Weekly Cryptocurrency Market Review: Unknown Territory

Based on historical and statistical data, the current bear market is arguably the worst in cryptocurrency history. Many global conditions are new to the cryptocurrency market, making cryptocurrencies move in unknown territory. In addition, BlockFi shareholders are likely to be completely diluted if the company accepts a $ 250m bailout from FTX, while depositors are likely to be fully insured.

Quotations below the existing multi-year highs

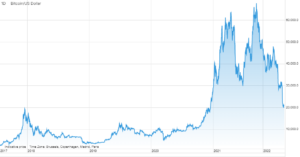

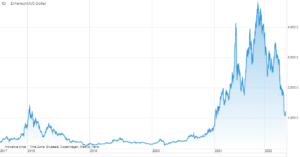

Last November, bitcoin and ethereum hit their all-time highs of $ 69 and $ 000, respectively. Shortly thereafter, the cryptocurrency market experienced fatigue, which led to a 6-month decline in prices. Currently bitcoin price is $ 21 (BTC / USD), and Ethereum $ 1 (ETH / USD), down from the low of $ 210 and $ 17 earlier this month. Note that these lows are below the multi-year highs of the infamous 550 and 880 market cycle of approximately $ 2017 and $ 2018. This is the first time that fatigue has led to lower prices than in the previous market cycle, meaning we are entering territory that doesn't have a similar history.

Mayer multiplier

According to Glassnode, the Mayer Multiple (MM) multiplier for both bitcoin and ethereum is historically low. Based on a two-hundred-day simple moving average as a long-term average, the Mayer multiplier tracks price variations above and below this level. Bitcoin recorded a lower MM (0,487) than the previous cycle's low (0,511) in 2018 for the first time. Just 84 of 4 days of bitcoin trading closed with MM below 160. The MM value for ethereum was only 0,5 recently. Taking into account all ethereum trading days, only 0,37% of them recorded an MM value below 1,4. Considering the rest of the price indicators and on-chain data, Glassnode essentially concludes that the current bear market is by far the most significant in cryptocurrency history.

From our point of view, we should be careful not to recognize too early that the situation cannot worsen any more, because the current bear market is already beating the current ones. At this point, the cryptocurrency market has conditions it has never dealt with, such as high global inflation, rising interest rates, global unrest and the likelihood of a recession on the horizon. In addition, under the influence of fatigue, particularly with regard to bullish stocks, investors have likely overestimated their overall risk appetite to an extent that cryptocurrencies have not experienced in previous cycles. More specifically, if investors continue to strive to eliminate risk, it is possible that cryptocurrencies will become an asset class that will continue to be liquidated by investors, particularly retail investors.

FTX saves BlockFi, Goldman Sachs considers buying Celsius assets

One of the largest cryptocurrency exchanges, FTX, has announced its intention to provide financial aid to BlockFi, a cryptocurrency lending company currently in distress. As with another company in this industry - Celsius, BlockFi's liquidity is reportedly insufficient to meet the company's obligations to customers. The FTX exchange offered BlockFi a loan of $ 250 million, which may prove to be enough to bring the company back on the straight. The FTX offer is structured in such a way that in the event of BlockF's insolvency, depositors will be repaid before FTX. However, the offer includes an option for FTX to take over BlockFi at "essentially zero cost", which in practice means the complete dilution of existing shareholders. Considering the company's valuation last year was $ 5 billion, many current shareholders are not satisfied with this fact, so the FTX offer has not yet been signed.

About the author

About the author

Mads Eberhardt, Cryptocurrency Market Analyst, Sax Banks. Cryptocurrency Market Analyst at Saxo Bank. He gained experience as a trader at Bitcoin Suisse AG and founder http://BetterCoins.dk (website taken over by Coinify).

Regarding Celsius, Goldman Sachs is reportedly looking to get $ 2 billion from investors to take over Celsius's assets in the event the lender goes bankrupt. An investment bank should be interested in assets at a large discount. For now, Celsius has suspended withdrawals, but there is no information about the company's forecasts.

More cryptocurrency market analysis is available here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response