Important week for the Polish currency [Market comment]

The zloty started the new week with a weakening versus the dollar, thus reacting to the strengthening of the US currency in the global markets. At the same time, it remains stable in relation to the euro. On Monday noon, the USD / PLN exchange rate was PLN 3,9494, and the EUR / PLN rate was PLN 4,5740.

USD / PLN daily chart. Source: Tickmill

Inflation higher than expected

It will be a hot week for the zloty. First of all, due to the accumulation of publications of macroeconomic data from the Polish economy. They will be the key to the performance of the Polish currency.

Today at 14:00 CET the September core inflation data were released. The market consensus was at the level of 4,1%, but after the recent jump in inflation in Poland to 5,9 percent. Y / y, an increase in core inflation in September even to 4,3% was not ruled out. from 3,9 percent in August. The data published by the Central Statistical Office speak of rising inflation, which amounted to 4,2%.

Inflation data will certainly increase expectations for a rate hike at the next meeting Monetary Policy Council (MPC), but the next releases may slightly diminish these expectations. Of course, if they turned out to be below forecasts.

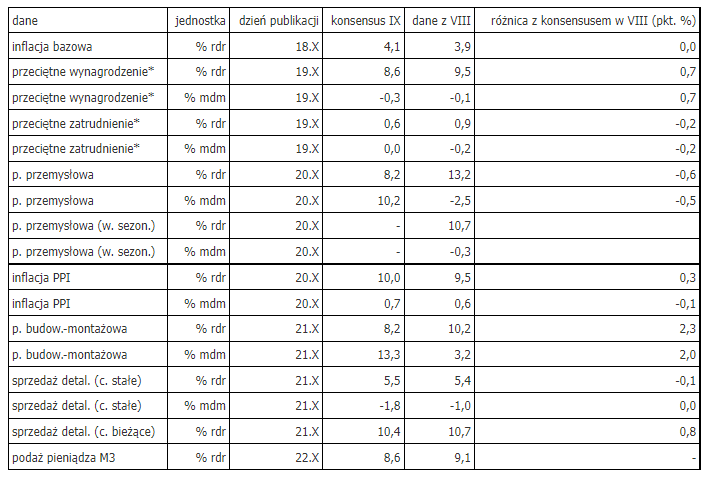

Data on wages and employment in companies will be published on Tuesday. A day later, data on industrial production, producer inflation and consumer sentiment. On Thursday, reports on retail sales and construction and assembly production will be published, as well as a very important minutes from the last MPC meeting. The week will close with the publication of reports on the economic situation and the M3 money supply.

Macroeconomic data from Poland

All these "figures" will be closely watched in the context of future MPC decisions, because after the unexpected interest rate hike in October, it is still unclear where the monetary policy in Poland is heading. Was this upward move with your feet a one-time shot, after which the Council is returning to a "wait and see" approach? But is this the beginning of the cycle? And if the beginning, will the Council chase the escaping inflation? But will the next hikes be the usual 25 basis points?

All these questions are extremely important in the context of the future behavior of the zloty. Especially if the Council was not eager to hike in November. The market is strongly focused on it, so the lack of such a move or an earlier announcement of such a decision could lead to a strong sell-off of the zloty.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Important week for the Polish currency [Market comment] Inflation, PLN 500](https://forexclub.pl/wp-content/uploads/2021/08/500PLN.jpg?v=1629128464)

![Important week for the Polish currency [Market comment] The energy crisis is hitting the market](https://forexclub.pl/wp-content/uploads/2021/10/Kryzys-energetyczny-uderza-w-rynek-102x65.jpg?v=1634546262)

![Important week for the Polish currency [Market comment] bitcoin etf](https://forexclub.pl/wp-content/uploads/2021/10/etf-bitcoin-102x65.jpg?v=1634558747)