Very good QXNUMX XTB - results strongly up

XTB, i.e. Dom Maklerski X-Trade Brokers SA published the report for the third quarter of this year. The information contained therein should exceptionally strongly please shareholders. Both the results for the last three months and from the beginning of the year, cumulatively, are much better in relation to data in the same period last year.

Net profit up by ... 640%

XTB recorded over PLN 73 million in revenues in the third quarter compared to PLN 43 million in the previous year. This gives an increase of as much as 70%. The data for operating profit (EBIT) looks even better. The company can boast a profit in excess of PLN 38 million compared to only PLN 8,4 million in 2016. This is a spectacular jump by 350%. Looking at the net profit, we can see an increase of 640% - this year it amounted to PLN 31,3 million, and a year earlier only PLN 4,2 million.

Interestingly, revenues for the last 9 months from the Polish market are only 24,5% of the total compared to Spain, where this share is 20,3%, showing how important it has become for the XTB market.

Is Forex's interest growing again?

We can read from the report that the increase was also recorded in the number of newly opened accounts. Thus, XTB can boast today 188 380 investment accounts in its database (data concern the entire Group), although the active accounts were on average approx. 20 500 (increase by 21%). The turnover made by customers is also impressive - up to 523 769 flights (increase by less than 12%).

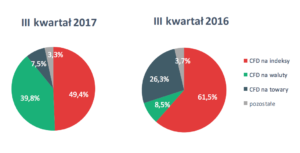

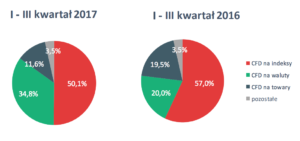

There is a growing interest in currencies, which was undoubtedly helped by increased volatility. The share of goods decreased. However, despite the significant decrease, the traders on which XTB traders are most often and most actively trading are stock market indices.

Share of instrument classes. III quarter 2016 vs 2017

Share of instrument classes. I-III kw. 2016 vs 2017

Shares after record lows

In May 2016, XTB made its debut on the WSE. Since then, the rate has only seen declines. Last week, historical lows were broken and the rate reached PLN 4,66 (the debut was PLN 11,55). However, the publication of the quarterly report gave a strong wind in the sails and now the rate is rising by less than 10% per day. It is also a big injection of optimism for investors and a chance to change the trend. The only unfavorable factor that may disrupt XTB's winning streak are the unknown "regulatory news" that ESMA plans to introduce at the beginning of next year (read: The EU dictates the conditions - ESMA updates the Q&A regarding the MIFID II directive).

For 2 years, the Forex industry has been going through harder times - a number of new regulations, restrictions, low volatility, as well as a bull market on the stock market (investors have become more interested in the WSE) are just a few reasons that have suffered brokers. As a result of changes and uninteresting prospects, several key players on the Polish market withdrew for good from the FX business (HFT Brokers, DM BZ WBK and PKO BP).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-300x200.jpg?v=1708677291)