Significant increase in FX turnover in January

Two large ECN networks today released the turnover achieved on the Forex market for January 2017. Both of them recorded a clear upward move, which is the effect of increased market volatility on the main currency pairs that we have been observing since the last 2 months. Such good results were not expected, although with the current amplitude of exchange rate fluctuations, next months should be even better. The increase in turnover is also a big advantage for traders, because it should translate into an increase in liquidity and thus narrower spreads (at least in theory).

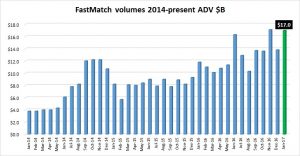

FastMatch

The turnover increased by 23% compared to December and amounted to USD 17 billion. At the same time, January 2017 turned out to be the second best month in history after November 2016 (US presidential election).

FastMatch is a joint property of FXCM and banks Credit Suisse Group and BNY Mellon Corp.

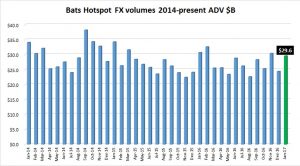

FX hotspot

The average daily value of turnover in January was 29,6 billion USD, which is about 10% more than the average volume in 2016 year, which was 27 billion USD. If in the calculation, 2 ruled out January, which was de facto a day off then the average turnover would increase by 1,7 billion USD and thus we would obtain the value 31 billion USD. Thus January would be the best month in the last 12 months.

Hotspot FX is owned by Bats Global Markets Inc, listed on the NASDAQ stock exchange.

FXSpotStream

The average daily volume increased in January month to month by 7% and amounted to USD 18,9 billion. This is clearly less than in November but at the same time it is the fifth result in the last year.

FXSpotStream is a market tool belonging to a banking syndicate. It provides liquidity from 12 of the world's largest banks such as BofA Merrill Lynch, Bank of Tokyo-Mitsubishi UFJ, BNP Paribas, Citi, Commerzbank AG, Credit Suisse, Goldman Sachs, HSBC, JP Morgan, Morgan Stanley, Standard Chartered and UBS.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)