Winners: Property, Plant and Equipment and Profitable Growth - Saxo Outlook for Q2022 XNUMX

There has been an epochal shift in market sentiment over the past six months, putting financial markets and the economy in a state that few investors (with the possible exception of Warren Buffett i Charlie Munger) has ever experienced. This in itself requires humility and caution as we all sit in a speeding train that is likely to derail and make things difficult for us.

The V-shaped recovery is not going to happen this time

Unfortunately, the memory of today's investors has been shaped by the relentless boom of the last ten years, and in particular of the last five years. As a result, few investors are realistically prepared for what may happen when we have to face the consequences of a physical limit that the whole world has most likely reached. Central banks and corporations were used to a flexible and ever-growing supply function. However, the supply function in the world economy has become inelastic for justified reasons, which means that any demand impulse leads directly to inflation.

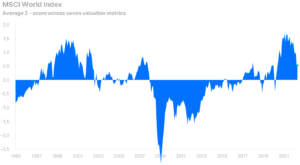

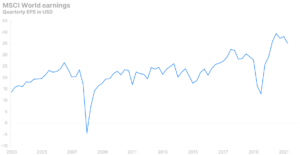

Despite the galloping energy and food crisis, galloping inflation and historic growth interest rates Worldwide, the MSCI World index was still trading above its historical average at the end of May. Taking into account the current forecasts and the level of interest rates, the valuation of shares on this index should be below average. Global companies' profits have already dropped by 10% compared to their peak in Q2021 500, and the forecasts do not look rosy. However, this does not stop analysts from giving their 18-month profit per share (EPS) estimate for the S&P XNUMX index, which is XNUMX% above earnings levels. The 12-year continuous boom, with only occasional short-term V-shaped recoveries, strengthened the 'trough' mentality and greater risk taking. Investors are just very slowly updating their views, and there is no significant shift in behavior among retail investors, which also gives the stock market more room for downturn.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

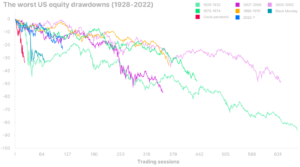

On June 16, the S&P 500 Total Return index fell by 23%, which means that the US stock market is officially slump. The big question is, where and when will we hit bottom in the current wave of downturns? Our strongest hypothesis is that the dynamics that best describe the current downturn is analogous to the downturns of the Internet bubble and energy crisis of 1973-1974, given the current commodity crisis and the bursting of the tech stock bubble. Based on today's picture of information, we assume that the S&P 500 index will correct by about 35% from its peak, and it may take 12 to 18 months to reach the bottom, which is around the end of this year or the first half of 2023. .

Revival in the energy market may cause an ESG crisis

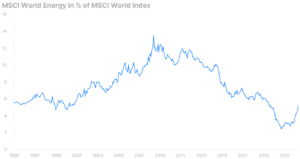

In our Q16 forecast, we said that the energy sector would provide the best expected return in the global equity market. This forecast proved to be correct. The energy sector is the only one to recover this year, fueled by soaring oil and gas prices caused by a shortage of supply, which in turn is the result of years of underinvestment. Add to this the recent liquidation of a significant part of world supply as a result of the imposition of sanctions on Russia. From the start of the year to June 500, energy stocks on the S&P 42 index rose by 500%, while the S&P 23 index itself fell 2008% over the same period. The energy sector has made its way from one of the largest sectors in the 13,5 oil price peak with a weight of 2020% to the smallest sector in October 2,4 with a weight of XNUMX% in the MSCI World index.

Since the introduction of the mRNA vaccine, there has been a spectacular return of demand which pushed oil prices to an all-time high in EUR and revealed the inflexibility of oil supply and refineries production reserves due to low investment levels. The energy sector records a strong increase in profits and market value, thanks to which the weight of this sector in May 2022 was as high as 5,2%.

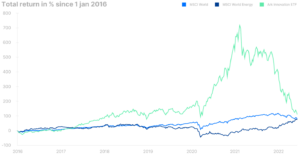

Tech stocks have benefited from ever lower interest rates since the financial crisis, an inflow of ESG funds (investing in environmental, social and governance areas) dominated by equities in this sector, and increasing margins during when energy stocks suffered from low returns on invested capital. A long stance in technology stocks and a short stance in oil and gas for 14 years have been an ideal investment strategy, reassuring investors in their logic. Examples here are the opposite results of the energy sector and Ark Innovation fund.

The situation is now turning around as the world is beginning to realize that it is still running on diesel and gasoline and that our increasing wealth is unfortunately linked to increasing carbon dioxide emissions. With every percentage point the energy sector gains relative to other sectors, ESG will come under increasing pressure on performance, and a resurgence in fossil fuels could result in a crisis of ESG funds suffering from an outflow of resources due to poor performance and a lack of exposure to natural resources in a new era of inflation.

Tangible fixed assets win

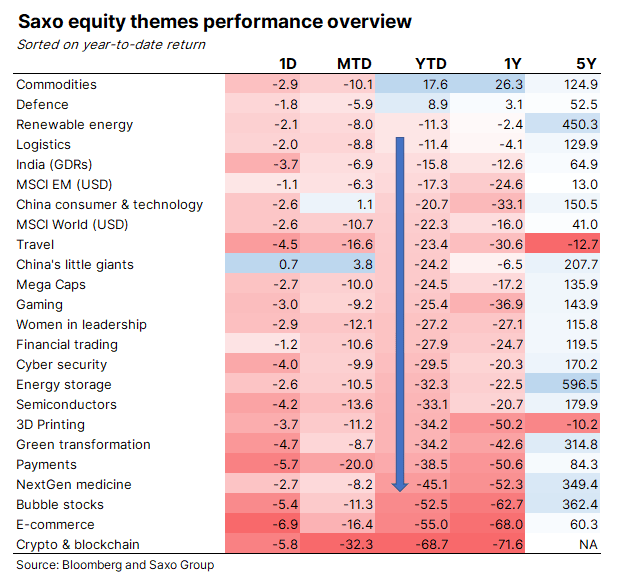

Taking into account the results of our thematic baskets on a year-to-day basis as of June 16, 2022, it is clearly visible which sectors stand out. Raw materials, the main driver of the current supply-side inflation, and defense industry stocks benefiting from the increase in military spending in Europe due to the war in Ukraine, are the only thematic baskets to record growth. The two thematic baskets with the best results of the total of losing value baskets are logistics and renewable energy.

We anticipate that these topics will continue to perform well until stocks hit bottom in the current downtrend. This year's worst-performing topics are cryptocurrencies and blockchain technology, e-commerce, bubble stocks, next-generation medicine and payments. The main conclusion is that tangible assets generally outperform intangible assets, which is a function of a higher cost of capital depressing the equity valuations of intangible assets from unreasonably high levels, as supply constraints in the physical world increase the price of physical capital goods and components.

Real estate exception

The real estate industry is the only exception to the winning property, plant and equipment rule. This is the part of the physical world that has been sucked into the rotation mode under the slogan "there is no other alternative" (TINA, there-is-no-alternative). This led to overpriced residential properties and a fall in CBRE capitalization (across all segments) as much as 5,4% in the US in the second half of 2021 from 6,4% just before the pandemic started. Low interest rates combined with limited supply in many urban areas in the United States and Europe have put real estate in a position where it has become quite sensitive to interest rate increases in the short term.

If we look at US house prices in the 70s, monitored inflation translated into a zero return on real interest rates - with purchasing power retained - which was much better than stocks, which did not keep pace with inflation during that period. In an ordinary inflationary cycle, we would be positive about real estate as a means of safeguarding purchasing power. However, if we start with very low interest rates and historically high property valuations and then combine that with a significant change in interest rates, it is difficult to make a positive outlook for the real estate sector, even though they are property, plant and equipment.

All Saxo Bank forecasts available here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response