Increase in profitability is a short-term threat to the bull market in commodity markets

Raw materials continue to enjoy particular interest and demand. After nearly a decade of sideline or drops, there has been a strong rally in which individual raw materials have reached long-term highs. Over the past ten years, individual raw materials have gained in value, but in recent months this process has clearly become in sync with all three sectors: energy, metals i agricultural products.

However, after last week's US bond yields surge, the sector's recent success in attracting record speculative buy deals could in the short term - and despite sound fundamentals - force a correction or, at best, a consolidation period. In this article, we discuss in detail the causes of the bull market and the significance of changes in profitability.

Another supercycle coming?

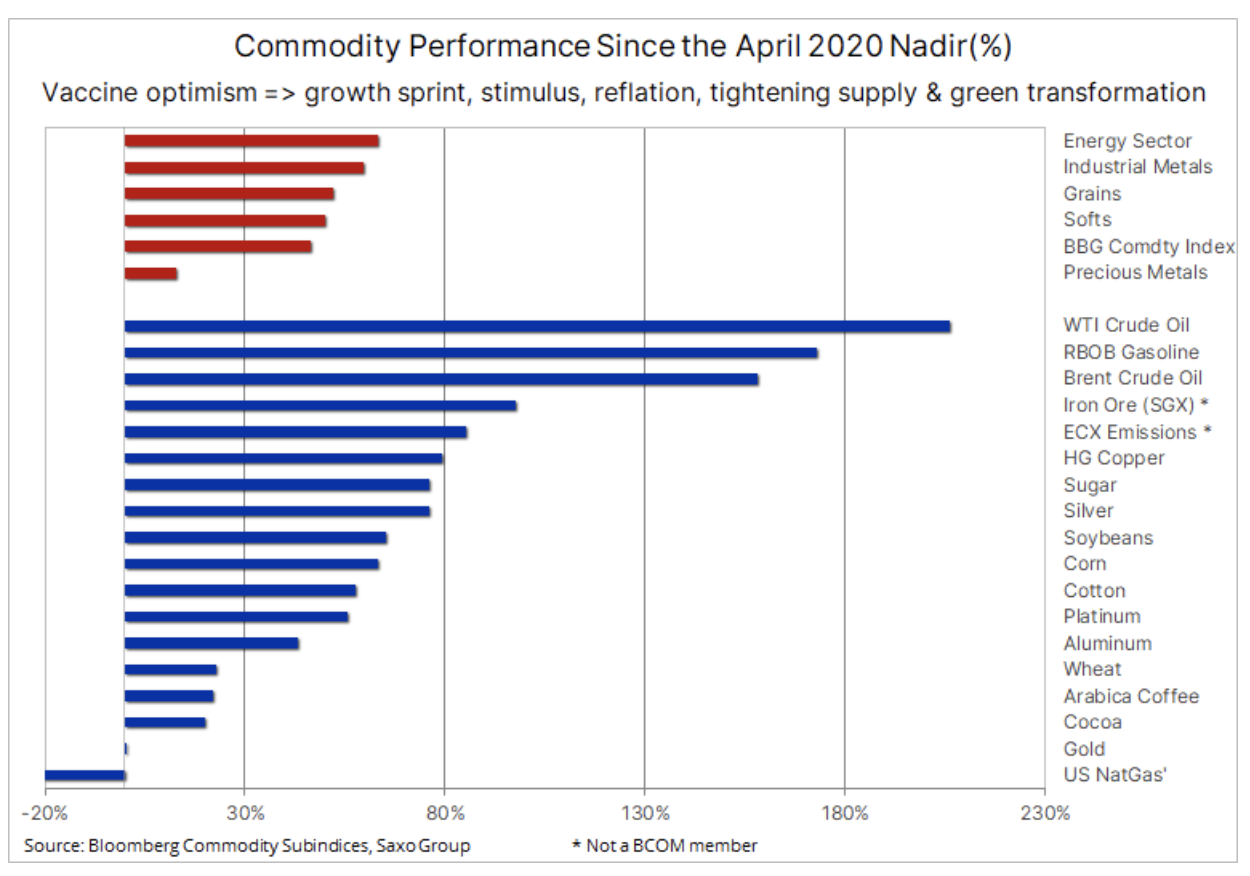

The rise in commodity prices is the result of a number of factors, but the expectations of dynamic post-pandemic growth are particularly important in this regard, thanks to significant fiscal stimuli that will increase the demand for hedging inflation and for green transition assets. At the same time, after years of insufficient investment, the supply of a number of key raw materials is shrinking. These phenomena increasingly contribute to the perception that a new era has begun for commodity markets and, in the future, perhaps another supercycle.

The supercycle is characterized by longer periods of disproportion between rapidly growing demand and inelastic supply. Correcting this imbalance between supply and demand takes time due to the high initial level of investment expenditure for new ventures, and the need to organize new supply. For example, in the context of copper, the time from decision to production can be ten years. Such long periods often cause companies to delay making investment decisions in anticipation of rising prices, when it is usually too late to avoid further increases.

Earlier demand supercycles included pre-World War II rearmament and the reform of the Chinese economy, which accelerated after China joined the World Trade Organization in 2001. By the time of the 2008 global financial crisis, Bloomberg's overall commodity return index rose 215% . Supercycles can also be of a supply nature - the last one concerned the OPEC oil embargo in the 70s.

The next commodity supercycle is projected to be driven not only by rising demand, but also by an increased risk of inflation as investors need real assets such as commodities to hedge portfolios after years of disappointing returns. Moreover, after a decade of prioritizing technology investments over hard assets, there is a lack of new supply lines.

Although the information on the vaccine from early November, combined with Joe Biden's victory in the US presidential race, helped support the sector, the current boom has been going on for almost ten months (see chart above). It started in April last year at the height of the first wave of the Covid-19 pandemic as a result of supply constraints by manufacturers while China deployed an extensive fiscal stimulus program to boost the economy.

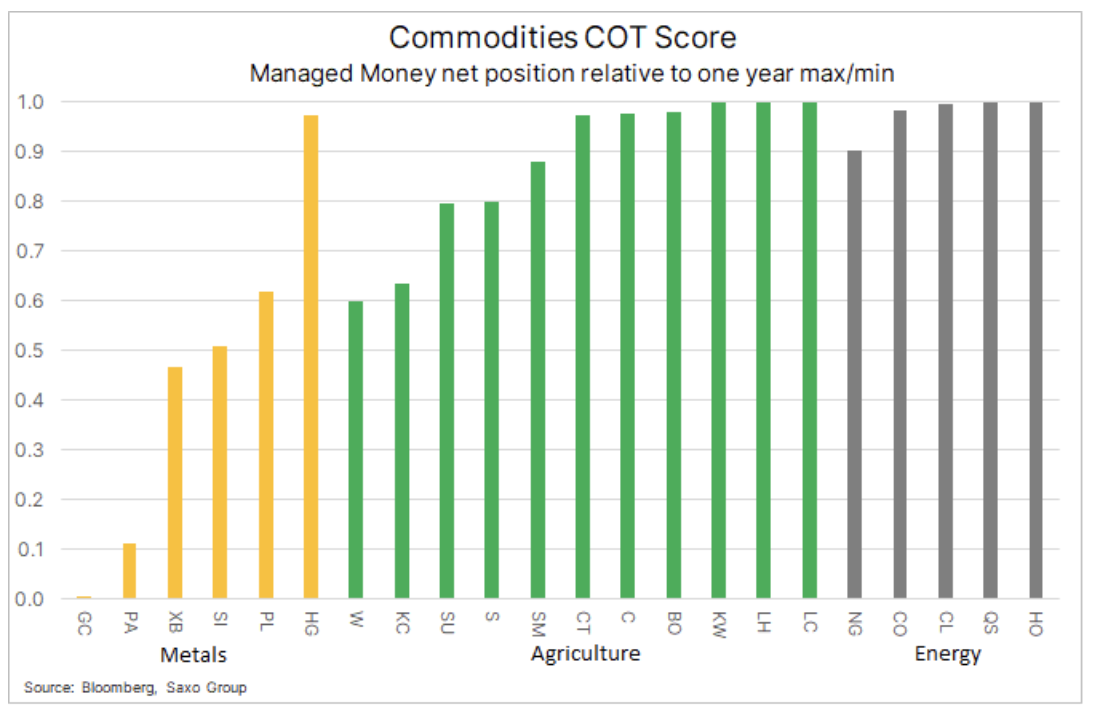

Fund positions in key commodities in relation to the annual minimum and maximum, showing the scale of growth of long positions in recent months. This is especially true for agricultural products and energy.

The strong momentum in commodity markets in recent months, combined with signs of a contraction in supply, has fueled buying deals from speculative investors, some of whom are looking to hedge against inflation while others have simply joined in on the wave of rising momentum. While physical demand and limited supply appear to be favorable for prices in the coming months, if not years, the short-term outlook may be more challenging as "paper" investments are exposed to the effects of a decline in risk appetite as a result of the recent rise in bond yields. especially real profitability.

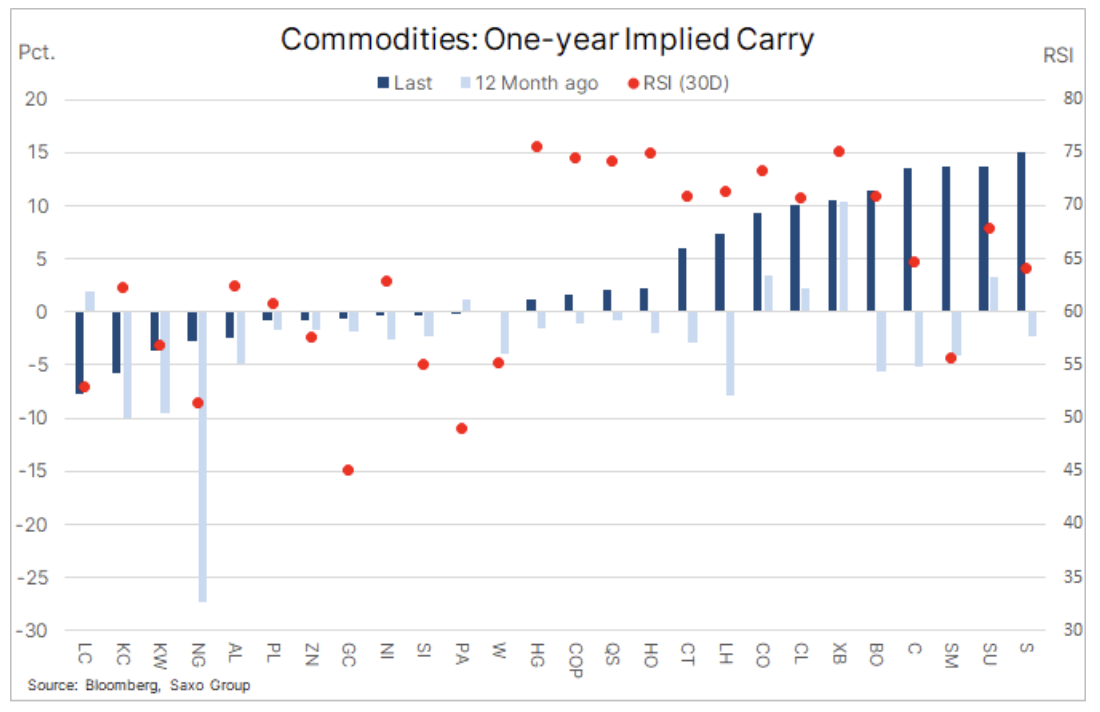

Shrinking supply for a number of commodities has made holding gains positive for a basket of 26 commodities for the first time in seven years, a development that is critical and has increased the appetite for investment by long-term investors. passive exposure to raw materials.

While the bulk of this increase is due to heightened inflation expectations via higher break-even yields, rising bond yields need not be a problem. However, in recent weeks an increase in nominal bond yields has resulted in a faster rise in real yields. This phenomenon is worrying for the stock exchange because the valuation of many so-called bubble stocks showing strong momentum with zero returns suddenly seem unreliable.

Risk mitigation as a result of falling stock prices and increased volatility can trigger consolidation across the commodity sector: extreme caution is advised during this period. We are confident that inflation will eventually pick up more than anticipated, stabilizing and possibly even lowering real yields further. However, given that many commodity positions are showing elevated levels and relative strength indicators suggest that there is an overabundance of buying deals in the markets, the possibility of correction or, at best, consolidation is likely to prove beneficial in the medium term.

Gold

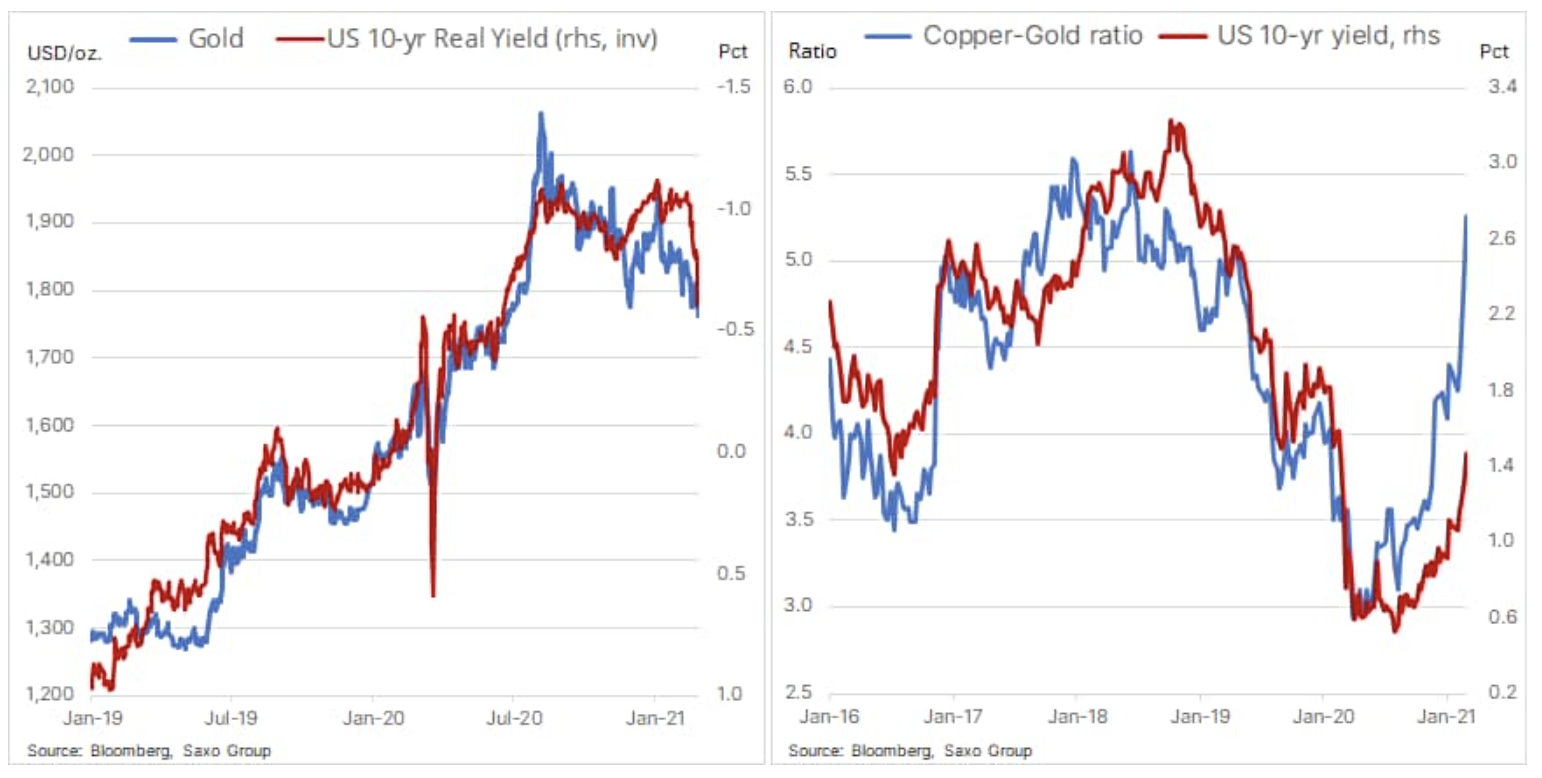

Finally, comment on gold, one of the commodities that has suffered the most in recent weeks, but which may also prove to be one of the first beneficiaries of the recent rise in bond yields. In the analyzes and comments we emphasized the risk that gold may record losses until bond yields rise to levels that could force a reaction from the US Federal Reserve by implementing measures to prevent further increases in the yield on bonds with longer maturities.

Over the last few months, gold has gone down, although real yields have remained around -1%. However, this changed last week: 0,55-year real yields jumped to -1% at one point, with gold not experiencing a similarly dramatic decline. As a result, the yields and the price of gold returned to equilibrium. In the short term, gold is exposed to the risk of a deep correction should it fail to stay above the key support level of around $ 760 / oz.

The ratio of copper to gold compared to the nominal US ten-year yields clearly highlights the recent disproportion between copper prices, suggesting a return to growth, and still low bond yields. Under normal circumstances, both of these indicators would be at a similar level. Currently, however, the circumstances are not ordinary, and given the risk of Fed intervention to contain further profitability increases, both figures could be significantly realigned. This would primarily be a consequence of higher gold prices, as real yields would drop sharply as inflation expectations continue to rise.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response