Return on Polish zloty: USD / PLN for PLN 4,86 and EUR / PLN for PLN 4,80

Today's morning brings a continuation of yesterday's strengthening of the zloty against the main currencies. The traffic is strong. Especially in relation to the US dollar and Swiss franc. Both currencies not only returned below the PLN 5 barrier, but also clearly moved away from it. The euro also looks good, which has returned to around PLN 4,80 and so far the specter of approaching PLN 5 has been postponed.

PLN (finally) is recovering from losses

The zloty is gaining strongly against the dollar, which is to a large extent a derivative of the global weakening of the US currency, including against the euro. On Tuesday morning, the dollar had to be paid PLN 4,8605, which is 5,5 groszy less than on Monday at the end of the day, when it went down by PLN 4,2 and almost 20 groszy less than last Wednesday. Additionally, there was a double high on the USD / PLN (H4) chart, which suggests further declines. Including breaking the nearest support, which would open up additional space for the USD / PLN discount.

USD / PLN daily chart. Source: Tickmill

The Swiss currency also returned clearly below the PLN 5 barrier. This morning the franc was cheaper by PLN 3,7 and cost PLN 4,9165, while last week the franc had to be paid over PLN 5,13.

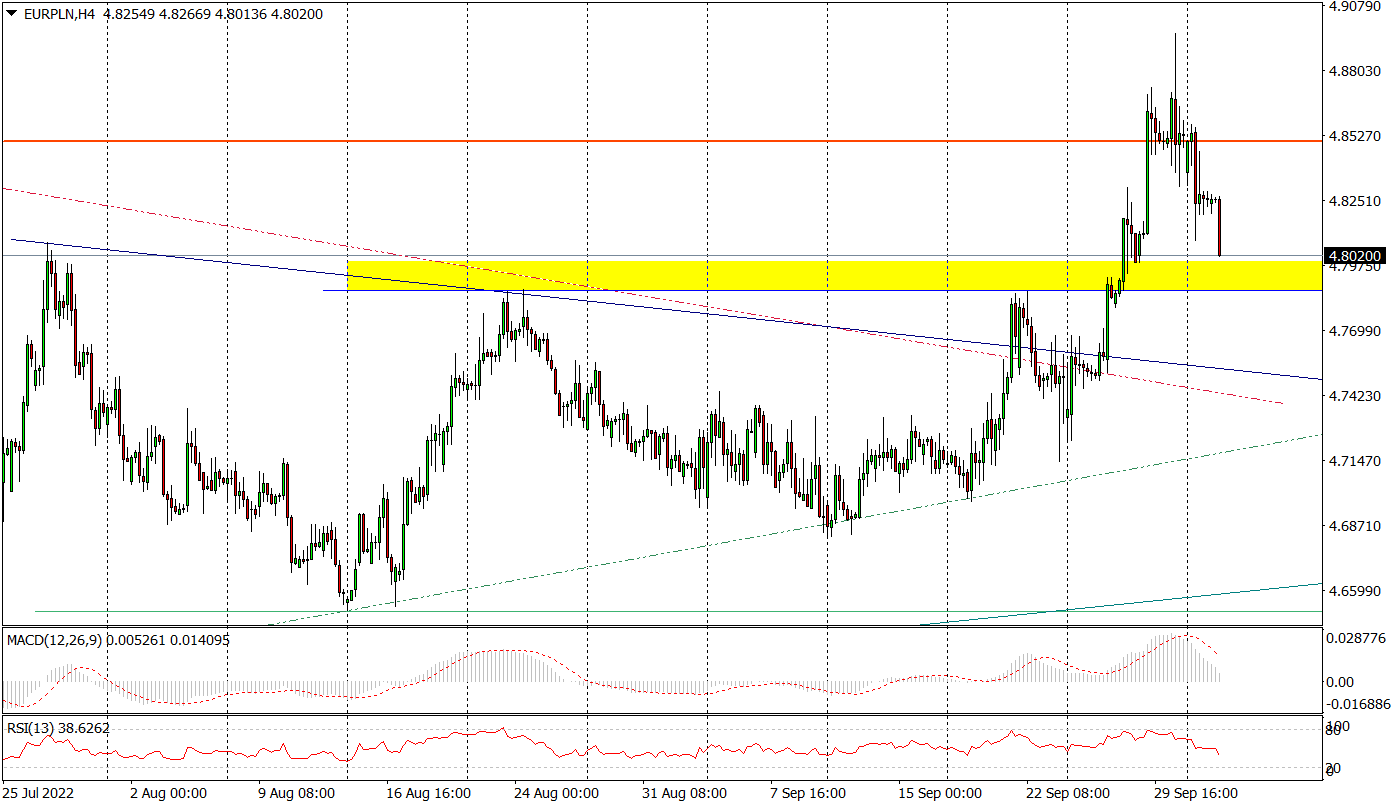

The zloty also appreciated against the euro. The EUR / PLN exchange rate fell by PLN 2,6 to PLN 4,8020, yesterday returning below the peak from July (PLN 4,8516) and confirming last week's return from PLN 4,8933. At the moment, the risk of the euro rising to PLN 5, which only a few days ago seemed a probable scenario, has been delayed by at least a few weeks. However, in the short term, the support zone around PLN 4,78 may stop the pair's declines.

EUR / PLN daily chart. Source: Tickmill

Why is the zloty strengthening?

The observed appreciation of the zloty is the effect of the improvement in moods in the global markets observed in the first days of October, but above all, the global correction of the dollar, which has been going on since last week. This return on the dollar, which automatically translates into a strengthening of the zloty and other emerging market currencies, is clearly visible on the chart EUR / USD. Today, the quotations of this pair are approaching 0,99 and are on the way to attack the parity (EUR / USD 1,00) later, while a week earlier the euro was setting long-term lows at 0,9536.

While the described appreciation of the zloty is mainly driven by global factors, its behavior in the coming days will be more determined by domestic events. Tomorrow it will be the decision of the Monetary Policy Council on interest rates in Poland (an increase of the main rate by 25 bp to 7% is forecasted). On Thursday, the president's press conference scheduled for 15:00 National Bank of Poland Adam Glapiński after the meeting of the Council.

Observing this several-day strong appreciation of the Polish currency, one must not forget that apart from the improvement in sentiment in the financial markets and the upward correction on the EUR / USD, all other risk factors, which have recently pushed Polish pairs to PLN 5, remain valid. These are the growing negative real interest rates, the decreasing disparity in the level of interest rates in Poland and the USA, rampant inflation and slowing economic growth in Poland, the war in Ukraine, or the lack of funds from the KPO. Therefore, in the medium and long term, further zloty depreciation remains the main scenario. At least until the end of the war in Ukraine (and, as a result, the end of the energy crisis in Europe), because it could strengthen the zloty by leaps and bounds.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)