Forex volume in October neutral. Is there a chance for improvement this year?

Mixed October volumes are largely due to September's weak turnover. From our monthly turnover analysis, a certain relationship can be deduced. After weak months in terms of volume, improvement in monthly terms is usually heralded by neutral 3-4 weeks.

Be sure to read: BIS Report - Daily Forex volume increased to $ 6,6 trillion

646,5 billion USD in a month in GMO Click

Classically for the workshop, as the first we will take GMO Click, a retail, broker giant and liquidity provider on the Japanese market. Recently, we got to know his reports on turnover on the OTC market. So far, from a very general analysis of the first publications, most suppliers and brokers provide data that can be considered very neutral. Therefore, the question arises, what are they caused by? To a large extent the September slump, which was largely due to the increase in geopolitical risk in the markets.

Returning to the analysis of the report published by GMO Click, the first information tells us about the monthly turnover, which was at the level of USD 646,5 billion. Comparing this to the September result (572,7 billion USD) we have an increase of 12,9%. Considering the annual approach, the publication is 3,5% smaller. In 2018, readings about OTC 670 billion USD turnover.

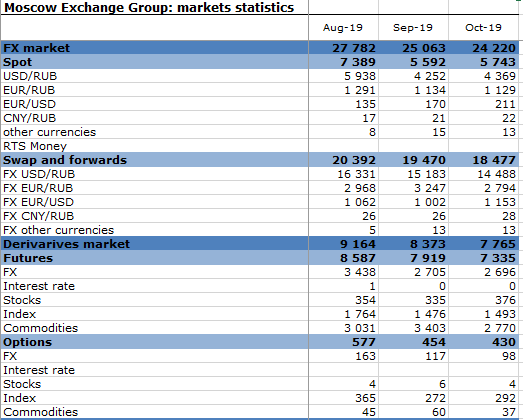

Worse results in Moscow

MOEX (Moscow stock exchange) is undoubtedly the largest institutional trading system in Russia. October was not the best month this year, and interest in currencies decreased not only in annual terms, but also in monthly terms (which is definitely a rarer phenomenon). Considering the 2018 year, MOEX reported a regression of almost 20%. In quota terms, in October this year, the Russian stock exchange could boast the result of 24,2 trillion rubles (380 billion USD), and last year 30,4 trillion rubles.

Turnover on the MOEX. Source: Moex.com

On a monthly basis, the published result is lower by approx. 4%. In September, readings showed that the turnover reached 25,1 trillion rubles. Translating the publication into an average daily trading volume (adv), it amounted to 1,053 trillion rubles, which, in terms of dollars, gives us a result of 16,4 billion USD.

Analyzing all MOEX operations, the best results were recorded at the beginning of the year. With the passage of subsequent months, there was an increasing regression regarding the generated turnover on the currency market. The increases from month to month began to slow, but gradually slow down.

Be sure to read: What is the volume on the Forex market

More activity

Kabu, a company dealing in securities trading, the currency market and broadly defined futures contracts, cannot complain about October. A considerable increase (comparing it to all previous months) appeared in the number of new bills established. The number of accounts increased by 2 107, reaching 1 133 181 accounts. The number of newly opened accounts was 2 709, which is 28 more than in the previous month. This is a satisfactory result, as reported by the group itself, on the occasion of publication.

September turned out to be a weak month in terms of valuation of assets on Kabu accounts. Therefore (as the company emphasizes) this could create a certain aversion in matters of market trading, which translated into worse results. Futures trading deserves special attention. The monthly value of futures trading increased to 3,04 trillion (((27,9 billion USD) compared to the September value of 2,33 trillion ¥. Score Kabu increased 30,1 percent last month.

Trading on the OTC market is worse. The decline is relatively small (compared to other companies with a similar profile). It's just 1,8%.

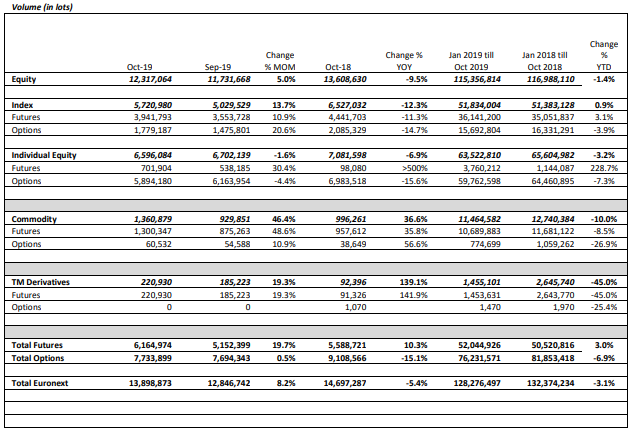

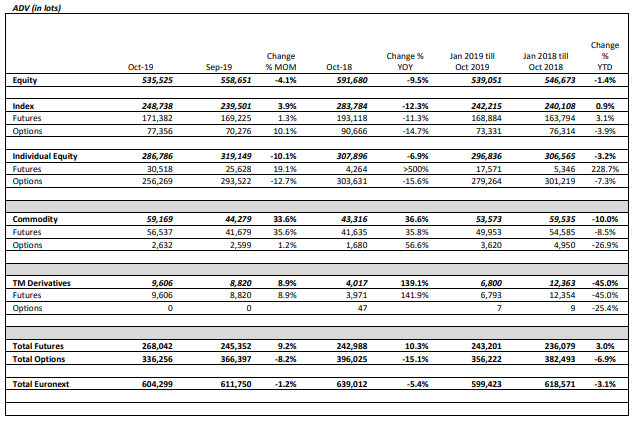

Euronext - worst since April

After a bad month of September for the Euronext group, even worse October came. Published results on average daily turnover and volume on the currency market have not been so bad since April 2019. Currency trading volumes have fallen even more, reaching 18,6 billion USD ADV.

Euronext has published information from which we can read that the total turnover was 429 billion USD. In annual terms, it deteriorated by 2,4%. The average (daily) turnover volume indicator was lower by about three percent on a monthly basis. In September it amounted to 19,1 billion USD, which was almost the same result as in annual terms.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)