Macroeconomic indicators: German ZEW Index

For many traders, information about the ZEW index is one of the most important macroeconomic indices regarding the current economic situation in the German economy. The ZEW index is based on sentiment as well opinions of specialists on the economic situation in Germany. In the article below, the index will be briefly characterized. It will explain how it is counted and what benefits you can get by regularly tracking your EXT readings.

Be sure to read: Macroeconomic indicators: Retail sales - The pulse of the economy

What is the ZEW index?

The ZEW index is often referred to as the sentiment measure. This is due to the fact that the index tries to aggregate the moods of professionals regarding the economic situation in the largest European economy. It is next I FO, one of the best known health indexes German economy. The subject of the study by the ZEW institute are expectations regarding the most important indicators: inflation rate, interest rates, stock indices, exchange rates and oil prices. The ZEW index was created by a German institute Zcenter for the European Wirtschaftsforschung w Mannheim. The index has been published since 1991.

Check it out: Germany - Capital market and investment opportunities

The process of creating the ZEW index

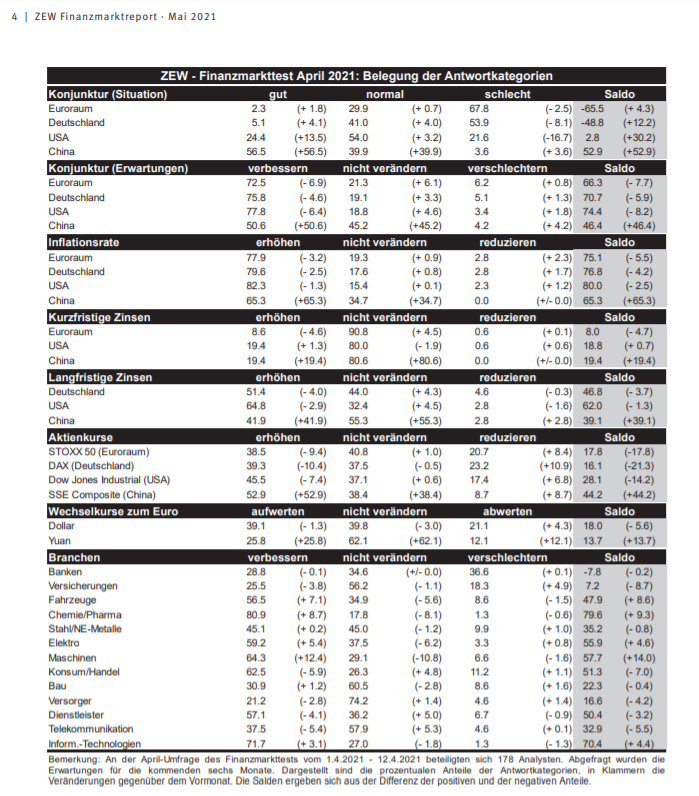

The ZEW index is created by conducting research on a group about 350 experts (including banks, insurers, financial departments or large companies). The aforementioned professionals present their forecasts regarding the medium-term economic situation and the shaping of the situation on the financial market, as well as in business over the next 6 months. The index is calculated as the difference between positive and negative opinions.

Due to the fact that the index examines the moods of professionals regarding the near future, the index can be treated as specialists' forecasts for the economic situation in the coming quarters. There is an argument among supporters of the ZEW index analysis that the economic situation "follows" the ZEW index. On the other hand, opponents argue that ZEW very rarely detects turning points in the economy and is rather an auxiliary tool in the analysis of the condition of the economy.

Publication of the index and its analysis

The ZEW index is published monthly and the publication date can be found in the economic calendar for Europe. Its basic interpretation is very simple. If the ZEW index rises, it means that the mood in the German economy is improving. Because the fact that professionals have a better knowledge of the "nuances" of economic sectors, it can be assumed that the improvement in the mood of professionals is a positive aspect for the next two quarters. On the other hand, when the index declines, a worsening of the economic situation should be expected. For this reason, the basic conclusion is simple: the higher the ZEW index, the better. In addition to the ZEW value itself, the index 'trend' (ZEW) is also important. It is especially important to correct the ZEW when it is at extremely low values. This may be a harbinger of an upturn.

However, please note that for investors, the most important thing is the reaction of financial markets to the publication of results. If good results are ignored, it is a negative signal, if negative ZEW causes a rise in prices, an improvement in market sentiment can be concluded.

History of the indicator

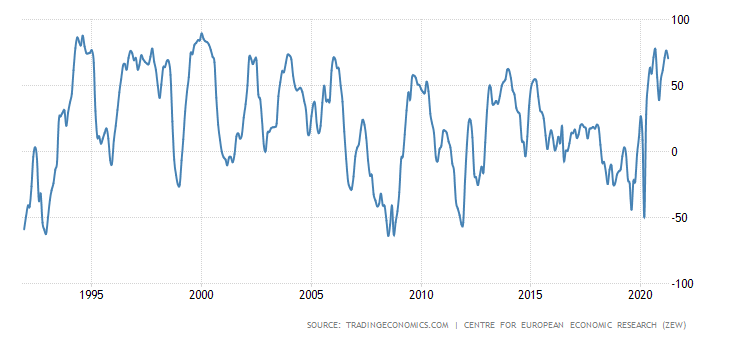

Below is a chart showing the behavior of the ZEW index over the years 1991 - 2021. As can be seen, in good times, professionals are optimistic about the future. On the other hand, in periods of strong economic downturn, the ZEW index was below -50. As a result, some investors take this indicator sometimes "Counter-trend". This is especially true of very high and low readings of the ZEW indicator.

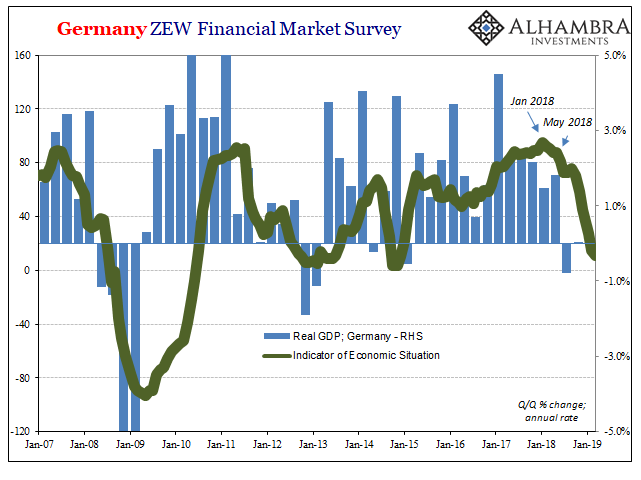

The aforementioned relationship between the ZEW and the economic situation is clearly visible in the chart below. The low readings of the index are around the trough of the economy. This is because during the peak of the downturn, professionals still have "Recessionary attitude". However, with each successive month, ZEW improves (along with the improvement in the condition of individual sectors). On the other hand, high values of the index are visible in good economic times.

Summation

The ZEW index is an interesting economic indicator that aggregates the opinions of professionals regarding the economic situation in the German economy. It is especially worth analyzing the index when the index goes to “extreme” levels. However, it is not an indicator that allows us to mark the end of the business cycle. However, it is a valuable indicator for those who analyze the economic situation of the largest European economy.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)