US GDP growth in Q2: Are we already in recession?

What is a recession? This question seems simple. Most investors and analysts would reply that we are dealing with a recession when the GDP dynamics is negative for two consecutive quarters. However, this is not entirely true. Therefore, even if US Q2 GDP growth is currently on a downward trend (after a negative Q1 figure of minus 1,4%), it does not necessarily mean that the US is in a technical recession.

Joe Biden's administration prepared the ground for negative US GDP growth in the second quarter. On July 24, US Treasury Secretary Janet Yellen confirmed that GDP growth in the second quarter may be disappointing. Yellen is scheduled to attend a special press conference today following the release of the GDP report. On July 21, the White House published a blog article titled “How Do Economists Determine Whether the Economy Is in a Recession? (How do economists determine if an economy is in a recession?)" which was quite an unusual move.

To begin with, let's ask ourselves an easy question: What is a recession?

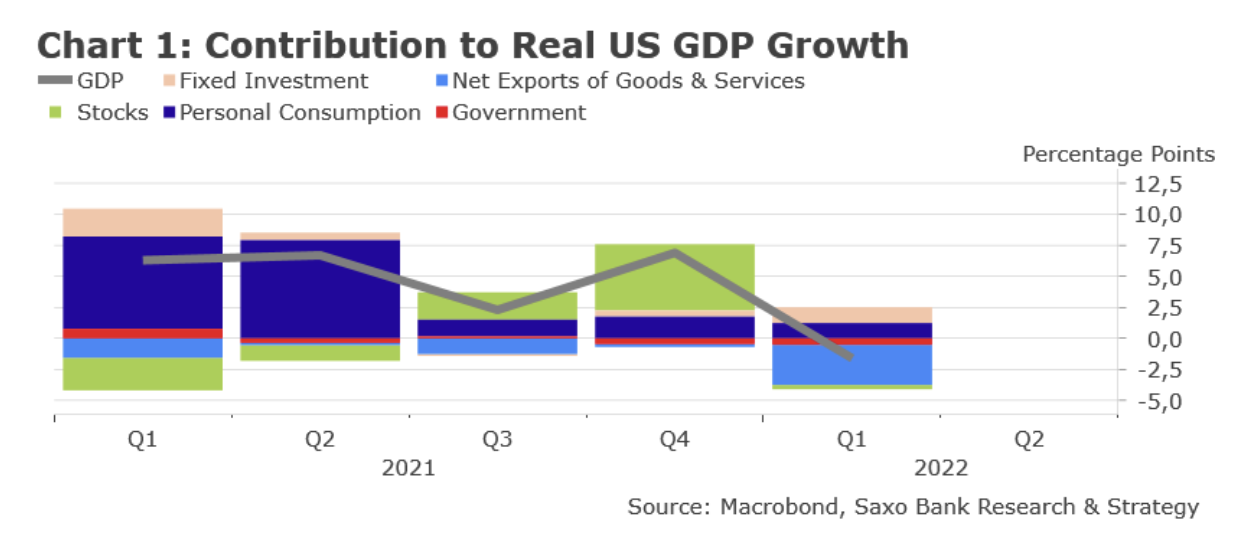

According to the common definition adopted in most countries, a recession is a state of negative GDP growth for two consecutive quarters. US GDP contracted by 1,4% in the first quarter - see diagram 1. Based on the latest statistics (including data from the housing market, which saw a 30% drop in new home sales since December 2021 and 8,1% in June alone), the risk that GDP will also contract in the second quarter becomes more and more real. This would mean that the United States is in a state of technical recession. However, it is not that simple. The official definition of a recession in the United States differs from that in other countries. The National Bureau of Economic Research (NBER) is an independent organization founded in 1920 that officially declares a state of recession. The NBER defines a recession as "A significant decline in economic activity, lasting more than a few months, visible in the entire economy". Several factors are taken into account, including: employment (based on data from work and household surveys), real consumer spending, real production and retail sales, industrial production, and real personal income (excluding government benefits such as unemployment benefits). It is surprising that the NBER does not to a large extent base its judgments on GDP. It is taken into account. However, it plays a minor role in assessing the real state of the recession. This is for a number of reasons. The GDP report is published only quarterly. It also undergoes significant revisions after the first release as data for several sectors may be distorted. This may also be the case here. Many economists believe that Q1 GDP will eventually be revised up positive (this makes sense given that gross domestic income data are estimates from an income perspective, while GDP data are estimates from a production perspective). It should be expected that the volume of domestic final demand (consumption + fixed capital formation of enterprises + housing construction) will be revised upwards. These are Saxo Bank's estimates, which we prefer due to the fact that they are correlated with future GDP growth. If this is indeed the case, the threshold of the "two consecutive negative quarters" (which is extremely important for market participants) will certainly not be exceeded.

Now let us ask ourselves a second question: Are we already in a recession?

In short: probably not, judging by the leading NBER and economists' indicators.

This does not mean, however, that the United States will exit this cycle without going through a recession or mini-recession (the so-called recessionette - a term coined by the American economist Diane Swonk to describe the desired contraction of GDP growth, which lowers inflation). This will depend on several factors that we cannot fully assess at the moment, such as the pace of monetary policy tightening and its impact on the entire economy, or the impact of the ongoing situation in China on the world economy. There are still many uncertainties that make it difficult to forecast the pace of economic development in the near future.

However, based on the indicators that the NBER pays most attention to (see list below), we can all agree that the United States is certainly not in a recession right now. All of these indicators have either continued to rise or have flattened. However, there was no significant decrease. If we look at real-time indicators (NBER indicators are mostly backward-oriented), the economy still looks good, although growth is slowing down. The condition of the labor market in particular does not reflect the state of the economy in recession. In June, the United States restored 98% of jobs lost in the pandemic (all private sector jobs lost at the start of the outbreak have been restored). In 2022, unemployment remains historically low. The number of applications for unemployment benefits has slightly increased. However, this can partly be explained by seasonal volatility. The number of new jobs decreased slightly. However, it still remains high. There are, of course, cracks in the foundations of economic recovery. Nobody can deny it. The data is also largely distorted due to the pandemic, making economic performance more difficult than usual to read. In our opinion, however, there are no signs of a recession. Therefore, we believe that we should avoid over-interpreting the data presented at the moment. They are volatile and are largely subject to corrections.

About the Author

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank. He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to the report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank. He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to the report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response