Zloty strong after US inflation data. EURPLN at the lowest level in 15 months

On Tuesday, the zloty gained strongly against the major currencies. It is supported by improvement of moods in the global markets after the release of data on lower than expected consumer inflation in the US. However, the decision of the Monetary Policy Council (MPC) to leave interest rates in Poland at current levels remains unaffected.

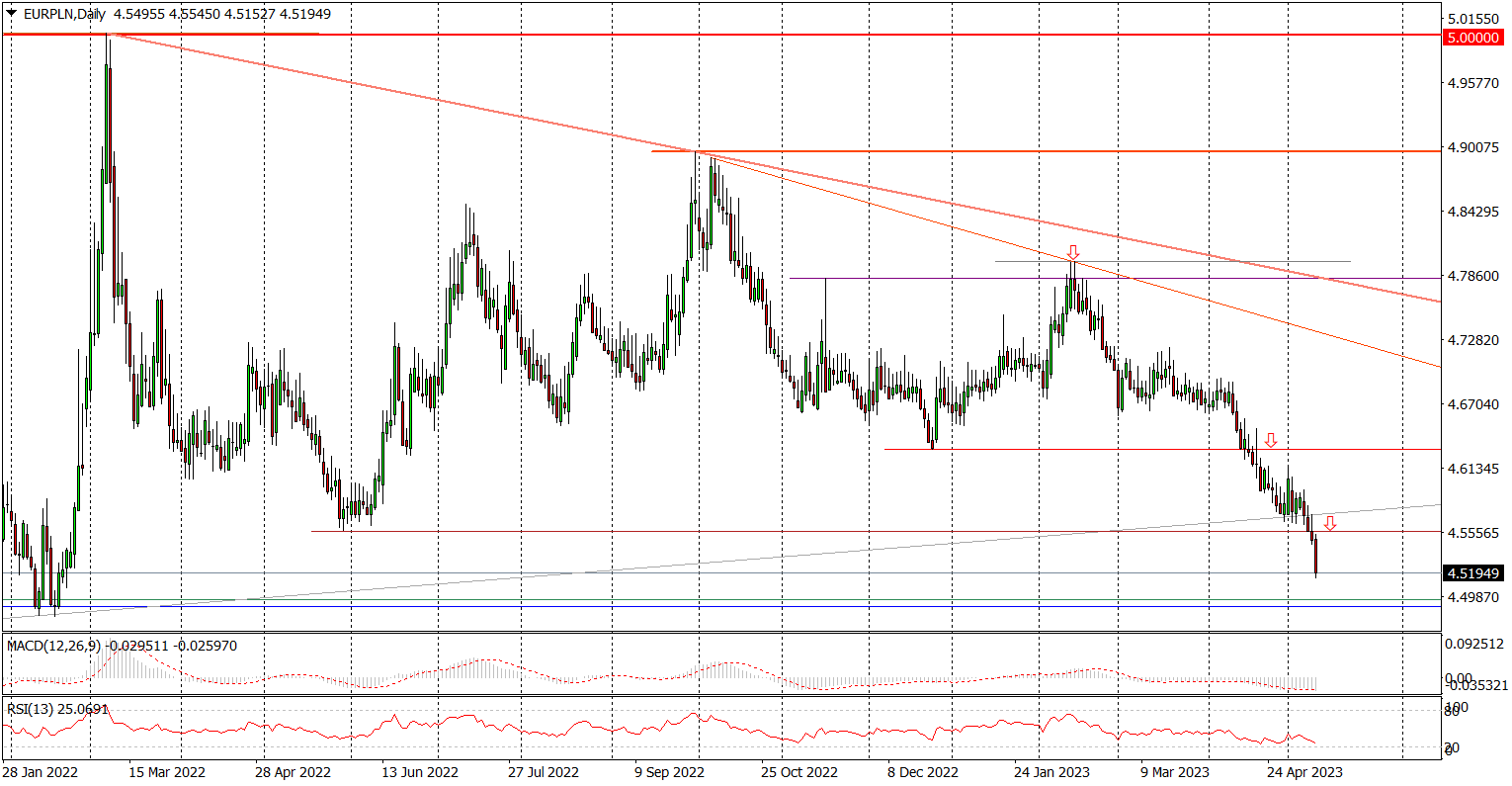

EURPLN at the lowest level since February 2022

At 15:14 the EUR/PLN exchange rate was PLN 4,5210, which means a decrease of 3,1 PLN compared to yesterday's closing and almost 28 PLN lower than in mid-February this year. The euro is also the cheapest since January 2022.

EUR / PLN daily chart. Source: Tickmill

You have to pay PLN 4,11 for one dollar, which is 4,1 groszy less than yesterday and the lowest since February 2022.

The Swiss franc is cheaper today by PLN 3,4 to PLN 4,6295 and is at the lowest price since June 2022.

The native currency did not react to today's decision of the Monetary Policy Council (MPC), which, as expected, did not change interest rates in Poland, leaving the main one at 6,75 percent. On the other hand, it reacted with a marked strengthening to lower-than-expected US inflation data released today.

In April, the CPI inflation in the US unexpectedly fell to 4,9 percent. year on year (forecast: 5%) from 5% in March, which is its lowest level since April 2021. Core CPI inflation fell to 5,5 percent. (forecast: 5,5 percent) from 5,6 percent.

Today's data perfectly fit the thesis that the US at the May meeting Federal Reserve ended the cycle of interest rate hikes. At the same time, part of the market may also perceive them as a confirmation of the thesis of relatively quick future interest rate cuts. As a result, the data led to a strong improvement in moods in the global markets, increased risk appetite and weakening of the dollar, which benefited the zloty and the Warsaw Stock Exchange.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)