Gold should drop to USD 1765 [Market comment]

Gold is currently the cheapest in over 4 months. It has dropped by 13 percent since the August summit. Goldman Sachs analysts believe this is just a correction. Maybe so, but it still has to go cheaper before gold can go up again.

Gold with a downward forecast

On Tuesday, the price of an ounce of gold dropped to $ 1800,34, breaking the support zone near $ 1850 the day before. In effect gold it was the cheapest since mid-July. Since the August peak, when you had to pay $ 2075 for an ounce of this metal, it has decreased by over 13 percent. Today, gold is slightly rebounding at $ 1812,06.

- We believe the correction in the gold market was temporary and we expect gold to rise as more evidence of inflation emerges - Goldman Sachs analysts wrote in the report.

At the same time, they reiterated their previous 12-month forecast for gold prices at $ 2300.

An increase in gold prices to $ 2300 will mean a price jump of almost 27%. That's a lot. However, before the inflation forecast by Goldman Sachs appears, which will result in new records on the gold market, the prices of this metal have to go down earlier. This is what technical analysis suggests.

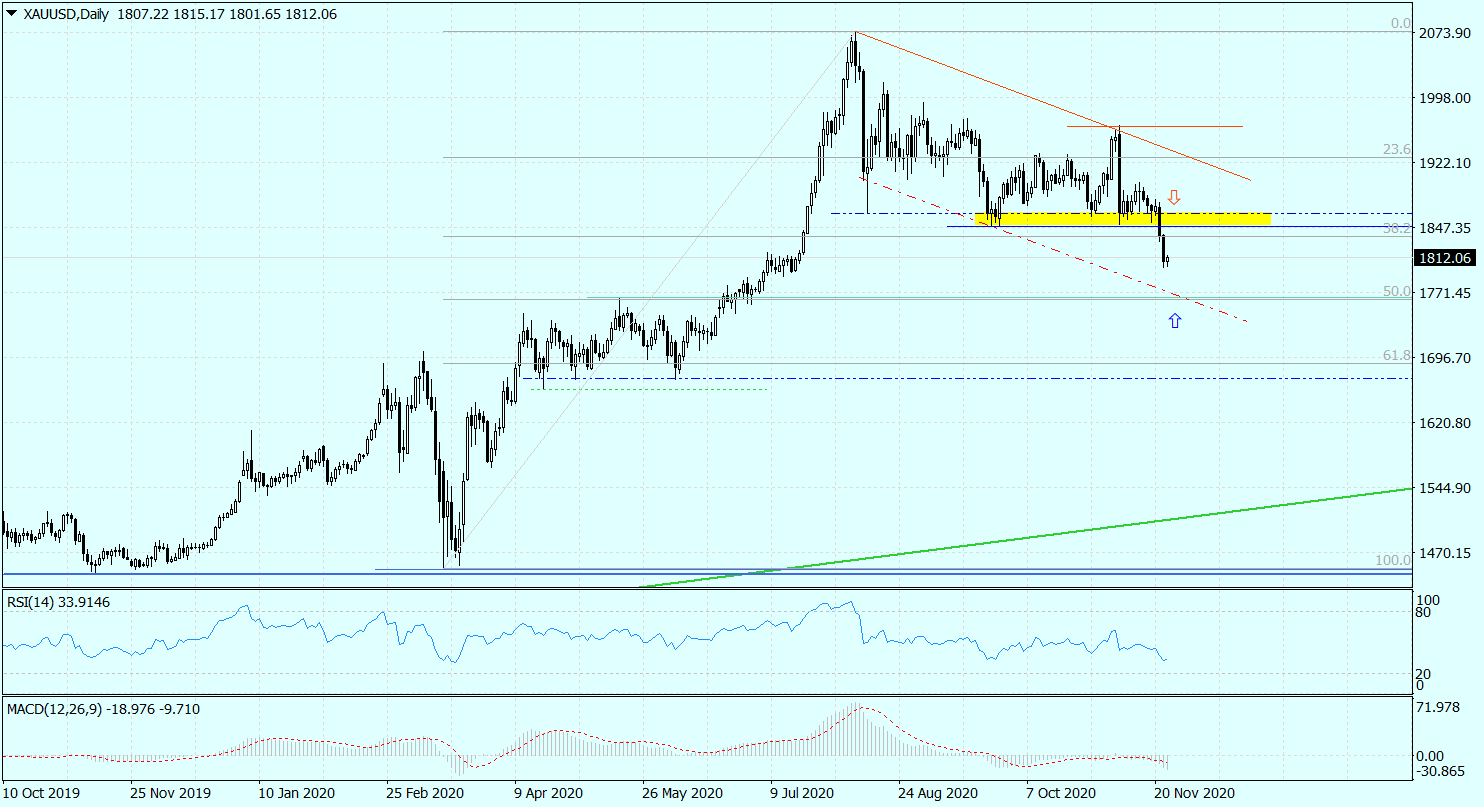

Gold chart, interval D1. Source: MT4 Tickmill.

Gold after breaking the support zone $ 1848,42-1863,69, which was confirmed both by a drop below 38,2%. of the Fibo retracement, as well as in the supply signals on indicators, now has an open path to further declines. The first significant support is the $ 1762,98-1765,05 zone. It is made up of 50% of the lifted Fibo increases from the period March-August this year, the local high from May 18 and the potential lower limit of the downward channel in which gold has been moving since the summer holidays. There is already a good chance to reverse the downward trend.

If it failed, another equally strong demand barrier is the $ 1670,73-1688,70 zone. It is created by 61,8 percent abolition of Fibo. It is also the last place to make a return if gold is to return above $ 12 in the next 24-2000 months.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Gold should drop to USD 1765 [Market comment] gold forecast](https://forexclub.pl/wp-content/uploads/2020/11/zloto-prognoza.jpg?v=1606313393)

![Gold should drop to USD 1765 [Market comment] world bank world bank](https://forexclub.pl/wp-content/uploads/2020/11/bank-swiatowy-world-bank-102x65.jpg?v=1606289135)

![Gold should drop to USD 1765 [Market comment] dax 40 index](https://forexclub.pl/wp-content/uploads/2020/11/dax-40-indeks-102x65.jpg?v=1606313785)

Leave a Response