Can 140 characters move the market? A few words about Volfefe.

Geopolitics on the international arena began to play an increasingly important role. It results, among others, from the events of the turn of April / May, where for good Trump started a trade war between his country and China. Media and analysts began to talk louder and louder about the new risk that has taken on the dimension of a global problem. I am referring to geopolitical risk, which was largely based on the trade conflict. Twitter, which the head of the White House used very often to convey the latest thoughts and information on this topic, became a new tool, "helpful" in its escalation. The impact of these 140 character messages on the market was so large that it aroused the interest of analysts JP Morgan Chase, who in September this year created an index that studies the relationship between US President's tweets and Treasury bonds.

Volfefe, what shall we read from him?

The president's tweets of the United States are very popular, which is confirmed by the number of users watching him. They are not just his voters and fans of controversial political entries. Their popularity has grown to such an extent that they have become the subject of research by well-known investment companies. So are they so important that the largest financial institutions try to find some repetition in them?

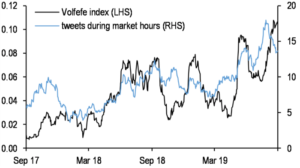

The impact of these 140 character messages on stock exchanges was dealt with by the American financial holding JP Morgan Chase & Co. In early September, it was very loud about a certain index that he introduced into the world of analysis. He created it and named it "Volfefe". The name of the index was inspired by a combination of two words - volatility and the word "covfefe" (Trump's most popular typo on Twitter in 2017).

Be sure to read: Tweet Trump trading. The United States guilty of recent declines on BTC?

According to research conducted to create the index, we know that from 2016 a year to the present, the US president publishes an average of 10 tweets per day. At first glance, this number seems quite large to us, but considering the entire Trump account in 2019 you can't say that anymore. The greatest activity of Donald Trump showed at the end of 2018 year. The impulsive increase in engagement and the increasingly "controversial" statements posted on Twitter have become the subject of research by Citigroup analysts. They showed and accurately calculated that as much as 10% of the news has a significant impact on US and strongly correlated with US global stock exchanges. Researchers identified keywords that resulted in the greatest variability. This group includes "China", "billion", "goods", "Democrats" and "great".

Bonds

It should be borne in mind that debt instruments (especially the US market) and gold or dollar are such assets that absorb capital during a period of market turmoil. The increase in risk aversion is particularly evident after the valuation (quotations) of emerging market indices. Often the flight of investors' money causes strong supply movements on indices. US President's tweets are usually visible on the market from the perspective of "scaring". Fears of his policy cause the following relationship: increase in geopolitical risk (Trump's tweet) = decrease in bond yields. Declining profitability means an increase in prices, which is beneficial for bond holders intending to sell them before maturity. Following this lead, one should bear in mind that tweets are only an element and a political tool by which formal information passes through the informal channel to the recipients. The declining bond yields are therefore the result of the president's overall term of office, while tweets, as the index shows, have additionally activated investors who are not following political activities in the US on a daily basis.

How did the profitability valuations look like and when did its biggest decrease begin? We could see a fall in US bond yields already at the end of 2018. Exactly since then, Donald Trump began to be more actively and more often involved in publications on Twitter. The largest yield drops on 2-year bonds (therefore the highest demand for them) took place in May and June. From the beginning of May to the end of June, profitability decreased from 2,307% to 1,803% respectively.

Speculation and geopolitical risk

Comparing geopolitical factors creating new risks to even macroeconomic data is quite subjective. There is absolutely no doubt that it strongly influences the shaping of market trends and sentiment. The current, most "burning" problem in the world (in the sphere of geopolitics) is the conflict of the United States with China, where the most powerful weapon acting on the stock exchanges is information. Given the nature of the speculative game on the stock exchange, it is impulsive news that causes rapid market volatility. Therefore, information is a speculative tool here. One of the rules of trading, "do not play under the data" or "do not play when something disturbing is happening on the market" is a bit ignored when we talk about geopolitics. Trump's tweets and the volatility they cause are often based on extreme emotions, which (panic / enthusiasm) are mainly used by speculators.

Summation

The very concept of geopolitical risk is still fresh now and only the interest in the subject from the analysts of the most important banks shed some light on a new area of risk created directly by the United States. There are a large number of examples where one tweet causes confusion in the markets and they can effectively influence the direction of currency appreciation. The emotionality associated with them causes that this information provides a large field for own interpretation in the context of global politics. The public availability and speed of information flow in this communicator allow for impulsive and emotional play by speculators and short-term investors who count on the chaotic use of exchange rate changes (mainly on the market of contracts for exchange rate differences). Thanks to this, the market takes on a snowball effect, where short-term demand and supply shape greater volatility. These transactions are additionally burdened with low (point) hedging orders, at the activation of which the effect of strong declines or increases increases.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)