Gold rebounds in the wake of the dollar weakening

This week gold market is recovering from last week's strong sell-off which brought prices below $ 1761 from the $ 1916,57 attacked earlier this month. In both cases, one of the main reasons for the changes in the gold market was the behavior of the dollar.

The gold catches my breath

The sharp strengthening of the dollar in the previous week, after the market perceived the results of the June FOMC meeting as surprisingly hawkish, gave an impulse to a strong sell-off in the gold market. The dollar rebound observed since the beginning of this week, strengthened by yesterday's assurances from the president Fed Jerome Powell said for raises interest rates there is still a long way to go in the US, it provokes a similar upward rebound in gold.

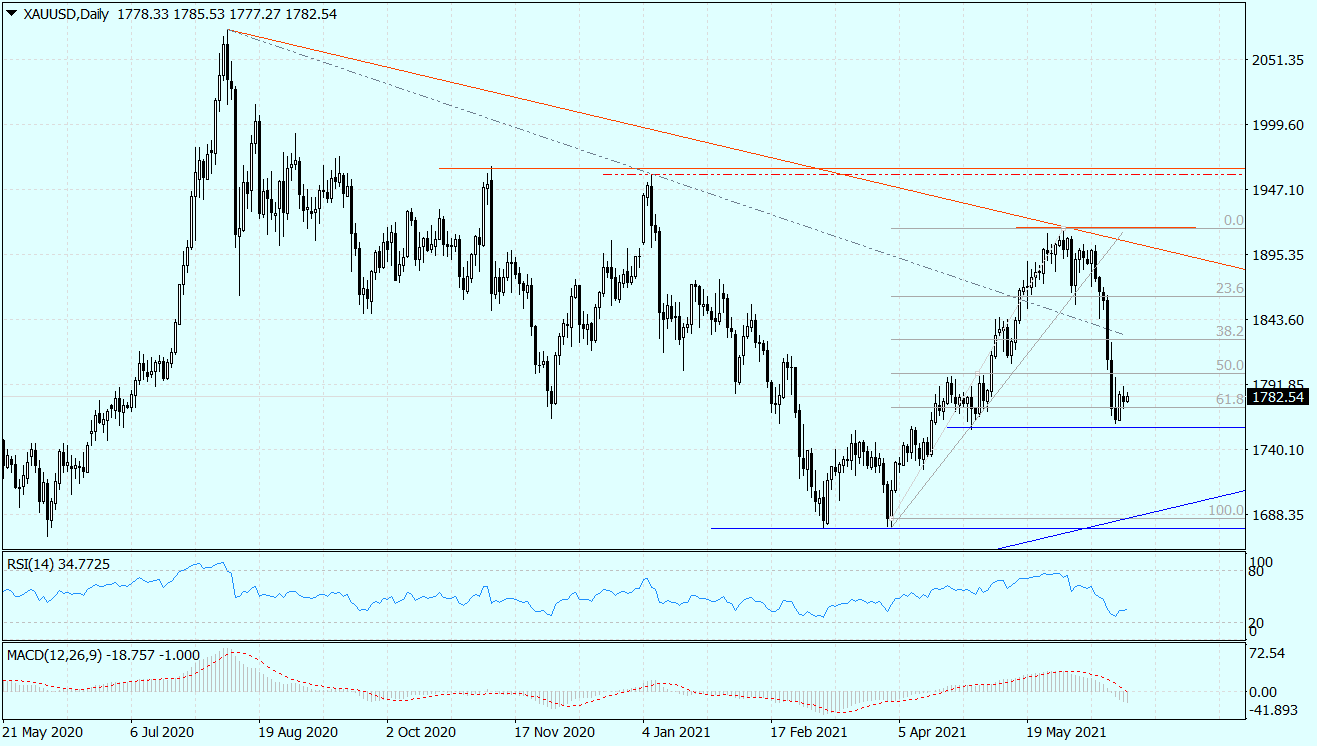

XAU / USD daily chart (gold). Source: Tickmill

In the following days and weeks, gold will remain a hostage to the dollar and expectations regarding changes in the US monetary policy. This means that among the data that this market is most waiting for are the Friday PCE readings (inflation measure preferred by the Fed) for May, as well as next week's entire series of data from the US labor market with the report on non-farm payrolls in the lead ( June; forecast: 500).

The situation on the XAU / USD daily chart shows the dominance of the supply side, so the recovery from Monday will be limited. This is even better seen on the weekly chart, where last week's long black candlestick dominates the others. Therefore, during the summer holidays, you should take into account at least one more wave of gold discount, which will bring the rate to the region of USD 1677-1687.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response