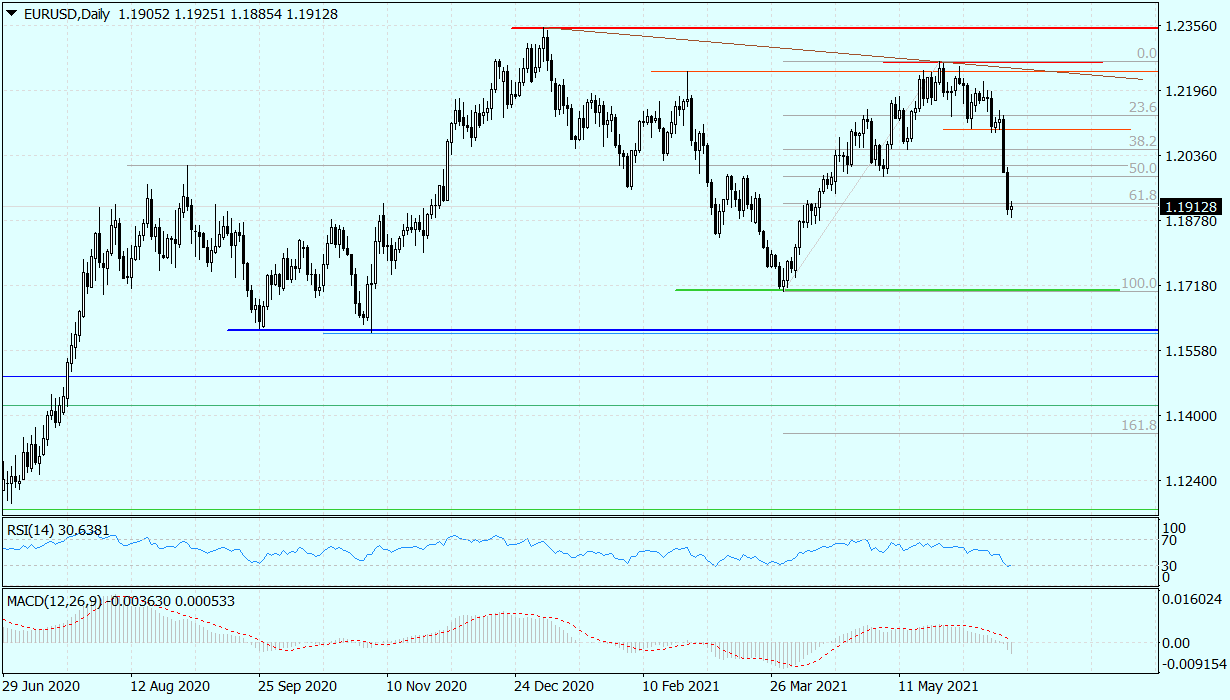

Of course, 2023 is still a long way off, but along the way, the scale of the asset purchase program will be reduced. The effect is that on Wednesday and Thursday the dollar strongly appreciated, breaking many key barriers and opening the way for further strengthening. This is clearly visible on the daily chart EUR / USD, where the road towards 1,17 is practically open, i.e. to the minimums from March,

Daily chart EUR / USD. Source: Tickmill

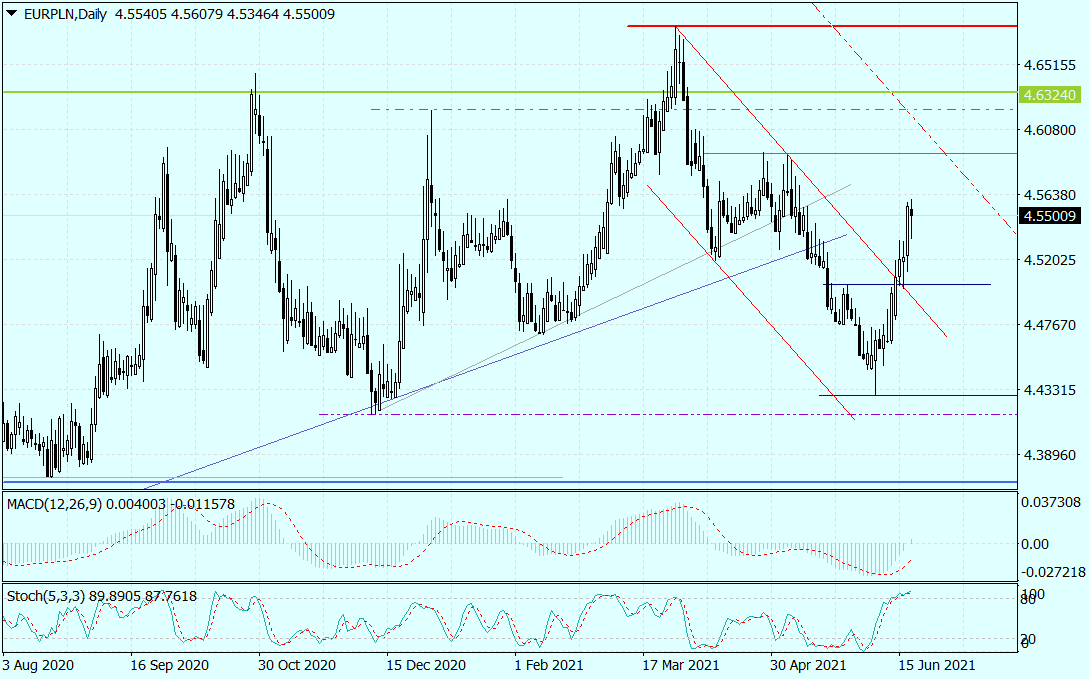

Hawkish surprise on the part of the FOMC and the accompanying dollar strengthening affected many currencies. Including the zloty. And not only for the USD / PLN pair, which is natural in such a situation, but also for EUR / PLN.

The daily EUR / PLN chart broke upwards from the 2-month downturn channel. On the basis of technical analysis, this opened the way to PLN 4,5925, i.e. to the local maximum at the end of April this year.

EUR / PLN daily chart. Source: Tickmill

And how to explain the increase in EUR / PLN in terms of fundamental factors? And what will happen next? Contrary to appearances, it is not difficult. The zloty was weakening before the FOMC meeting. The impetus for this was provided by the Monetary Policy Council and prof. Glapiński, who, despite the remaining high level of inflation, will refrain from any rapid increase in interest rates. Against this background, the last MPC meeting could even surprise with its dovish tone.

Nevertheless, the depreciation of the zloty itself, be it against the euro or the dollar, seems… temporary. Much earlier than American Fed the interest rates will be raised by the Council, and this will strengthen the zloty. Such expectations may appear even next week, when the Bank of Hungary and the Czech Bank will discuss monetary policy. And in both cases raises are real.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)