High volatility is a trader's friend. Trading during the crisis

High market volatility is a speculator's friend. Using the momentum of a given move and thus being shorter in the market, it is enough to be "shorter" right. We don't necessarily need to recognize long-term trends. All you need is a sudden, decisive move, which will become a "golden shot" for us. And it all sounds beautiful in theory. But are crises really the best time to earn for traders?

For old stalkers, most of this article may be an obvious banality, but does everyone remember the crisis of 2008-09? Beginners at most from stories and memories in the media. Therefore, if this is your first big market crisis that you look at from the perspective of charts, be sure to know the potential threats that may be waiting for you.

Pyramid, grid, catching knives

Panic market reaction generates a series of benefits, but also risks. The advantage is that the chosen direction is quite stable, although short-lived. The result is definitely higher volatility than it was a moment ago. After the fact, it looks impressive and works on the imagination: "I would sell here, I would close there" and 100% collected within XNUMX hours. In practice, it is more difficult, because how many of us predicted it?

The downside from the trader's point of view is the fact that such situations occur once every few to several years, so it's hard to find them in and our experience can be modest in this field. Another issue is that each crisis can be slightly different.

Warren Buffet, observing current events, said:

"It's a knock-out. I had to live 89 years to see something like this. Investors react immediately to all bad news. "

The consequence of increased volatility in the case of instruments that are not quoted continuously 24/XNUMX (all but currencies) is frequent existence of price gaps (for currencies only on Sunday at the opening). This is the moment when we can do nothing too much. During the break in quotes a lot can happen and Stop Loss will not save us from this (we will come back to that soon).

In such situations, three simple methods are popular - piramida, grid and catching a falling knife. After all, hardly anyone predicts that the crisis will suddenly occur - which is why the sell-off reaction (in the context of oil, the stock market) is very intense and we usually find out that it was possible to play for a short time after the fact (or at least we think so) . At the same time, it also happens that the rebound after the discount is just as strong, but no one knows where the bottom is. Hence averaging entry levels and trying to catch the hole. Then the trader sets himself the task to withstand enough to wait for this rebound.

With much higher volatility necessary action is adjusting the transaction volume to it. If we do not do this, the average loss on the position to which we were just a moment ago suddenly may definitely exceed our "expectations".

Price gap, Stop Loss… and overdraft

These are the main threats facing speculators waiting for a "crisis" opportunity. Having an open position and a set Stop Loss, you should be aware that SL is not a guarantee that we will not lose more. In the event of a price gap, the position will close at the first market price, i.e. the market opening price, even if the gap is 1000 pips.

In recent days, the biggest sensation was oil, which has been discounted by more than 30% at Monday's opening. Having a long position, even with a modest lever of 1:10, which applies to this instrument in the EU, with the increased exposure, losses were certainly severe for some and could cause an overdraft. However, the salvation for retail traders are regulations that have been in force for about 2 years, which provide protection against a negative balance (or rather the lack of the need to pay it back). Of course, this medal has two sides - if our broker is a small company but has a few wealthy clients with a tendency to play "under the cork" (which of course we cannot know), then the broker's problem may become ours as well. They have experienced it Alpari UK customers after the "Black Thursday" of January 2015..

Be sure to read: Negative Balance Protection - Safety or a Shot to the Knee?

Non-EU broker and debit

What if we use the services of a broker from outside the EU with a larger lever? Well, practice shows that it shouldn't be bad, but that's also not certain. Outside the EU, practically no broker offers a guarantee against the overdraft, but ...

Swiss Dukascopy A bank that offers a leverage of 1: 200 issued an official statement after the recent events. It was reported that 80 accounts had an overdraft in the total amount of PLN 340 thousand as a result of the recent market turmoil. USD and this debit ... will be fully written off. The situation was not dramatic, because the Dukascopy Group recorded a profit of CHF 8 million only this year. It is also not new, because the same pro-client approach was used in 2015.

You also hear that an Australian broker IC Markets (currently considered one of the largest Forex retail brokers), which offers a leverage of 1: 500, approached the issue of overdrafts equally well, although requests for their redemption are considered individually. Another issue is the probability that a foreign broker from outside the EU will be able to effectively enforce such a repayment from his client, of which he is certainly aware of himself, and this can only help traders.

But of course, thinking sensibly, we cannot count on our broker to cancel every debit. Because maybe he will do it or maybe not?

Current situation

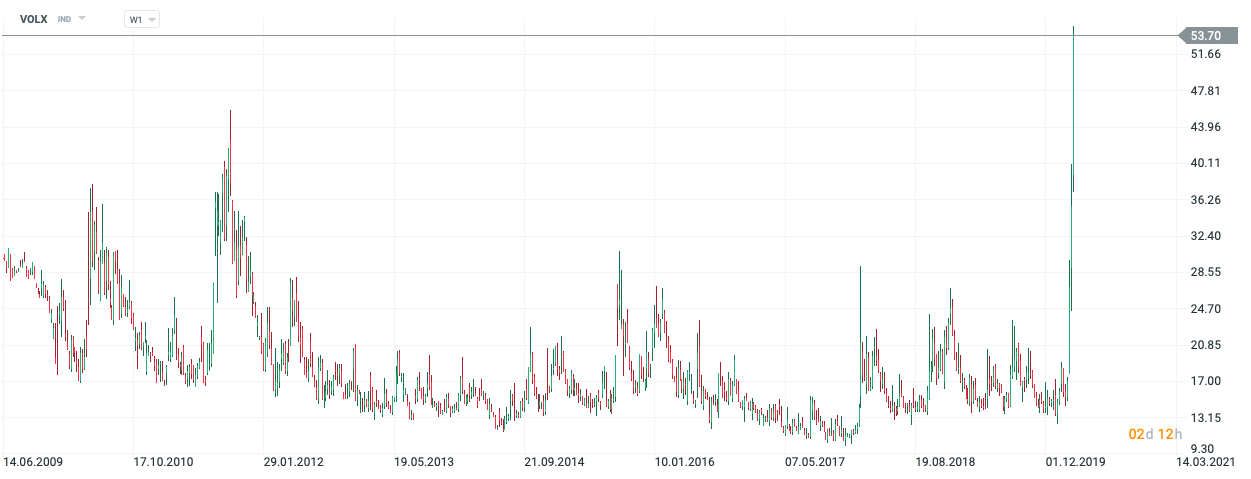

VIX, i.e. the volatility index showing investor sentiment is definitely higher than during the crisis 11 years ago. This shows the scale of market uncertainty and fear.

VIX chart, W1 interval. Source: xNUMX XTB xStation

The declines seen on the American S&P 500 are definitely more dramatic than a decade ago. Crude oil recorded the highest sell-off since 1991. The index of the 20 largest Polish companies is just reaching the bottom set in 2009. The situation is very dynamic - in the economy and in the charts. Massive sell-offs have already taken place in many markets, and many investors are wondering "should I buy now?" And unfortunately - nobody knows that, even if they think otherwise.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)