Currency summary of the week. What awaits us in the next sessions?

The last week was full of macroeconomic data, mainly from the US and the Euro zone. Currencies have woken up to life, starting from the periods of consolidation. We have learned the decisions of the European Central Bank regarding the possible lowering of interest rates. There were also significant readings from the industrial sector, mainly for the euro area. Weak data will surely affect the euro exchange rate. Let's look at what the next week's exchange market will look like.

The weakening euro?

About possible We wrote interest rate cuts just a few days ago. We already know the effect of the European Central Bank meeting. Any reduction will wait for us the fastest in September. We could observe the biggest drops in EUR / USD directly after the ECB conference. The market began to verify information on the need for monetary stimulation and the growing problems related to the economic slowdown in the euro area. For now, no one predicts data improvement, mainly in the PMI category of the industrial sector.

Diagram EUR / USD, D1 interval. Source: xNUMX XTB xStation

Against the background of data and decisions EBC the euro should weaken. For some time mainly on EUR / USD we observe longer consolidation and price movement between two price zones. The upper resistance is located 1,11852, and support (recently tested twice) in the vicinity of 1,11222. When viewing the graph on the 4-hour interval, nothing is expected for any increases.

A strong dollar thanks to FED

The reverse situation to the euro zone can be found in market data from the USA. This is mainly about GDP, which after publication turned out to be better than market expectations. Among the components of GDP, the highest increase was recorded in consumer spending on fixed assets (12,9%). In general, the published information is positive. Good consumption does not give too much basis for cutting interest rates. However, it appears from market reports that FED he intends to allow this in the near future. Analysts estimate the reduction by around 25-50 points.

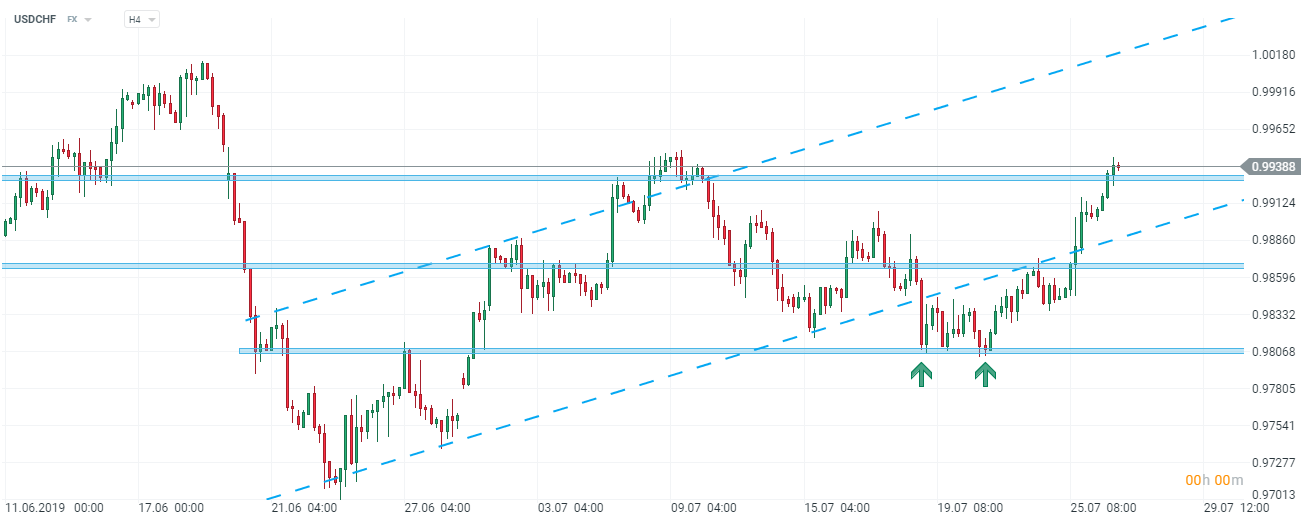

Chart USD / CHF, H4 interval. Source: xNUMX XTB xStation

The US dollar is holding very well. Rather than weakening, we can look for possible corrections after recent increases. PMI readings from the US indicate similarly to the ongoing slowdown in Europe. Therefore, where to look for the growth force driving the dollar? First of all, in Donald Trump. Recently, he has definitely ruled out intervention on the currency market. By the way, he accused the other countries of deliberately acting to weaken the USD. Wall Street is still in vain to look for pessimism. Good moods and positive results of joint stock companies bring further gains.

Uncertainty on the lyre

Before the weekend, the Turkish Central Bank surprised investors by opting for a larger than expected rate cut. For a long time, CBRT has not decided to do so despite the high inflation. Erdogan decided to influence the central bank's findings by appointing a new boss.

Chart USD / TRY, H1 interval. Source: xNUMX XTB xStation

According to Erdogan, the cuts made by the Turkish Central Bank were insufficient. Among analysts, there are voices about the rapid depreciation of the lira while further continuing the cuts. The actions of the Turkish government are to bring about a boomerang effect, which will lead to a rebound of inflation sooner or later.

A big candle on the lyre, along with the continuation of drops, probably does not bode the improvement of the situation (at least from the technical point of view). The markets are waiting for further information from CBRT. The key support for USD / TRY will be around 5,62885, where the exchange rate may stay longer or continue to decline.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)