Wall Street may close the week on new records

Thursday's session on Wall Street began with new historical records of the S & P500 (3346,11 points) and DJIA (29406,39 points). The technological Nasdaq Composite was also growing, but it was still a little short of yesterday's records. All three indices may end this week on new records.

And the coronavirus epidemic - someone will ask. What epidemic? What coronavirus? If anyone deserves a crown, it is ... Wall Street. After just over a week's hiatus, the local indices have returned to record highs, despite 565 deaths from coronavirus and 28,3 deaths. infected.

The market has forgotten about coronavirus?

Why was the epidemic ignored? It's easy. Greed rules on exchanges. More than the fear of an epidemic, the imagination of investors is more appealing to the decision of the Chinese authorities to halve the tariffs on US goods starting from Valentine's Day. At the same time, the same investors ignoring e.g. data about a much higher than expected decline in industrial orders in Germany in December (-8,7% y / y against forecast -6,7% and -6% in November).

Positive moods on Wall Street and hopes for further records, further fueling the expectation of the monthly data from the US labor market published on February 7th. According to market forecasts, in January the US unemployment rate will remain at 3,5 percent, and employment in the non-agricultural sector will increase by 160 thousand, after 145 thousand arrived in December new jobs.

Macroeconomic calendar. Source: macroNEXT

The expectations of some investors are, however, significantly higher, because they speak of a jump in employment outside agriculture at the level of about 200 thousand. And this is fully justified by other data. Wednesday's ADP report showed an increase in jobs in January by as much as 291, while forecasts were about 156. A similar positive surprise was in the weekly data on unemployment benefits. Their number dropped by 15 to 202 thousand, while only a drop of 2 thousand was expected Therefore, it seems that Friday's data will give an additional kick to the indexes, pushing them to the next records.

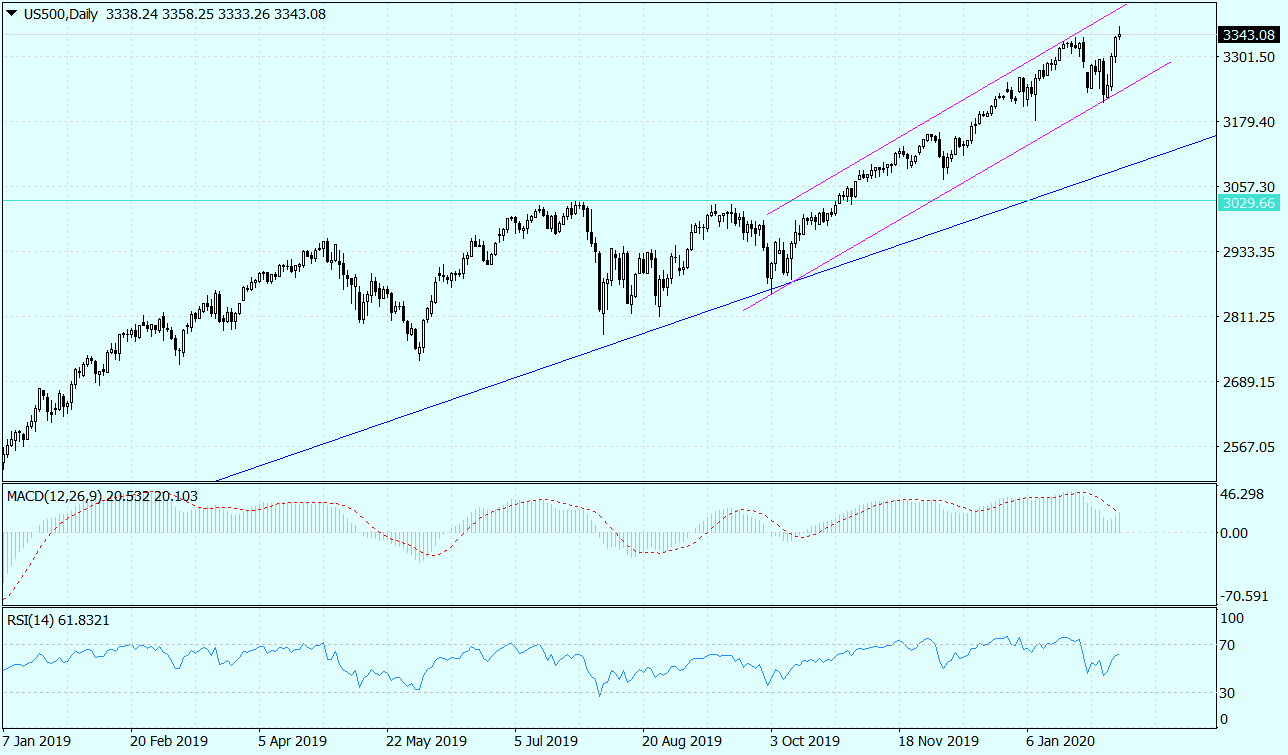

Situation on the chart US500, offered by Tickmill an instrument based on the S & P500 index, confirms a good chance for new records not only this week, but also the next ones. Even though today, after three days of gains, the demand has become a bit out of breath, the recent "coronacorect" has cooled down the indicators so much that the rate can easily rise, without fear of large overbought. What is more, this fast-off correction turned bearish again, and showed other investors that buying local lows is a good strategy.

US500 chart (CFD on the S&P 500 index), D1 interval. Source: MT4 Tickmill.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)