The zloty makes up for losses [USD / PLN, EUR / PLN analysis]

For over a week now, the zloty has provided us with a lot of emotions. Its fluctuations are large. And what is most interesting, the behavior of the zloty eludes market patterns known for months. Hence, not all movements can be easily justified. Then only the trust of technical analysis remains.

The golden one returns to favor

The Polish zloty started to depreciate more from September 21. It was then that markets began to seriously fear the rising tide of coronavirus infection, which occurred even before the fall / winter season. It was also then that the euro started to weaken against the dollar, heralding a decline EUR / USD even below 1,15.

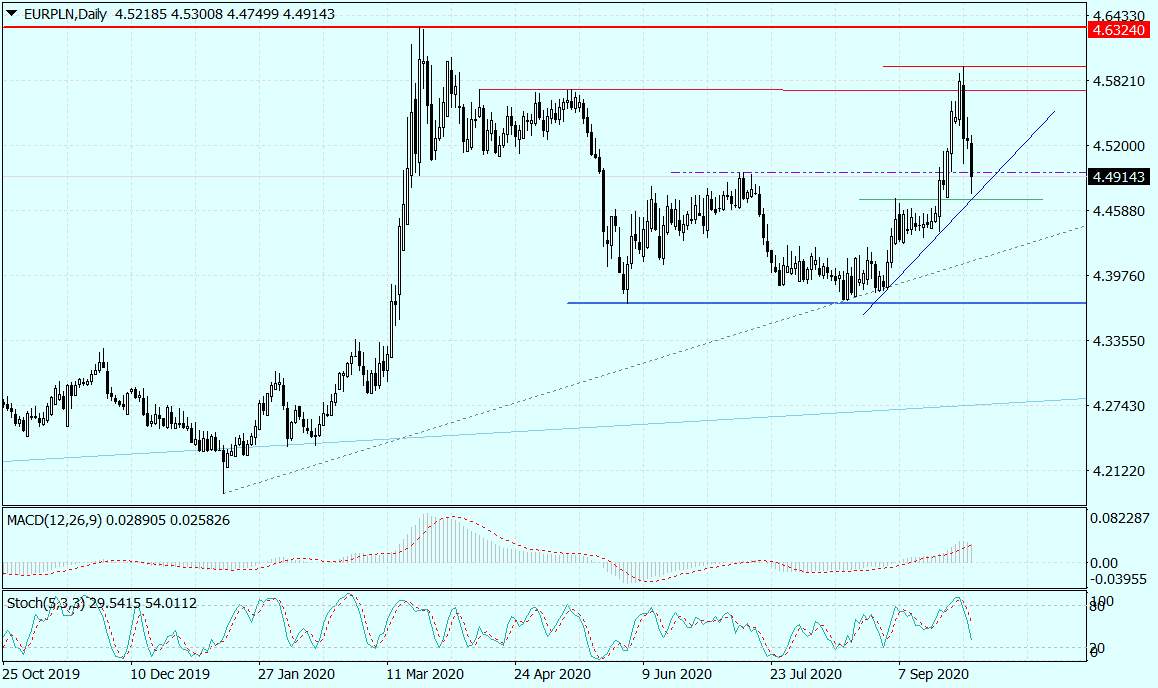

EUR / PLN chart, D1 interval. Source: MT4 Tickmill.

Chart USD / PLN, D1 interval. Source: MT4 Tickmill.

The depreciation of the Polish currency accumulated in the morning of September 29. The day after information appeared that European funds will be linked to the assessment of compliance with the rule of law in a given country. So there is a risk that Poland will get less funds from the European Union. As a result of these fears, which also affected the Hungarian forint, the EUR / PLN exchange rate increased to PLN 4,5956, and USD / PLN to PLN 3,9393. And then there was a turning point. At first, it was just a simple profit taking and using expensive currencies to sell them. However, it is difficult to justify today's strengthening of the zloty.

On Thursday, the zloty appreciated despite the September PMI reading disappointing strongly, running significantly below expectations (50,8 points vs. 52,4 points), which indicates a slowdown in the economic recovery. The same is also shown by the recent strong increase in the number of people infected with the coronavirus. Especially that, as announced by the Minister of Health, for the next two months the daily number of confirmed documents will remain above 2 thousand. This must have a negative impact on the sentiment and, consequently, on consumption and the entire economy.

An argument for a stronger zloty is also not the quite unexpected jump in inflation in Poland in September. Nobody has any doubts that the MPC will not react to it, and interest rates will not increase until 2024 at least.

The only justification for a stronger one is the basket purchases of currencies in our region. Not only is the zloty gaining, but also other currencies.

Co dalej?

In a situation where the market has become less logical, it is necessary to resort to the logic of the crowd. So for technical analysis. Today's strong pullback of EUR / PLN and USD / PLN pulled back quotes near the preliminary lines of the uptrend. As long as these support levels (PLN 4,4680 for the euro and PLN 3,79 for the dollar) remain valid, the chances for a further strengthening of the zloty are slim, and a significant return to the above. Especially in the case of the dollar, for which a return from around PLN 3,7903,80 would open the way to PLN 3,94 again. And this is the baseline scenario for the "green" for October at the moment.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![The zloty makes up for losses [USD / PLN, EUR / PLN analysis] One Zloty](https://forexclub.pl/wp-content/uploads/2020/10/Jeden-zloty.jpg?v=1601563370)

![The zloty makes up for losses [USD / PLN, EUR / PLN analysis] usa trump biden election](https://forexclub.pl/wp-content/uploads/2020/10/wybory-usa-trump-biden-102x65.jpg?v=1601560512)

![The zloty makes up for losses [USD / PLN, EUR / PLN analysis] Donald Trump](https://forexclub.pl/wp-content/uploads/2020/10/Trump-102x65.jpg?v=1601626943)