Suspended EU funds for Poland. The zloty is depreciating

The zloty started the new week with a weakening against the main currencies. He is burdened by reports from the Financial Times and Rzeczpospolita about the suspension of European funds for Poland.

PLN is losing value again

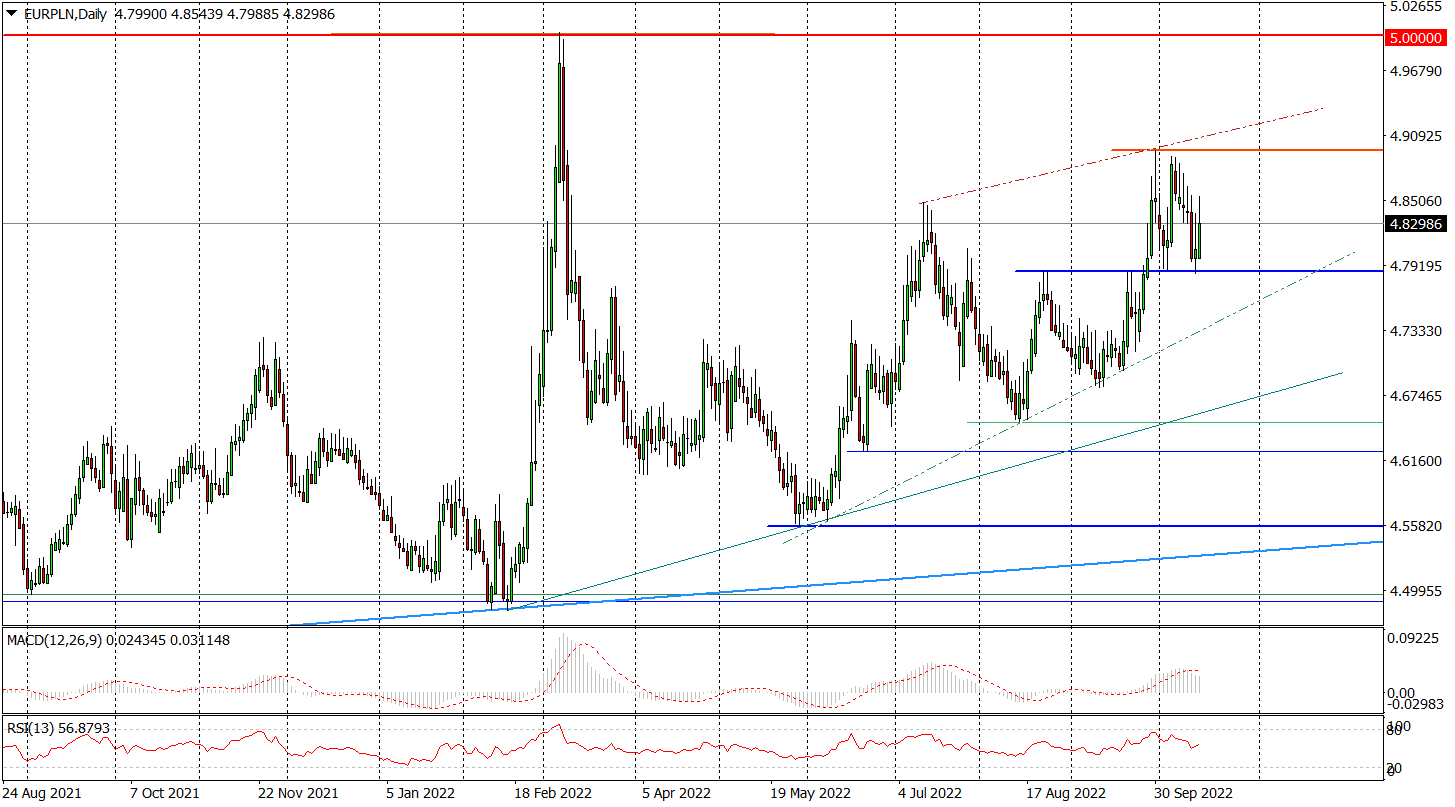

Monday morning brings the zloty depreciation to the basket of major currencies. At 09:50 the euro went up by PLN 2,7 and you had to pay PLN 4,8298, the Swiss franc went up by PLN 4,2 to PLN 4,9550, and the dollar by PLN 2 to PLN 4,9570.

EUR / PLN daily chart. Source: Tickmill

“Brussels is holding virtually all funds for Poland until we repair the judiciary. It is primarily about implementing the judgment of the Court of Justice of the EU regarding the liquidation of the Disciplinary Chamber of the Court " - wrote the Monday Rzeczpospolita.

The Financial Times informed about it a day earlier. It is not only about funds from the KPO, on which the Polish government has already set a dash by not implementing the negotiated "milestones", but also about cohesion funds.

The weakening zloty stood out negatively compared to other currencies in the region, and its behavior contrasts with the behavior of other markets, where the moods on Monday morning were much better, which would otherwise support the Polish currency. Financial markets in Europe welcomed the new week in moderately positive moods. Most European stock exchanges opened up to a slight advantage, futures contracts on US indices are trading at XNUMX% gains, which may suggest an upward rebound on Wall Street, and EUR / USD exchange rate grows slightly.

Suspended EU funds for Poland and the zloty

The suspension of the payment of European funds will weigh on the zloty. The example of the Hungarian forint is significant here. But it does not have to mean its immediate and abrupt weakening. The market can still hope that the Polish government, despite the intensification of anti-EU rhetoric in recent weeks, will fulfill its obligations and reform the judiciary. Here once again we can use the example of Hungary, which recently announced through the mouth of its finance minister, in order to save the forint, even the possibility of joining the ERM-2, i.e. taking a step towards joining the euro area.

It can be argued that the issue of funds will weigh heavily on the zloty when the general sentiment in the financial markets is bad. Then one should even take into account the EUR / PLN quotation approach of around PLN 5, and in an extremely negative scenario it is even possible to exceed this barrier.

In a situation where the moods in the markets improve, and at the same time the US dollar will weaken, this "topic" will only limit the possibility of zloty strengthening.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)