Wall Street is at its highest level in almost 2 years. Will the Fed spoil the fun for stock market bulls today?

The boom on Wall Street is in full swing. Yesterday's session indices S & P500 i DJIA ended at their highest levels in almost two years. The only question is whether tonight the Fed will spoil the champagne mood that the stock market bulls have been in for many weeks?

Will the FED kill stock market optimism?

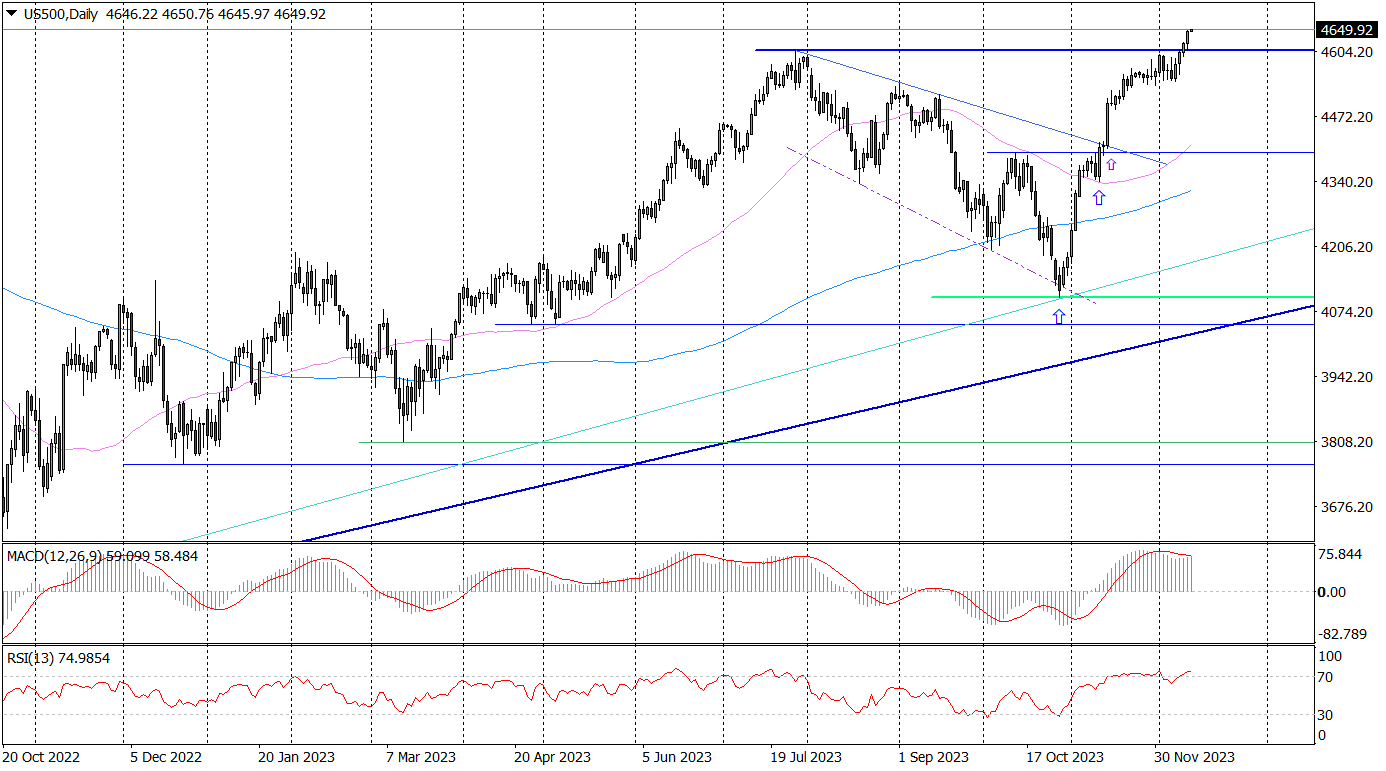

Tuesday's session in the US ended with moderate increases in indices. The DJIA increased by 0,48%, the S&P500 closed the day with an increase of 0,46%, and the technological Nasdaq Composite by 0,7%. In the case of the DJIA and S&P500 indices, it was the highest close since January 2022. Additionally, the former is only 1% short of the historical record from two years ago. Both indexes are rising for the 7th consecutive week, which is the longest such series since 2017 and additionally highlights the advantage of buyers observed on Wall in recent weeks. And not only there. An equally large dominance of bulls can be observed on many other trading floors. For example, on the Frankfurt Stock Exchange, where the DAX index increased by about 1,5% in 15 months, practically without any major correction. and set new records.

US500 daily chart (S&P 500 Index CFD). Source: Tickmill

The highlight of the day on the stock exchanges will be the ending two-day US meeting Federal Reserve (Fed). The signals coming from the Fed (and Powell) will determine whether, despite the already visible overbought situation, the growth on Wall Street will continue. But maybe there will be some significant profits realized in the coming days.

Today at 20:00 p.m. investors will learn about the Fed's decision on interest rates, the statement after the meeting will be published, as well as new macroeconomic and interest rate projections. Half an hour later, Fed Chairman Jerome Powell's press conference will begin.

US interest rates will not be changed

There is no doubt about it. This will mean that the Fed will maintain the fluctuation band for the federal funds rate at the current level of 5,25-5,50%. Hence, the markets' attention will focus on the new projections, and even more on what Powell will have to say at the press conference.

Nowadays, everyone basically asks themselves only one question. Namely, will Powell pour the proverbial bucket of cold water on the hot heads of stock market investors? Investors who are betting on quick interest rate cuts in the US and have been buying shares heavily recently, while ignoring almost all signals that contradict the scenario of quick rate cuts. Unfortunately, there is no simple answer to the above question.

When analyzing the likelihood of the Fed cooling down sentiment, it should be noted that although the risk of a downward correction on Wall Street and many other stock exchanges is growing, even if such a correction occurs, it will in no way threaten the ongoing bull market. Here, the prospect of recovery in the global economy in 2024, continuation of the disinflation process and expected reductions in interest rates will continue to constitute fuel for growth for at least a few more months.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response