The AI craze is taking the market to new extremes

The emergence of advanced artificial intelligence systems such as GPT-4 on the market since OpenAI, is definitely the most surprising event of the year, turning everything upside down. The AI boom has taken the US stock market to new extremes, and the benefits and risks of this new technology are hotly debated. Artificial intelligence will also become the focus of the race between the United States and China.

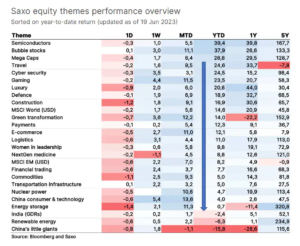

This year has been a real rollercoaster for investors. Stocks took off like a rocket, gaining nearly 7% in January as investors bought in to a "no landing" scenario where the world economy, rather than a soft landing, will experience accelerated growth due to the impulse associated with the reopening of China to the world. Animal instincts gained momentum and were clearly visible in relation to Tesla stocks, Bitcoin and our high beta-growth themed baskets such as "bubble" stocks. Our newly created luxury goods basket also generated a solid return as investors bet that China's reopening would boost luxury goods sales significantly.

This year's swing on the market continues

In early 2023, pessimism took over, but optimism about the reopening of the Chinese economy and early talk about artificial intelligence awakened animal instincts, thanks to which stocks of companies from the semiconductor and luxury goods industries and companies with the largest capitalization recorded double-digit growth by mid-March. The banking crisis, initiated by the bankruptcy of Silicon Valley Bank i takeover of Credit Suisse, rekindling recession fears and the market began to price in aggressive interest rate cuts totaling 150 basis points by the end of this year. This stemmed from the belief that the economy would eventually collapse.

Despite this, this year's swing on the market unexpectedly soared. Around the time of peak economic pessimism and predictions of aggressive rate cuts, OpenAI launched its artificial intelligence system, GPT-4, and this year's situation has changed beyond recognition. Every AI-related stock shot up in a speculative frenzy, mirroring developments seen in previous speculative bubbles. Our thematic basket of stocks from the semiconductor industry gained 17,5% by mid-March, and as much as 39,8% by mid-June. Even more impressive is the increase in the value of the stock basket related to the speculative bubble – from 8% to as much as 37,8%.

US economic data continues to show below-trend economic activity, but also shows no signs of recessionary momentum, and earnings estimates have increased significantly, particularly in Europe, since QXNUMX earnings season began in mid-April. Financial conditions in the United States peaked at levels in late March at levels that can still be described as loose, given the economic backdrop, and have since fallen to near the loosest levels since March 2022 before financial conditions began to tighten significantly due to the interest rate shock.

Previous interest rate cuts before the end of the year have already been almost fully taken into account in valuations. In other words, starting from the beginning of QXNUMX, the balance of power points more to a risk of higher inflation compared to current market expectations and higher reference rates than to a scenario of "return to low inflation and low rates".

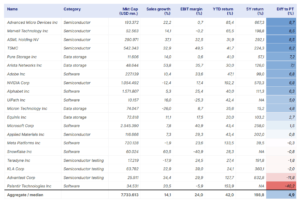

While the excitement about AI has undoubtedly unleashed animal instincts and sparked growing optimism about productivity gains, it also means increasing risk for the US stock market. US stock market valuations have returned to their highest levels since April 2022, and with the S&P 500 Index free cash flow return down to 3,9%, the market is starting to look a little tighter. While it is too early to speak of a general speculative bubble, the semiconductor industry is clearly showing bubble-like behavior, and semiconductor stock valuations, as measured by 2010-month EV/EBITDA, are at their highest since XNUMX.

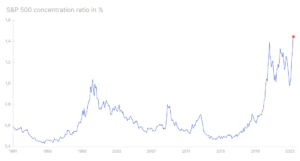

Another threat that has returned, and which we thought would never happen again, is the concentration of the US stock market. This year's bull market was driven by a small group of companies with the largest capitalization, as the emerging AI technology is expected to provide the largest profits to stocks of large tech companies. A bigger concern is that the US stock market is experiencing a concentration of index weighting that has never been seen before: shares of the 10 largest companies on the S&P 500 index weigh 30,4%, and the Herfindahl-Hirschman ratio exceeds the market concentration by 40% at the height of the dot-com bubble. As a result, the US stock market has become more fragile and vulnerable to fewer risk factors. As a result, we change our assessment of companies with the largest capitalization to negative and in the context of these companies we focus primarily on the long tail of shares.

The main question global investors are still asking is whether to reduce their exposure to equities? World stocks measured MSCI index All-Country World have a dividend yield of 2,3% and an estimated return on redemption of 1,2%. If we add to this the expected real earnings growth of 2,2%, then the long-term expected annual rate of return on global equities in real terms will be 5,7%. By comparison, global investment grade bonds have a yield-to-worst of 3,8%, but subtracting the 2,5-year inflation expectations of 1,2% causes the long-term expected return of investment grade bonds to fall to XNUMX% on an annual basis. In other words, if an investor wants to maximize long-term wealth, the most prudent solution is still an overweight exposure to equities.

Two faces of artificial intelligence technology

New technologies have both positive and negative impacts on society, and artificial intelligence is no exception. A recent report by consulting firm McKinsey on generative AI suggests that the technology will generate between $2,6 trillion and $4,4 trillion annuallywhich is roughly the size of the UK economy. McKinsey predicts that 60-70% of the work done today can be automated with AI, enabling a 0,1-0,6 percentage point increase in productivity. Making long-term predictions about technology is a difficult task, but the McKinsey report perfectly captures the spirit of the times, as AI technology is becoming our new hope for a better and richer future, similar to the era of spaceflight during the Cold War or the development of the Internet twenty years ago.

We believe that AI stocks have entered a speculative bubble phase characterized by the "peak of excessive expectations", in line with the logic of Gartner's hype cycle model. It is likely that soon companies will disappoint inflated expectations and will lead investors to the valley of disappointmentbefore it is possible to ascend the slope of enlightenment. To help our clients get the best overview of the companies that have responded most strongly to the rise of AI, we have created an AI themed basket of 20 stocks. This list has already received the most views of any stock market analysis, underlining the interest in the topic of artificial intelligence. It is worth noting that many of these stocks are trading close to their target prices, indicating that stock market analysts are having a hard time justifying current valuations in the context of the forecast.

Pessimists maintain that while AI will bring economic benefits in the long run, the world is strongly extrapolating the current trend, creating a speculative bubble in the area of shares of companies related to artificial intelligence. Number of Google searches for "ChatGPT" and "AI" in the United States in April reached its peak value and is now declining, suggesting that the initial enthusiasm is beginning to fade, although it has not yet died out in the stock markets. Pessimists also argue that generative AI will result in a flood of false information, images and videos, essentially contaminating our own future training data and causing future systems to naturally stagnate, and even worse, potentially undermining trust in our information systems. Such a scenario could mean a great return to traditional media as a trusted source of information.

The artificial intelligence race between the United States and China

In 2017, Vladimir Putin announced that whoever becomes a leader in the field of artificial intelligence will rule the world. Given that Russian leaders have a long tradition of using hyperbole in speeches, this prophecy should naturally be taken with a grain of salt, however, artificial intelligence is likely to play an important role in the future great power rivalry.

From articles published around 2017 on technology and AI, it is clear that the whole world believed that China would either take the lead in the AI race, or at least have the capacity to overtake the United States in just a few years. Unexpectedly it turned out that

The Americans outperformed all other players as AI systems such as GPT-4 (OpenAI) and Bard (Google) leave Chinese AI systems far behind in numerous benchmarks.

As we described in our previous quarterly outlook, the future will be shaped by what we have named fragmentation gamewhich is essentially a strategic geopolitical dynamic dividing the world into regions with a greater degree of independence, and due to national security issues, the policy will focus on four pillars: defence, energy, technology and raw materials. The game of fragmentation is primarily evolving in terms of how the physical world works, and it is a game where Europe and the US will seek to reduce China's role in their supply chains. While this spells problems for China, it offers benefits for other countries, as our chart shows the performance of the Chinese stock market versus countries benefiting from the current situation.

Semiconductors also play a key role in the game of fragmentation, as they form the basis of the microprocessors used for artificial intelligence. Capital expenditures on semiconductors over the next decade will cause an investment boom in the United States and Europe, because these regions will increase domestic production to become independent from Asia. This dynamic will be beneficial for semiconductor equipment manufacturers, as their revenues are related to capital expenditures on semiconductors.

No matter how tumultuous the experience investors will have with AI stocks, one thing is certain: the technology will be an important area of competition between the US and China, and there will be many opportunities and threats in the coming years.

All Saxo Bank forecasts available here.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response