How the ecosystem around electric cars is developing

More and more people are switching from a combustion engine car to an electric one. As it is difficult to predict which electric vehicle manufacturer will ultimately become the industry leader, investors betting on the future of electric vehicles should consider exposure to the growing ecosystem of charging station networks and battery recycling. In this analysis, we discuss listed companies operating in two industries that will record dynamic growth in the next decade: the development of a network of charging stations for electric vehicles and battery recycling.

The rapid development of the electric vehicle charging industry ensures positive profitability

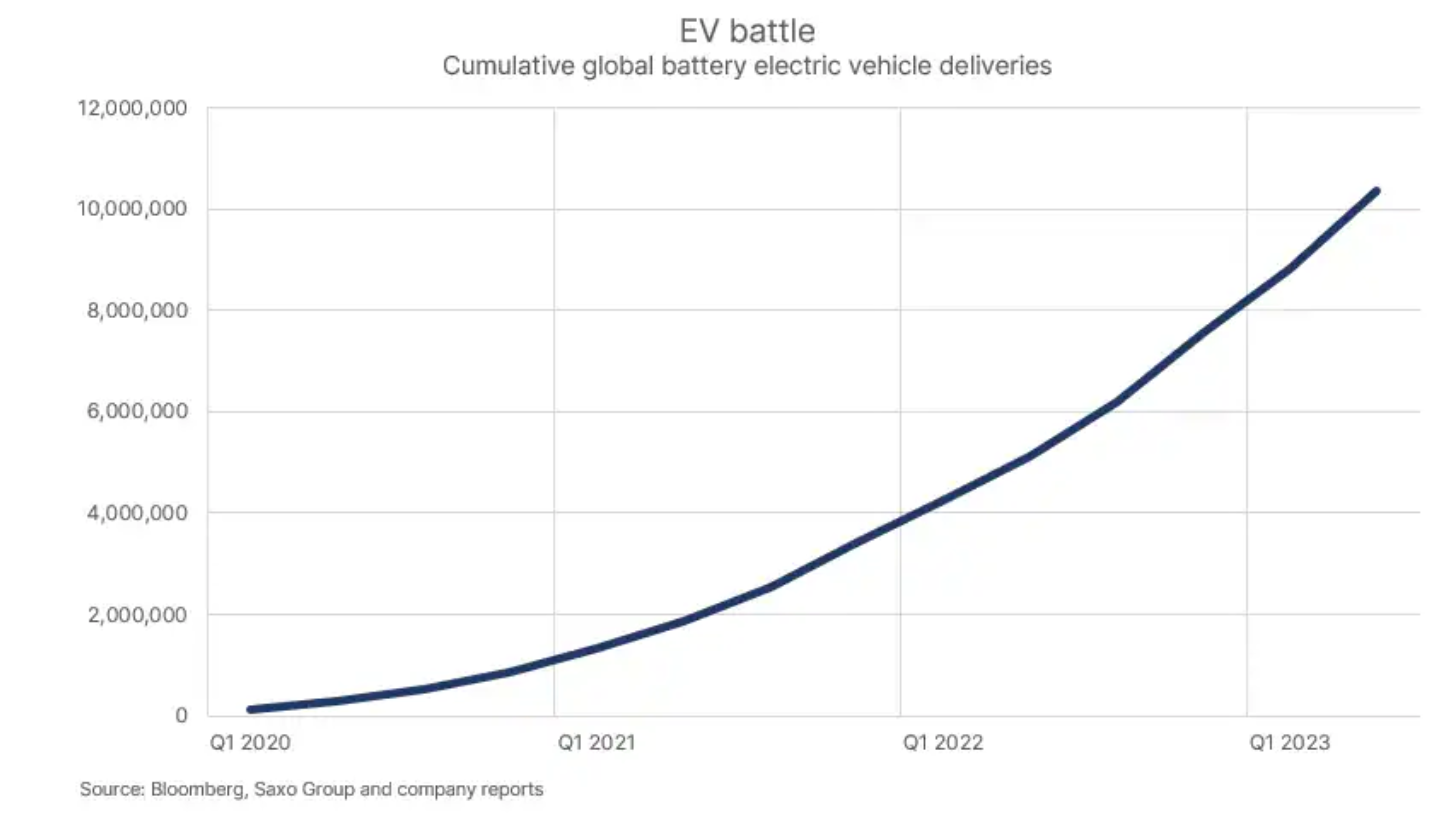

We recently mentioned that in the global electric vehicle (EV) industry, the total number of electric cars delivered has exceeded 10 million, and since Q2020 XNUMX, the industry is booming as consumers in the US, Europe and China embrace this new technology . Although it is difficult to predict which electric vehicle manufacturer will dominate the industry in the long term - many are now betting on Tesla - it is certain that the number of users will increase, and thus the demand for raw materials necessary for the production of electric cars and for the elements of the ecosystem that supports them. This means that in relation to raw materials, we are constructive towards industrial metals such as nickel, lithium and copper, and in the context of the electric vehicle ecosystem - towards the network of electric car charging stations and battery recycling.

We recently saw the perceived value of a network of electric vehicle charging stations when automakers such as GM and Ford implemented the charging model developed by Tesla. These decisions could be wrongly considered as sealing the fate of other networks of charging stations for electric vehicles, but we observe something else on the market. Rather, it seems that while the industry is moving towards a single standard, there will be multiple providers in the electric vehicle charging station network industry. We believe that the capital requirements for electric car charging stations are quite restrictive, and with the increase in competition and the development of other charging station networks Tesla will slowly reduce its investment outlays on these stations.

The reason electric car charging station networks are so interesting is that in the future they will become the equivalent of "oil pipelines" in the electrification process and will generate attractive returns on investment because - like pipelines and railways - charging stations do not will be placed in close proximity to each other. It also means that economies of scale will increase over time, and we predict that in the distant future, a small number of electric vehicle charging companies will control the entire market. Already today, many entities in the electric car charging industry are either already profitable or close to profitability. This is another interesting feature of this segment. This industry is growing rapidly, ensuring positive profitability.

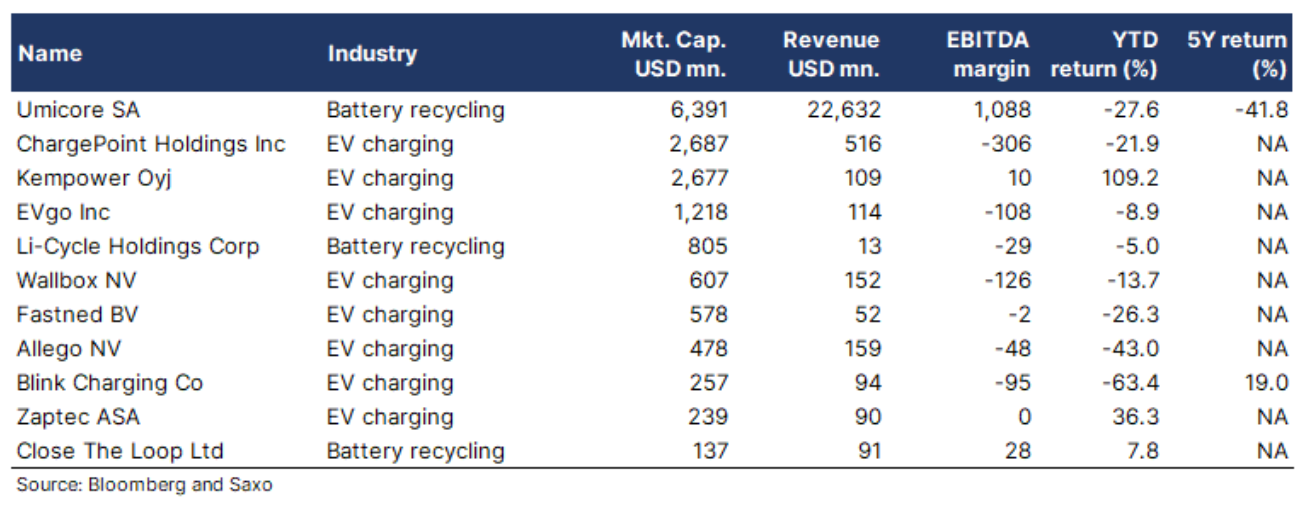

The table below shows the largest publicly traded electric vehicle charging and battery recycling companies, highlighting the growth of the electric vehicle ecosystem.

Battery recycling will become a huge market in the future

Yesterday's article in FT was dedicated battery recycling and why a revolution is needed in this industrybut today at battery recycling also writes Wall Street Journal. As the transition to electric vehicles will continue at a breakneck pace and ore grades will deteriorate in the future, recycling of old batteries will be crucial to keep battery prices low, as well as to protect the environment, as batteries are quite toxic.

The future prospects for battery recycling are so good that one of the world's largest players in this industry, Umicore, based its entire strategy until 2030, entitled RISE, on its recycling business group - Battery Recycling Solutions. Approximately 75% of Umicore's capital expenditures in 2022-2026 will be allocated to battery materials, battery recycling and fuel cells, with battery recycling being the most important growth area. The company has already announced a significant scale-up of its battery recycling business in Europe with the construction of the world's largest battery recycling facility capable of processing 150 tonnes of material.

The largest direct exposure to the battery recycling market is provided by US-listed Li-Cycle, but here the investor must assume that the long-term winning technology will be lithium-ion batteries, or at least that Li-Cycle is able to modify its recycling business in the event of victory of another technology. In any case, the purpose of today's analysis is to provide inspiration for the evolving electric vehicle ecosystem.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)