Win Rate, or how to increase the profitability of our strategy

Win Rate, or how to increase the profitability of our strategy

Sometimes we get the impression that we already know everything about trading, our strategy is profitable, and our emotions are perfectly mastered. Of course, we wish everyone that this moment lasts as long as possible. Sometimes, however, it happens that we note a series of losses, which slowly devours our bill. Of course, there can be many reasons, from the desire to quickly "forge" and enter into absurdly large positions that our capital cannot withstand, to problems of a purely psychological nature or breaking the rules of the transaction system.

Without looking too far into the reasons for this state of affairs for the time being, we will analyze ways in which we can improve our profitability and analyze trading again.

Win Rate - what do we need to count?

Generally, if we already use a strategy for a longer time, be it on a demo account or on a real account, it is worth starting by downloading the order history. This is our database on which we will work. In order not to count everything on foot (unless this method gives us outstanding pleasure), it is worth throwing the downloaded information into the selected number editor. In excel or with use Google sheet certainly the analysis will be easier and above all faster. It is important that we first calculate the effectiveness of our strategy. So the number of positions that ended in a profit and which a loss. We can easily determine the% value of winnings and losers. It is known that the greater the number of transactions (the length of application of a given strategy, the more reliable our results will be).

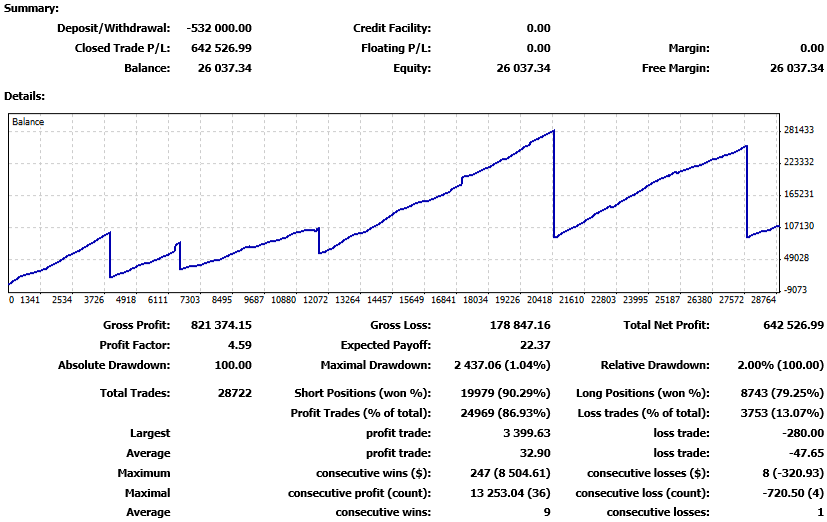

Some platforms, including MetaTrader 4/5 is able to generate account statistics based on the account history. You can read more about it in a separate article HERE.

It is extremely important that we treat our strategy unconditionally, i.e. following its guidelines in every order. The results will then be reliable. Nevertheless, every trader should set a threshold of error, which he will take into account in the event of any modernization of the trading system. Of course, I do not mean undervaluing or overstating my own calculations, but only accepting a slightly larger safety limit. With such condensed data, we also look for a series of the longest losses. It will be a good reference point, which will largely determine us the right size of the position. Thanks to finding it, we will be able to quantify how much our capital will withstand in the event of a series of failures when concluding orders of the same size.

But why do we need these results?

In general, everything we hoped for is able to tell us a lot about our trading style. It would be worth determining at this stage the level of profitability of our strategy, i.e. Win Rate. Perhaps small or unstable profits result from the wrong level stop loss and take profit. We must see the mistake that undermines the chances of profit and the effectiveness of the strategy. It is worth analyzing the results. If our effectiveness is high and profit is small, maybe we place orders to close the position too close to the price at which we conclude the transaction. However, if our profit-to-risk ratio is 4: 1 (high), and at the same time our effectiveness is small (and in addition we operate at higher intervals), we may set TP too far at the expense of efficiency and profitability of our position. Of course, giving up a reduced level of profit to risk is rewarded in profitability (and vice versa).

TOOLS TO HELP WITH RISK MANAGEMENT

As a rule, it is easier for the price to reach our stop loss than an order that is too far positioned for a certain profit. Perhaps after lowering this ratio (profit: risk) from 4: 1 to 3: 1, the price will more easily reach the assumed levels. Surely everyone is able to recall many times a situation in which the price was just a hair from TP, and then it broke down drastically or went up impulsively. Such a minor procedure could improve not only the effectiveness of entries (% winnings), but also increase the profitability of the transaction used.

How To Increase Win Rate - Less Is Better?

There is no denying that the strategy used, the duration of the position, our psyche and discipline in trade are among the many factors that affect our earnings. It is also no secret that the price will reach closer to SL levels faster than to advanced TP ones. Therefore, position profitability and greater chances to win are when these levels are actually closer.

Profitable transactions in the majority - is it really so important? - READ

Actually, this is where we enter into an in-depth exploration of our strategy, which is to set closer (or further) TP / SL levels and explore their profitability. Moreover, if we have never tested our trading system for the win rate and its dependence on the stop loss and take profit methods used, this may be the best time to do so. In this text, we are mainly inclined to consciously manage the position, knowing what scenario its conduct is the best for our strategy and psyche. It is also worth counting here whether smaller, but more frequent profits pay off more.

Capital management

Strangely, this topic is extremely friendly and pleasant to us when our strategy is unsuccessful, or when there is something wrong with it suddenly. First, she earned successfully, and now something (?) Has broken down. Usually, this reflection follows a series of losses that we more or less control. Understanding your own psychology, the best time for the position we have made, and a cool approach to profitability are just a few elements that increase our potential profits. Their understanding and adaptation to their own rules and conditions of trading can be extremely good medicine and the proverbial missing piece of the "puzzle".

Therefore, if our strategy actually begins to fail us, it is not worth looking for another one and jumping from flower to flower and analyzing just the win rate and transaction history that makes up it. Just put a little effort to discover the mistakes that began to hinder her in being effective and earning.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Day Trading or Scalping? Money Management – Mr Yogi, part 2 [VIDEO] Money Management - MrYogi. Time frames and position size risk](https://forexclub.pl/wp-content/uploads/2023/11/Money-Management-przedzialy-czasowe-v2-300x200.jpg?v=1701591046)

![Building a risk management plan - How to do it? [Guide] risk management](https://forexclub.pl/wp-content/uploads/2021/12/zarzadzanie-ryzykiem-300x200.jpg?v=1639495023)