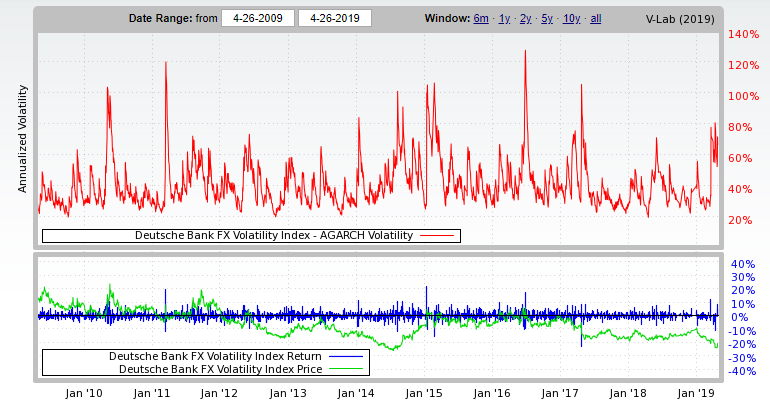

Variability on the forex market is getting closer to the 5-year minimum

Despite good results on a monthly or quarterly basis, volatility on the forex market leaves much to be desired. Looking more broadly at the turnover, over the past few years they have been heading towards the achievement of the 5-year minimum. Low volatility is not helpful in attracting investors to the market. Despite the fact that brokerage companies publish good results recently in the segment of acquiring new accounts and having active ones, this does not translate into an increase in volume and profitability (especially in the case of companies from the EU).

Be sure to read: Over 38 thousands of active traders in Tickmill

When will the improvement come?

This question will certainly remain unanswered for a long time. You have to take a very large error limit on any forecasts that predict increased market engagement. It is puzzling to see good (annual) results when it comes to acquiring new clients by brokerage houses and brokerage companies. Regular users seem to reduce their exposure to the market. In the last report, Deutche Bank has published new information on volatility in the currency market. The presented data show that the volume is close to that of the 2014 year. This year marks the 5-year minimum. Looking at the graphics below, nothing shows that there is something to change in this topic.

A reverse trend in Asian countries

Involvement of investors on the currency market does not decrease ruthlessly in every region of the world. The Asian countries are doing very well, where the trade center is based on the Singapore stock exchange. In recent years, currency exchange (forex) volumes have increased in Singaporean banks, fueled by strong economic growth in Asia. Good promotion of this sector and favorable regulations are beneficial in the light of the involvement of potential investors. In 2018, DBS Bank (an international banking and financial services corporation based in Singapore) recorded strong growth in the cash sector of the FX. Over the 3 years (not taking into account the current year, i.e. from 2016-2018), the progress was shaped by 20%, 26% and 45% in y / y terms.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)