Week with macro data from Poland

In July, core inflation in Poland increased more than forecasted, in line with the scenario of high inflation that will remain with us for many months to come. These data, however, did not affect the performance of the zloty, which on Monday was quite stable in relation to the basket of currencies, reacting only to changes in quotations EUR / USD. However, this does not change the fact that it will be the Polish week on the currency market, and the next published macroeconomic reports will have a direct impact on the domestic currency.

Macro data from Poland

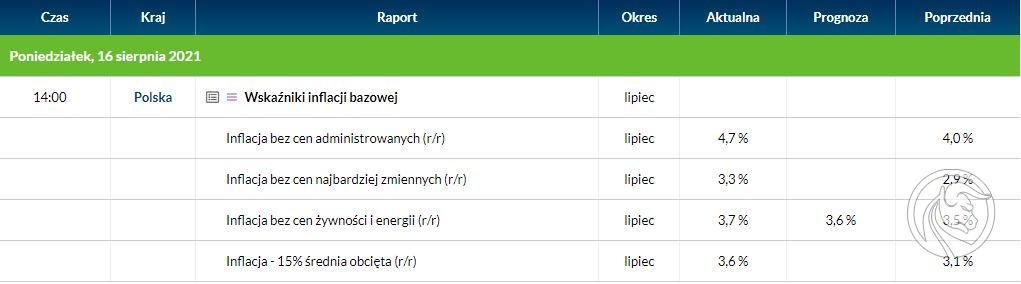

In July, net core inflation, ie excluding food and energy prices, increased to 3,7% in Poland. annually from 3,5 percent. in June, exceeding market forecasts at 3,6 percent. Other measures of inflation also increased. Inflation excluding administered prices jumped to 4,7%. from 4%, inflation excluding the most volatile prices to 3,3%. with 2,9 percent, and "15 percent. mean cutoff "to 3,6 percent. from 3,1%

Published by National Bank of Poland Inflation data had no impact on the zloty, which was quite stable compared to last week's fluctuations. At 16:00 pm the EUR / PLN exchange rate was at the level of PLN 4,5660, which is exactly the same at which the euro ended the previous week. The USD / PLN quotations increased by 0,5 grosz to PLN 3,8750, and for the Swiss franc by 1,7 grosz to PLN 4,2460. The changes in the dollar and Swiss franc exchange rates were a direct reaction to the strengthening of both currencies in the world markets, which was associated with a slight deterioration of the investment climate.

Inflation data has been ignored today, but the starting week will be marked by the publication of macroeconomic reports from Poland and they will mainly decide about the fate of the zloty. Thus, it will be such a short break before next week's Jackson Hole central bankers symposium, which will probably be the main event in August on the foreign exchange market.

On Wednesday Central Statistical Office (GUS) will publish July data on employment and wages in companies and August report on the consumer climate in Poland. A day later, the first of two important reports will arrive. Data on industrial production (forecast: 10,5% y / y) in July. On the same day, investors will find out how much producer inflation (PPI) has increased. On Friday, the second important report will be published, ie retail sales (forecast: 9% y / y), and it will be accompanied by data on construction and assembly production for July and August economic report.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)