The zloty is playing on an interest rate hike

The third consecutive day of the zloty strengthening. The currency market, since the publication of data on the surprisingly strong jump in inflation in Poland, is playing under interest rate increases by the Monetary Policy Council.

Inflation is accelerating, rates are (so far) unchanged

The new week on the domestic FX market brings a continuation of the zloty appreciation to the basket of currencies, which makes it stand out from other currencies in the region. On Monday noon you had to pay PLN 4,5662 for the euro and PLN 3,9309 for the dollar. The market plays with the fact that the highest inflation in 20 years in Poland, which has surprised with its growth since the beginning of the year and which may finally reach 7%, will soon force the Monetary Policy Council to raise interest rates. This is going to be a really hot week in the FX market. And it is difficult to guess how it will end for the zloty.

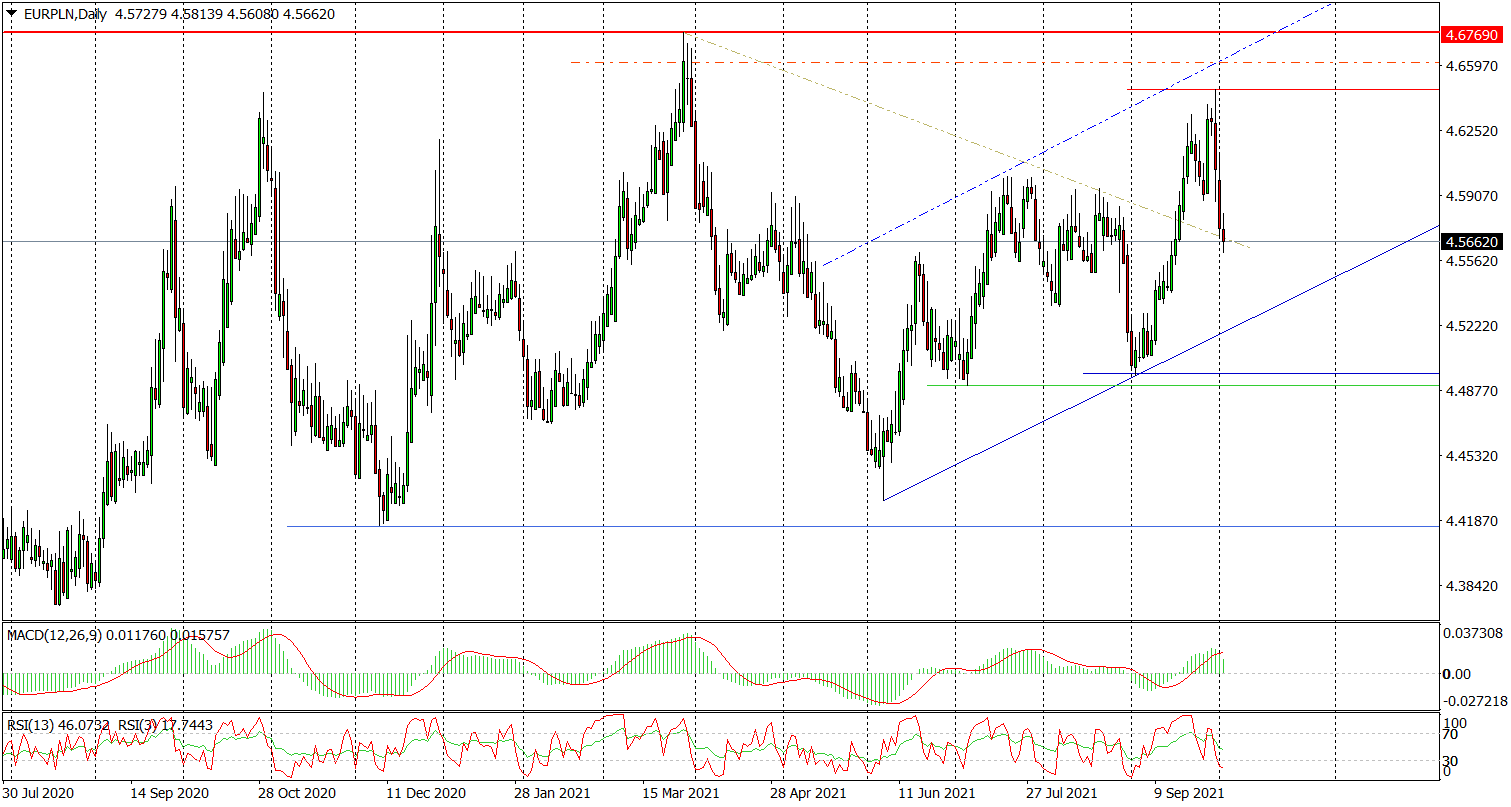

EUR / PLN daily chart. Source: Tickmill

The main event of this week will be the Wednesday meeting of the Monetary Policy Council (MPC) and the monthly press conference of the president National Bank of Poland (NBP) Adam Glapiński. With an emphasis on the latter, as there may be potential announcements of what to do with interest rates in Poland.

USD / PLN daily chart. Source: Tickmill

The market awaits the NBP conference

The NBP has not announced the date of the press conference yet. It can be expected that when the MPC meeting attracts so much interest, and the US labor market data, which is extremely important for the markets, are also released on Friday, the conference will be held on Thursday rather than on Friday.

Regardless of the date of the conference, the most important thing will be what is said there. Will the president of the NBP suggest that the highest inflation in 20 years in Poland, which is constantly accelerating and, additionally, is a surprise not only for the MPC, but also for analysts, brings an interest rate hike in Poland closer? Will he continue to argue that the boom in inflation is only temporary, so there is no need to hurry with the rate hike?

Depending on what suggestions come from Glapiński, this is how the zloty will react. And that will be the main impetus for him. An impulse that will push other impulses to the background. Including Friday's data from the US labor market and possible dollar's reaction to them. If the market believes in the hike already at the November MPC meeting, the zloty will continue its appreciation and the EUR / PLN and USD / PLN quotations may drop even by 5-10 groszy in the coming days. Otherwise, it will start to lose everything it has gained in the last three days, and the reluctance of the MPC to raise interest rates despite the highest inflation in 20 years will again become the main reason for the weakening of the Polish currency.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)