The rise in US bond yields weakened the commodity market

Commodity prices plunged in a week, which was largely driven by another rise in US bond yields along the curve. Investors were again forced to overestimate the level of pain the US Federal Reserve is willing to inflict on the market by raising rates to contain inflation. Natural gas, cotton and coffee recorded the largest decreases.

FED and pain levels

Commodity prices plunged in a week which was largely driven by another rise in US bond yields along the curve; as a result, the ten-year US bond yield reached 4,33%, the highest level since 2007. This change was due to the fact that investors were again forced to overestimate the level of pain the US Federal Reserve is willing to inflict on the market by raising rates to contain inflation.

While the dollar has remained broadly unchanged, the Japanese yen has depreciated, exceeding the closely watched level of 150 yen per dollar as a result of the widening gap between rising US bond yields and those imposed by Bank of Japan Japanese government bond yields of 0,25%. The aforementioned increase in the yields of US securities was followed by aggressive comments from Fed representatives, which caused the market to now price in the reference rate peak at the beginning of 2023, amounting to 5%, i.e. 1,75% higher than today.

As can be seen in the table below, losses in the commodity market were common and all sectors were affected. The Bloomberg commodity index, which monitors a basket of key commodities split in equal proportions into energy, metals and agricultural products, fell 2,5%, approaching the March low. It was mainly due to natural gas which, despite a decline of more than 40% since August, continues to increase by more than 50% year-on-day, resulting in an excessively high index weight of 12,6% compared to a target weight of 8%. .

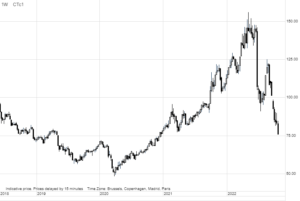

Gas prices in Europe and the United States show strong falls on a weekly basis

US natural gas futures saw their longest streak of weekly declines since 1991 as pre-winter inventories grew faster than predicted. The November contract with the earliest expiry fell by more than 20% on a weekly basis, and overall lost more than 45% of its value compared to its August peak due to mild fall weather and increased production. In addition, the explosion at the Freeport LNG export terminal on June 8 reduced exports, which translated into an unusually strong increase in inventories. Total inventories rose to 3 billion cubic feet, just 342% below the five-year average, compared to 5% in April.

In Europe, the price of the Dutch benchmark TTF gas contract continued its week-long decline and at some point came close to EUR 100 / MWh - a level that we did not take into account until the outlook for winter demand was clarified in January. There are many reasons for the spot price to fall by more than half since September - the most obvious of these is that the price should never have exceeded 300 EUR / MWh, as during the six months of pain for European consumers and industry, no shortages have ever been observed. Other reasons for the fall in gas prices are as follows:

- The gas storage facilities are almost full.

- A gentle start to autumn combined with a reduction in consumer and industrial demand.

- LNG carriers lining up for unloading in the current oversupply market, which in the short term may cause an even greater drop in prices.

- Russia's Gazprom's ability to cause chaos in the market has been significantly reduced - only two pipelines are currently in operation.

- EU leaders agreed to support further work on introducing a price cap to tackle the energy crisis.

The greatest risk to a successful transition through the coming winter is when consumers rest on their laurels and cease to constrain demand in the face of lower prices.

Crude oil remains within the range; emphasis on profits and low stocks of distillates

Market oil remains neutral and numerous supply and demand uncertainties keep prices within a relatively narrow range. The slight weakening seen last week is once again linked to the risk of a recession as US interest rates continue to rise rapidly. However, crude oil and related fuel products are still backed by the risk of further limited supply in the coming months due to the fact that OPEC + is reducing supplies and the EU is imposing sanctions on Russian oil.

The constrained supply is clearly visible in the shape of the forward curve, where a high deportation in the oil market continues to indicate solid demand for barrels that can be delivered immediately. An example of this is the $ 5,3 / barrel difference between the December 2022 and March 2023 contracts, now the largest in almost two months. The main factor in this regard remains the product market in the Northern Hemisphere, where the scarcity of diesel and heating oil still gives cause for concern.

This situation has worsened as a result of OPEC +'s decision to cut production from next month. While the continued release of US (light sweet) oil from strategic reserves will support gasoline production, production cuts OPEC + they will mainly include Saudi Arabia, Kuwait and the United Arab Emirates, i.e. medium / heavy oil producers, from which the most distillates are produced.

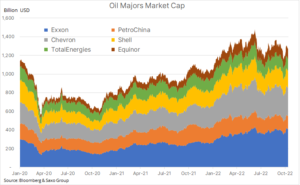

This week's focus will be on quarterly earnings reports from the five largest oil and gas companies in the Western world with a combined market capitalization of more than $ 1 trillion. On Thursday, Shell and TotalEnergies and the Chinese PetroChina will present their results, while on Friday - Exxon, Chevron and Equinor. The market awaits the companies' demand forecasts and the information whether the growing political pressure on spending on new supplies will translate into an improvement in investment appetite.

Gold sticks to support despite another jump in US bond yields

Gold fell on a weekly basis in response to the aforementioned surge in US bond yields and an upward revision in market expectations for the Fed funds rate before the Federal Reserve deems rates high enough to bring inflation under control. While rising yields will continue to generate numerous problems for precious metals, the reason why gold has so far managed to stay at support levels ($ 1, September low and a 617% retraction from the 50-2018 rally line) is most likely an exceptionally complicated geopolitical situation.

These fears - favorable to gold - did not, however, prevent a further exodus from gold-backed funds that had picked up pace last week. With the dollar being the prime safe haven, some investors have started to find value on the short end of the US yield curve, where two-year bonds now offer yields around 4,6%.

Looking ahead, we see no reason to change our long-term constructive view of gold, with the support potentially running the risk of a political error that could dampen US economic growth as well as lower the dollar and bond yields. In addition, we are concerned that long-term inflation may turn out to be higher than currently priced in by the market. Failure to bring long-term inflation down to market expectations may result in a significant and favorable shift for gold between (rising) above break-even rates and (falling) real yields. For now - until we get more data on the timing of the change in US interest rate expectations - the precious metals market is likely to remain on the defensive.

Cotton and coffee price drops: Consumers tighten their belts

In addition to falling prices natural gas on the Bloomberg energy commodity index, the sector of "soft" commodities, headed by cotton and coffee, also recorded losses, the prices of which depend on rational purchases made by consumers around the world. Cotton, which has fallen 42% since May, is struggling with a demand problem: in the United States, one of its most important suppliers, export demand has fallen sharply compared to the same period last year, especially from key Asian buyers. Adidas and other apparel manufacturers saw a rise in inventories due to lower consumer demand in major Western markets.

The same phenomena also have an increasing impact on the price of coffee, which has so far managed to survive most of the problems associated with the economic slowdown in conditions of very limited supply. However, last week's price of Arabica coffee fell to its lowest level in 13 months as a result of weaker demand amid lower concerns about the forecast supply in Brazil, the world's largest exporter of this product.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

More analyzes of commodity markets are available here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response