Orders on the WSE. What is worth knowing about them?

We have already chosen a good company for the portfolio. We know its condition, the environment in which it operates and all the parameters that made its purchase attractive. We know at what price we intend to buy it. Now we face another important task. Namely how to do this.

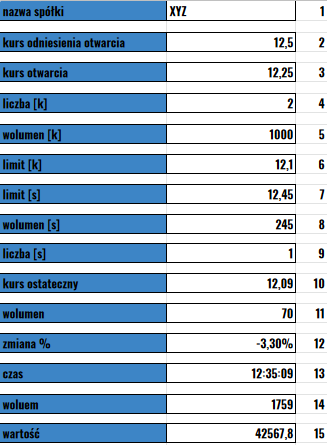

Orders on the WSE - order sheet

To be able to buy a security of a given company, of course, we need a brokerage account. Unfortunately, we will not be able to do this without it. Putting this aspect aside, let's focus on the order sheet itself. Willing buy a company, check its quotation or resell it, an order sheet will be displayed. At the beginning, this seemingly insignificant table, full of (so far) incomprehensible numbers, is the basic source of information at what price investors want to buy or sell a given asset. Let's take a look at the very general pattern I have included in the graphic below.

How to interpret the order sheet?

Order sheet. Source: own study

The worksheet contains numbered columns to make it easier to interpret. It is worth noting here that order books differ slightly from each other, for example in that some of them contain more positions. Nevertheless, this one is the basic version and contains a lot of useful information that will allow us to determine the price at which we will buy or sell our stocks.

Let's start with the first line. It tells us which companies the quotes relate to. On the second, i.e. the reference price, we can read the data at which the last transaction was concluded in the previous session. The third line informs about the quotation level that was in force at the opening of the current session (it is calculated on the basis of the order book).

The next six items will be of our greatest interest. From them we will learn, first of all, about the amounts at which investors are able to sell [s] and buy [k] a given stock. By observing this sample table, we can easily read these levels.

The amount for which they are ready to buy the stock of XYZ is 12,10 (limit [k]) and sell it for 12,45 (limit [s]). These are the two best buying or selling offers that are currently available on the market. The transaction will take place when one of the parties agrees to make it at a specific rate of the other party.

Who, when and for how much?

Now the question is how many investors and how many securities do they want to buy or sell? Depending on the order, we will be informed about it by lines 4,5 and 8,9 of the sheet. Suppose in our example that we want to purchase XYZ assets. From the quotes applet we read the information that currently 2 players (number [k]) want to buy 1000 securities (volume [k]) at the price of PLN 12,10. We read it analogously in the case of sales.

The final price with the volume just below it informs us about the price of the last transaction. In the case of our company, we read that the transaction was finally concluded at a price of PLN 12,09, where 70 shares changed hands. This order was executed at 12:35:09. On this basis, the percentage change is calculated. It is the difference between the opening reference price (12,5) and the last executed order (12,09). In our example, it is 0,41 groszy (0,41 / 12,5 x 100 = 3,3%).

READ ALSO: How to analyze companies? Fundamentally or technically?

The last two items show the total turnover during the entire session. Looking at the volume, we can say that 1759 shares have changed hands. The total turnover was PLN 42. This is double the amount due to the fact that two investors have committed cash. One sold the item for e.g. PLN 567,80, therefore the other had to buy it for the same amount. Which gives us a total turnover of PLN 100.

Orders available on the WSE

If you already know how to interpret the order sheet, which is helpful in assessing the chance to sell or buy a given item during a specific session, it is worth taking a look at what orders are made available to us Warsaw Stock Exchange. It is quite a wide range that allows the use of various tactics of folding them. In a very general classification, we could divide them into two groups: orders with a price limit and orders without a price limit.

Orders with a price limit

In fact, it is the most frequently used order on the WSE. Where does this popularity come from? It mainly results from the fact that by using this type of placing our orders, we know well at what price and how many assets we want to buy or sell. We must provide all these parameters during its activation. The transaction will eventually be finalized when it encounters a counter-offer. It may happen that we will wait quite a long time for its implementation. It is worth adding some information about their validity along with these orders. In the new system for marking broker's orders, we distinguish the following division:

- D - valid as of the current day, i.e. not longer than until the end of the trading session on a given day.

- WDD - valid until a specified day - we choose by ourselves when the offer is to be valid, but it cannot be longer than 365 days.

- WDA - valid for an indefinite period - as the name says, the order will be completed or canceled by us.

- WDC - valid until a specific time - how is it different from WDD? Here, the main determinant of the order validity is not the day but the hour. We can define its implementation with accuracy to the second.

- WWF - valid for fixing, i.e. until the end of the nearest opening phase, closing phase or balancing period, respectively, on the day the order is placed on the exchange.

- WNZ - valid for closing - until the end of the closing phase on the day on which it was submitted to the exchange.

- WIA and/ or WLA - execute and cancel and the second execute or cancel. In the first case, valid until the first transaction is concluded on its basis, the rest of the order is canceled. WLA works by executing or canceling the entire order.

In fact, we will mainly use WDA and WDD orders. These are the two most frequently used types of offers submitted by individual investors.

Orders with no price limit

The first order discussed by me will concern PKC, that is, developing this abbreviation - at any price. The advantage of this offer is its immediate implementation, regardless of the rates of the opposing offers. The only parameter that we have to provide is how many shares of a given company we want to buy or sell. In the case of buying or selling a large number of shares, it is very likely that our instruction will be carried out at several different rates.

PCR (at market price) works similar to PKC with one exception. This order is executed only after the best bid or offer to buy or sell. Therefore, there may be a situation in which it will not be fully implemented. The rest of the offer is then recorded on the appropriate side of the order book.

The last type of order discussed is PCR - at market price. It is very similar to PKC, except that it differs only in the transaction rate. They are not implemented on the basis of selecting the best offer. In fact, with PCR, there are three ways to determine the purchase / sale of a given item:

- opening rate (at the opening market price),

- closing rate (at closing market price),

- the price set at the fixing (this applies only to the single-price quotation).

If the entire offer is not realized, it goes to the appropriate page of the order book, as in the case of PKC.

Size revealed

It is known that the price of a given asset is driven by supply and demand for a given asset. While there is a large investor on the market who intends to buy or sell shares of a given company, his order will have a large impact on the quotation price. Disclosing that someone is about to purchase large quantities of a company's paper may result in sellers over-pricing. Therefore, there is an order with the so-called the amount disclosed. To better illustrate them, it can be compared to an iceberg, where only the top of the iceberg is visible on the order sheet. It works in such a way that during the execution of a part of a large order on the market (depending on the execution), successive components will appear successively.

Summation

Knowing the order book itself, its operation and the information that we can read from it allow us to determine several important issues when concluding transactions. Among other things, we can find out what is the demand or supply for the items we want to sell or buy. Subsequently, we can set an order that will meet our criteria in terms of price and the possible time of its implementation. We are able to adapt them to our tactics, which, thanks to the wide possibilities of offer implementation, allows us to define priorities (speed of implementation, appropriate rate for a specific number of items).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Is index investing for everyone? [Debate] globalconnect gpw](https://forexclub.pl/wp-content/uploads/2022/11/globalconnect-gpw-300x200.jpg?v=1667553873)