Currency summary of the week. American mood swing at the top of G7

We have seen chaos in the markets virtually Monday. Donald Trump's desire to calm investor sentiment was not effective enough to stop bearish sentiment. During the week he was able to repair it, but the question remains as to how long and isn't it just a momentary impulse?

"China called twice"

With these words the American president Donald Trump tried to calm the panicked market. The situation of the US leader is very tense. He wants to save the US from recession and the negative effects of the trade war before the election. A clean card and good condition of the American economy are to guarantee Trump's re-election. It looks like a slight retouching of your own mistakes. The US did not expect China to bounce back the customs ball. In fact, Trump's little lie came out on Monday. China has not confirmed "Two phones"which they were supposed to make to the White House, which the President of the United States calmed down on the markets. At a local conference, Beijing announced its willingness to return to the conditions it had developed, which did not bring any response from the other party to the conflict.

What is China's plan for the next few days? In the overall assessment, they are not expected to make concessions in the negotiations. Now is a good time to use Trump's submission. To some extent, he must ensure a favorable resolution of the conflict. The motives for this are the upcoming elections. Investors keep hopes for an agreement between the two powers.

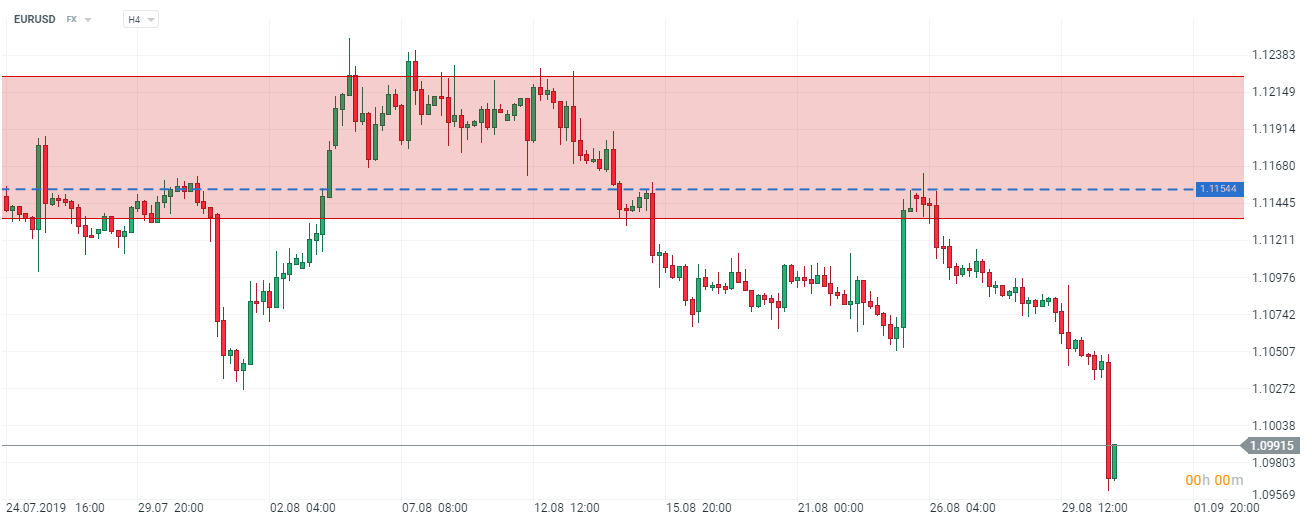

What does the dollar mean? A week ago we talked about a large supply zone, which we showed on the daily chart. This zone is marked on H4 in the graph above. Despite the uncertain start of the week and neutral reading (better than forecast, but worse than earlier reading) the dollar began to slowly strengthen against the euro. The downward sentiment on this instrument will probably not run out in the coming days.

Chart EUR / USD, H4 interval. Source: xNUMX XTB xStation

Increases in Asia are contributing to Europe

Tuesday's session definitely belonged to the most successful in Asia. The increase in risk appetite has encouraged investors to greater exposure to the Middle East. Good moods also came in Europe. Brexit remains the main topic. Lighter and more compromise Boris Johnson policy begins to lift the pound from his knees. Nevertheless, the pressure from sellers still weighs on him. Recent events related to the suspension of the parliamentary session have shown this. From September 9, the Queen accepted the request of Boris Johnson. The pound lost around 1% that day.

Chart GBP / USD, H4 interval. Source: xNUMX XTB xStation

Information on the suspension of the meeting was received by British parliamentarians as an attack. Instead, they want to avoid leaving the community without agreement at all costs. However, these uncertainties in the face of even milder Boris Johnson's policy may be so strong that we will see another black series or larger supply movements after recent increases.

Looking from a technical angle, the quotations GBP / USD we are at an important support zone. The large demand movement we've seen in 22.08 has been virtually completely negated. The 1.21451 zone is significant due to numerous tests. After a long red candle, a bullish candle formed around 1.21451. Is this rebound enough for the GBP / USD pair to continue rising?

The depreciation of the euro

The recession in Germany is in full swing and recent reports show that the Bundesbank does not currently see any need for intervention in fiscal policy. In the opinion of many analysts, the economic situation requires action on the part of the Central Bank of Germany. Recent poor readings of inflation are probably not a sufficient argument even for the Bundesbank. A decrease was recorded from 1,7% y / y to 1,4% y / y. The result was worse than forecast. For the time being, you won't expect any reaction in vain.

The main German index is not too bad. From the point of technical analysis, it is in an interesting place for players looking for long positions. Perhaps he is feeling positive after slightly escalating the conflict escalation.

DAX 30 chart, H4 interval. Source: xNUMX XTB xStation

In addition, we already know that the Bundesbank will not intervene in the case of negative interest rate mortgages. A significant reduction in the margin of German banks resulted not only in paid storage of deposits in EBCbut lower earnings from the core business. On the one hand, a negative interest rate is beneficial not only for consumers who pay back less than they borrow, but above all for banks, because this rate is higher than the one that banks have to pay for deposit storage.

In the near future, however, we should focus on further depreciation of the euro, especially against the dollar. Let us remind you that the EUR / USD exchange rate is the lowest since 2017 of the year. The leading currency of the community is doing better definitely better than the zloty or pound.

The situation on the EUR / PLN pair is definitely the most interesting. After increases since 23 in July, we are still in the growth channel. Neither fundamentally nor technically there is a trend reversal. However, we can expect a slight correction (at least in the coming days) around 4,3666.

EUR / PLN chart, H4 interval. Source: xNUMX XTB xStation

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)